Tyson Foods 1999 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 1999 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company’s foreseeable cash needs for operations and capital expenditures will continue to be met through

cash flows from operations and borrowings supported by existing credit facilities, as well as additional credit facilities

which the Company believes are available.

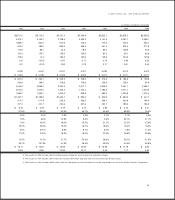

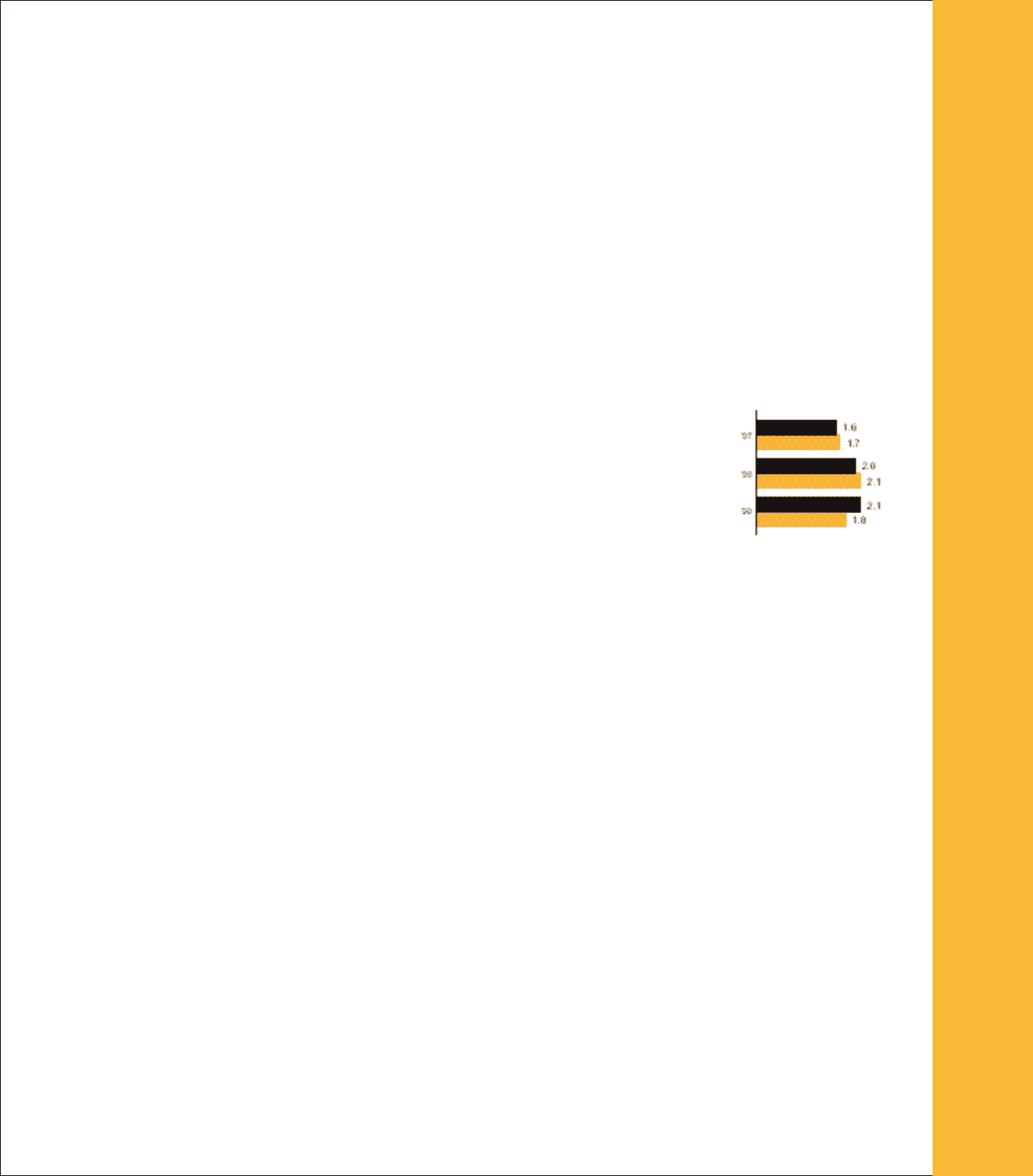

At 1999 fiscal year end, working capital was $739.9 million compared to $934.1 million at the end of 1998, a decrease

of $194.2 million mostly due to an increase in the current portion of long-term debt. The current ratio for 1999 was 1.75

to 1 compared to 2.12 to 1 for 1998. Working capital levels are adequate to meet the operating needs of the Company.

Total assets have increased by $1.4 billion or 38.6% over the past five years inclusive of acquisitions.

Additions, net of dispositions, to total property, plant and equipment for the last five years were $1.1 billion including

acquisitions, an increase of 43.7% over the last five years. At 1999 fiscal year end, the Company had construction proj-

ects in progress that will require approximately $134.2 million to complete. Cash from operations or additional

borrowings will provide funding for these expenditures.

Total debt at 1999 fiscal year end was $1.8 billion, a decrease of $325.1 million from fiscal

1998 year end. The Company has an unsecured revolving credit agreement totaling $1 billion

that supports the Company’s commercial paper program. This $1 billion facility expires in May

2002. At Oct. 2, 1999, $290.5 million in commercial paper was outstanding under this $1 billion

facility. Additional outstanding long-term debt at Oct. 2, 1999, consisted of $879.8 million of pub-

lic debt, $111.6 million of institutional notes, $154.5 million of leveraged equipment loans and

$78.8 million of other indebtedness. The Company may use funds borrowed under its revolving

credit facility, commercial paper program or through the issuance of additional debt securities

from time to time in the future to finance acquisitions as opportunities may arise, to refinance

other indebtedness or capital leases of the Company, and for other general corporate purposes.

The revolving credit agreement and notes contain various covenants, the more restrictive of which require mainte-

nance of a minimum net worth, current ratio, cash flow coverage of interest and a maximum total debt-to-capitalization

ratio. The Company is in compliance with these covenants at fiscal year end.

The Company prefers to maintain a mix of fixed and floating debt. Management believes that, over the long-term,

variable-rate debt may provide more cost-effective financing than fixed-rate debt; however, the Company issues fixed-

rate debt when advantageous market opportunities arise.

Shareholders’ equity increased 8% during 1999 and has grown at a compounded annual rate of 10.5% over the past

five years, inclusive of $76.9 million loss on the sale of assets and asset impairment in 1999, $214.6 million in asset

impairment and other charges in 1998 and $363.5 million for the purchase of Hudson in 1998.

IMPACT OF YEAR 2000 The Year 2000 Issue is the result of computer programs being written using two digits rather

than four to define the applicable year. Any of the Company’s computer programs that have date-sensitive software may

recognize a date using “00” as the year 1900 rather than the year 2000. This could result in a system failure or miscal-

culations causing disruptions of operations, including among other things, a temporary inability to process transactions,

send invoices or engage in similar normal business activities.

Because of the nature of the Year 2000 issue, older software is more likely to have issues with Year 2000 readiness,

while newer software is more likely to be Year 2000 compliant. The Company has replaced its entire computer software

applications portfolio since 1990. Nonetheless, the Company has been working on testing and ensuring application readi-

ness since 1996. Many of the applications that are used to support core business processes have been taken to offsite

computer testing facilities to ensure their Year 2000 readiness. This includes core application functionality as well as

interfaces to other applications and outside partners.

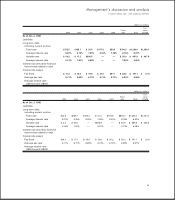

Management’s discussion and analysis

TYSON FOODS, INC. 1999 ANNUAL REPORT

31

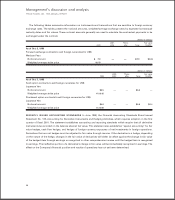

■equity

■debt

TOTAL CAPITALIZATION

dollars in billions