Tyson Foods 1999 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 1999 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to consolidated financial statements

TYSON FOODS, INC. 1999 ANNUAL REPORT

52

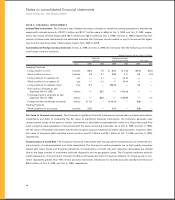

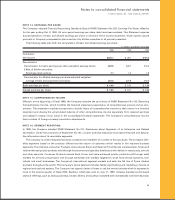

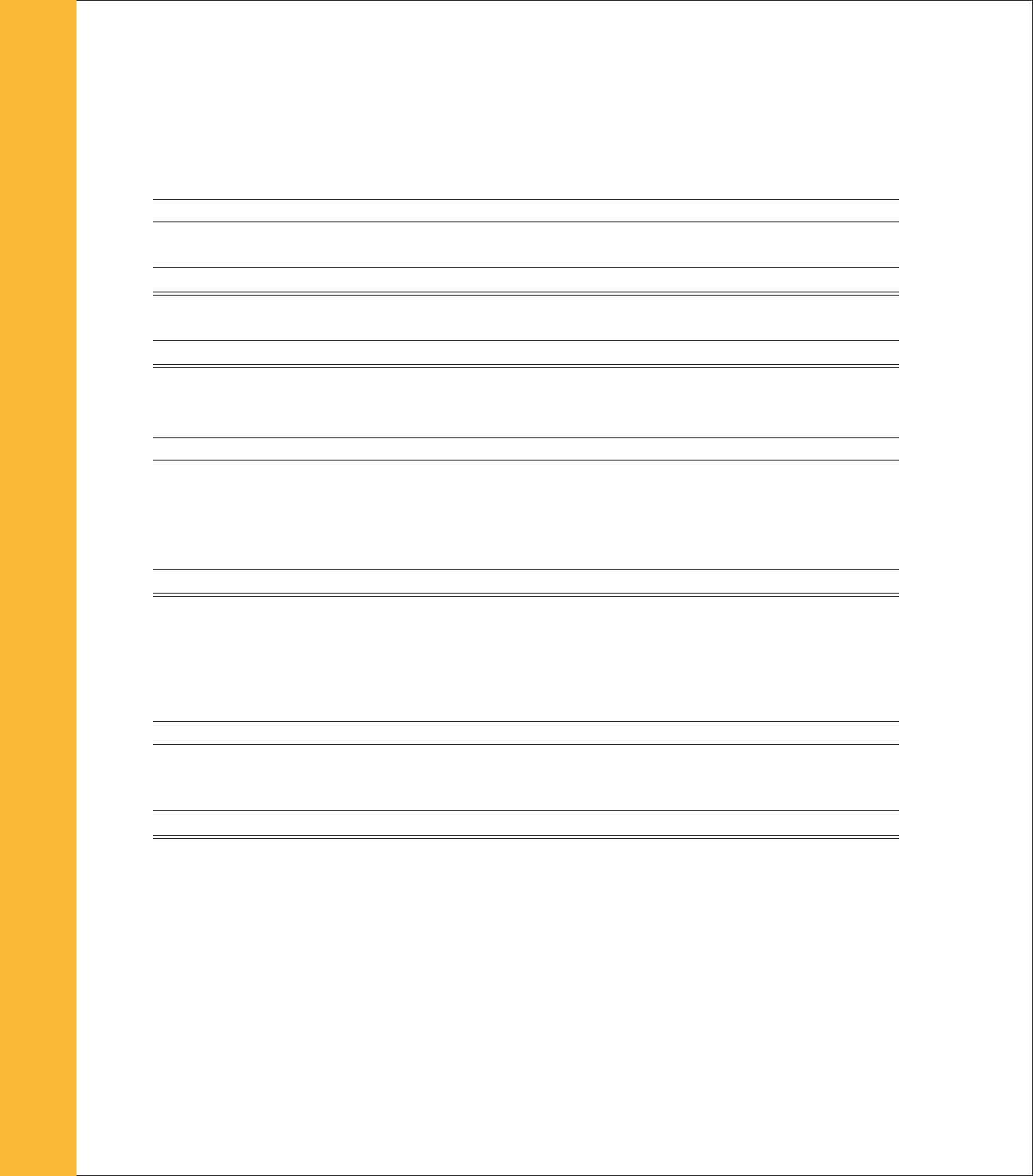

NOTE 13: INCOME TAXES

Detail of the provision for income taxes consists of:

in millions

1999 1998 1997

Federal $121.2 $50.1 $129.7

State 8.2 (4.2) 14.2

$129.4 $45.9 $143.9

Current $142.9 $80.6 $133.4

Deferred (13.5) (34.7) 10.5

$129.4 $45.9 $143.9

The reasons for the difference between the effective income tax rate and the statutory U.S. federal income tax rate are

as follows:

1999 1998 1997

U.S. federal income tax rate 35.0% 35.0% 35.0%

Amortization of excess of investments over net assets acquired 5.3 23.6 8.6

State income taxes (benefit) 1.6 (3.8) 2.8

Foreign losses (benefit) (6.3) 10.9 —

Other (0.7) (1.0) (2.8)

34.9% 64.7% 43.6%

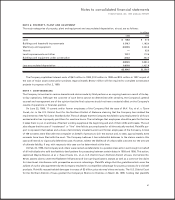

The Company follows the liability method in accounting for deferred income taxes. The liability method provides that

deferred tax liabilities are recorded at current tax rates based on the difference between the tax basis of assets and lia-

bilities and their carrying amounts for financial reporting purposes referred to as temporary differences. Significant

components of the Company’s deferred tax liabilities as of Oct. 2, 1999, and Oct. 3, 1998, are as follows:

in millions

1999 1998

Basis difference in property, plant and equipment $236.8 $289.9

Suspended taxes from conversion to accrual method 127.6 135.1

Other 33.6 9.4

$398.0 $434.4

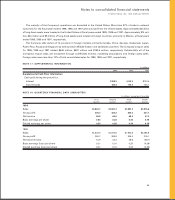

The Omnibus Budget Reconciliation Act of 1987 required family-owned farming businesses to use the accrual method

of accounting for tax purposes. Internal Revenue Code Section 447(i) provides that if any family corporation is required

to change its method of accounting for any taxable year, such corporation shall establish a suspense account in lieu of tak-

ing the adjustments into taxable income. The suspense account represents the initial catch-up adjustment to change from

the cash to accrual method of accounting and any related income taxes are deferred. However, legislation was enacted

in 1997 that now requires the Company to pay down the suspense account over 20 years.