Tyson Foods 1999 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 1999 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to consolidated financial statements

TYSON FOODS, INC. 1999 ANNUAL REPORT

45

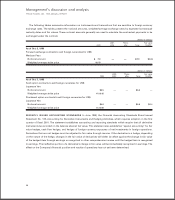

On Aug. 28, 1998, the Company’s Board of Directors approved management’s proposed restructure plan. The restruc-

turing, which resulted in asset impairment and other charges described below, was in furtherance of the Company’s

previously stated objective to focus on its core business, chicken. The acquisition of Hudson in 1998, and the assimilation

of Hudson’s facilities and operations into the Company’s business permitted the Company to review and rationalize the

productive capabilities and cost structure of its core business. The restructuring included, among other things, the closure

of eight plants and feedmills resulting in work force reductions, the write-down of excess of investments over net assets

acquired allocated to closed facilities, the reconfiguration of various production facilities and the write-down to estimated

net realizable value of certain seafood assets which were sold in fiscal 1999.

In 1998, as a result of the restructuring, the Company recorded pretax charges totaling $214.6 million ($0.68 per share)

consisting of $142.2 million for asset impairment of property, plant and equipment, write-down of related excess of

investments over net assets acquired and severance costs, $48.4 million for losses in the Company’s export business to

Russia which had been adversely affected by the continuing economic problems in Russia and $24 million for other

charges related primarily to workers compensation and employment practice liabilities. These charges were classified in

the Consolidated Statements of Income as $142.2 million in asset impairment and other charges, $48.4 million in selling

expenses, $20.5 million in cost of sales and $3.5 million in other expense. Additionally, the foreign losses were netted

with accounts receivable on the Consolidated Balance Sheets.

During the fourth quarter of fiscal 1998, the Russian Ruble was devalued from 6.3 to 16.0. This event and other related

economic factors in Russia resulted in the Company recognizing losses of $48.4 million.

The majority of the $24 million charge noted above relates primarily to revisions to the Company’s estimated liabilities

for workers compensation and employment practice related matters. This charge is based upon two separate actuarial

studies completed during the fourth quarter of fiscal 1998.

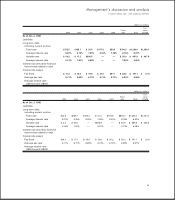

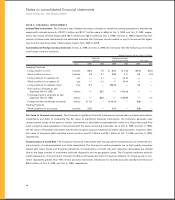

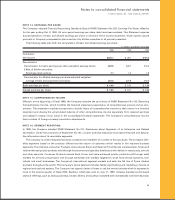

The major components of the asset impairment and related charges consisted of the following:

in millions

1999 1998

Impairment of property, plant and equipment $36.2 $120.7

Write-down of related excess of investments over net assets acquired 21.5 19.3

Loss on sale of seafood assets 19.2 —

Severance and other related costs —2.2

$76.9 $142.2

The impairment charge represents the excess of the carrying value of those assets discussed above over their fair

value less cost to sell. Impaired assets that are expected to be disposed of within the next 12 months are included in

assets held for sale.

The write-down of excess of investments over net assets acquired is related to plant closings and related book value

impairments, which originated from prior business acquisitions. Substantially, all of the severance and related costs were

paid in fiscal 1999.