Tyson Foods 1999 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 1999 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

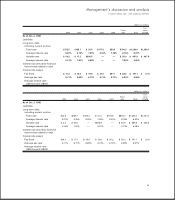

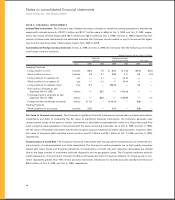

The following tables summarize information on instruments and transactions that are sensitive to foreign currency

exchange rates. The tables present the notional amounts, weighted-average exchange rates by expected (contractual)

maturity dates and fair values. These notional amounts generally are used to calculate the contractual payments to be

exchanged under the contract.

dollars in millions

2001- There- Fair value

2000 2004 after Total 10/2/99

As of Oct. 2, 1999

Forward exchange contracts to sell foreign currencies for US$

Mexican Peso

Notional amount $««««7.3 — — $7.3 $(0.6)

Weighted average strike price 10.13

dollars in millions

2000- There- Fair value

1999 2003 after Total 10/3/98

As of Oct. 3, 1998

Sold option contracts to sell foreign currencies for US$

Japanese Yen

Notional amount $6.5 — — $6.5 —

Weighted average strike price ¥109.48

Purchased option contracts to sell foreign currencies for US$

Japanese Yen

Notional amount $5.6 — — $5.6 $0.4

Weighted average strike price ¥126.69

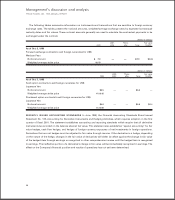

RECENTLY ISSUED ACCOUNTING STANDARDS In June 1998, the Financial Accounting Standards Board issued

Statement No. 133, Accounting for Derivative Instruments and Hedging Activities, which requires adoption in the first

quarter of fiscal 2001. The statement establishes accounting and reporting standards which require that all derivative

instruments be recorded on the balance sheet at fair value. This statement also establishes “special accounting” for fair

value hedges, cash flow hedges, and hedges of foreign currency exposures of net investments in foreign operations.

Derivatives that are not hedges must be adjusted to fair value through income. If the derivative is a hedge, depending

on the nature of the hedge, changes in the fair value of derivatives will either be offset against the change in fair value

of the hedged item through earnings or recognized in other comprehensive income until the hedged item is recognized

in earnings. The ineffective portion of a derivative’s change in fair value will be immediately recognized in earnings. The

effect on the Company’s financial position and results of operations has not yet been determined.

Management’s discussion and analysis

TYSON FOODS, INC. 1999 ANNUAL REPORT

36