Tyson Foods 1999 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 1999 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Because the Company’s year 2000 compliance is dependent upon key third parties also being Year 2000 compliant

on a timely basis, there can be no guarantee that the Company’s efforts will prevent a material adverse impact on its

results of operations, financial condition and cash flows. The possible consequences to the Company due to its busi-

ness partners not being fully Year 2000 compliant include temporary plant closings, delays in the delivery of finished

products, delays in the receipt of key ingredients, containers and packaging supplies, invoice and collection errors, and

inventory and supply obsolescence. These consequences could have a material adverse impact on the Company’s

results of operations, financial condition and cash flows if the Company is unable to conduct its business in the ordi-

nary course. The Company believes that its readiness program should significantly reduce the adverse effect any such

disruptions may have.

To date, the Company has completed 100 percent of the assessment and remediation phases. The Company will

continue to test various components of the software portfolio until Dec. 31, 1999. The Company has not established a

contingency plan for possible Year 2000 issues. However, all information systems personnel will be available over the

New Year’s holiday should any unforeseen problem arise. The information systems group has also implemented a

technology “quiet period” for the last eight weeks of the year during which changes to the current technology archi-

tecture and portfolio will be limited.

MARKET RISK Market risks relating to the Company’s operations result primarily from changes in commodity prices,

interest rates and foreign exchange rates as well as credit risk concentrations. To address these risks the Company enters

into various hedging transactions as described below. The Company seldom uses financial instruments which do not

qualify for hedge accounting. In those situations in which instruments do not qualify for hedge accounting, the Company

marks the instrument to fair value and recognizes the gains or losses currently in earnings.

Commodities Risk The Company is a purchaser of certain commodities, primarily corn and soybeans. The Company peri-

odically uses commodity futures and options for hedging purposes to reduce the effect of changing commodity prices

and as a mechanism to procure the grains. The contracts that effectively meet risk reductions and correlation criteria are

recorded using hedge accounting. Gains and losses on closed hedge transactions are recorded as a component of the

underlying inventory purchase.

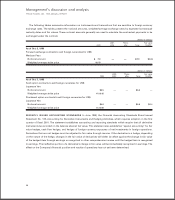

The following table provides information about the Company’s corn, soybean and other feed ingredient inventory and

financial instruments that are sensitive to changes in commodity prices. The table presents the carrying amounts and

fair values at Oct. 2, 1999 and Oct. 3, 1998. Additionally, for puts and futures contracts, the latest of which expires or

matures 15 months from the reporting date, the table presents the notional amounts in units of purchase and the

weighted average contract prices.

Management’s discussion and analysis

TYSON FOODS, INC. 1999 ANNUAL REPORT

33