Tyson Foods 1999 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 1999 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

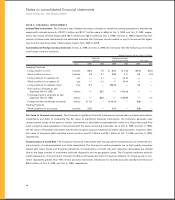

Notes to consolidated financial statements

TYSON FOODS, INC. 1999 ANNUAL REPORT

47

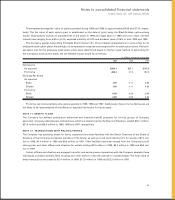

NOTE 6: PROPERTY, PLANT AND EQUIPMENT

The major categories of property, plant and equipment and accumulated depreciation, at cost, are as follows:

in millions

1999 1998

Land $«««««56.8 $÷÷«57.8

Buildings and leasehold improvements 1,179.7 1,163.0

Machinery and equipment 2,033.5 2,004.6

Vessels —83.8

Land improvements and other 111.7 112.6

Buildings and equipment under construction 223.8 262.6

3,605.5 3,684.4

Less accumulated depreciation 1,421.0 1,427.9

$2,184.5 $2,256.5

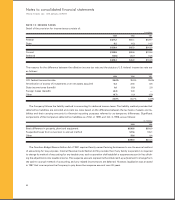

The Company capitalized interest costs of $5.2 million in 1999, $1.8 million in 1998 and $3.4 million in 1997 as part of

the cost of major asset construction projects. Approximately $134.2 million will be required to complete construction

projects in progress at Oct. 2, 1999.

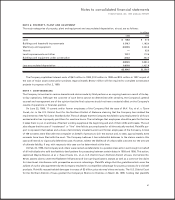

NOTE 7: CONTINGENCIES

The Company is involved in various lawsuits and claims made by third parties on an ongoing basis as a result of its day-

to-day operations. Although the outcome of such items cannot be determined with certainty, the Company’s general

counsel and management are of the opinion that the final outcome should not have a material effect on the Company’s

results of operations or financial position.

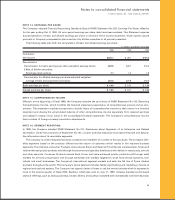

On June 22, 1999, 11 current and/or former employees of the Company filed the case of

M.H. Fox, et al. v. Tyson

Foods, Inc.

in the U.S. District Court for the Northern District of Alabama claiming that the Company has violated the

requirements of the Fair Labor Standards Act. The suit alleges that the Company has failed to pay employees for all hours

worked and/or has improperly paid them for overtime hours. The suit alleges that employees should be paid for the time

it takes them to put on and take off certain working supplies at the beginning and end of their shifts and breaks. The suit

also alleges that the use of “mastercard” or “line” time fails to pay employees for all time actually worked. Plaintiffs pur-

port to represent themselves and a class of all similarly situated current and former employees of the Company. A total

of 159 consents were filed with the complaint on behalf of persons to join the lawsuit and, to date, approximately 3,100

consents have been filed with the court. The Company believes it has substantial defenses to the claims made in this

case and intends to vigorously defend the case. However, neither the likelihood of unfavorable outcome nor the amount

of ultimate liability, if any, with respect to this case can be determined at this time.

On Feb. 20, 1998, the Company and others were named as defendants in a putative class action suit brought on behalf

of all individuals who sold beef cattle to beef packers for processing between certain dates in 1993 and 1998. This action,

captioned

Wayne Newton, et al. v. Tyson Foods, Inc., et al., U.S. District Court, Northern District of Iowa, Civil Action No.

98-30,

asserts claims under the Racketeer Influenced and Corrupt Organizations statute as well as a common-law claim

for intentional interference with prospective economic advantage. Plaintiffs allege that the gratuities which were the

subject of a prior plea agreement by the Company resulted in a competitive advantage for poultry products vis-a-vis beef

products. Plaintiffs request trebled damages in excess of $3 billion, plus attorney’s fees and costs. The U.S. District Court

for the Northern District of Iowa granted the Company’s Motion to Dismiss on March 26, 1999, holding that plaintiffs