Tyson Foods 1999 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 1999 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

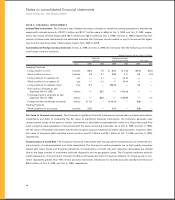

Notes to consolidated financial statements

TYSON FOODS, INC. 1999 ANNUAL REPORT

48

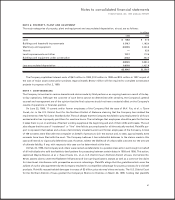

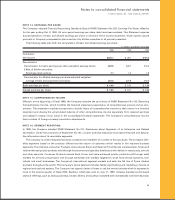

lacked standing to sue. Plaintiffs timely appealed to the U.S. Court of Appeals for the Eighth circuit. The Company is vig-

orously contesting the case. Briefing of the appeal was completed in August 1999, but no date has been set for oral

argument. Based on the current status of the matter, the Company does not believe any significant exposure exists.

On or about July 23, 1998, the Maryland Department of the Environment (MDE) filed a Complaint for Injunctive Relief

and Civil Penalty (the Complaint) against the Company in the Circuit Court of Worcester County, Md., for the alleged

violation of certain Maryland water pollution control laws with respect to the Company’s land application of sludge to

Company owned agricultural land near Berlin, Md. The MDE seeks, in addition to injunctive and equitable relief, civil

penalties of up to $10,000 per day for each day the Company had allegedly operated in violation of the Maryland water

pollution control laws. The Company does not believe any penalties, if imposed, would have a material adverse effect

on the Company’s results of operations or financial condition.

On Dec.16, 1998, Hudson Foods, Inc., Michael Gregory, Hudson’s former Director of Customer Relations and Quality

Control, and Brent Wolke, the former plant manager of Hudson’s Columbus, Neb. facility, were indicted by a federal

grand jury in Omaha, Neb. on two counts – making false statements to the U.S. Department of Agriculture and conspir-

acy to make such statements – in connection with the August 1997 recall of Hudson beef products suspected of

containing E-Coli 0157:H7. The charges arise out of presentations made on behalf of Hudson between Food Safety

Inspection Service officials during Hudson’s cooperation with the government in attempting to identify potentially con-

taminated product. The government has conceded that the contamination did not originate in the Hudson plant, and it

does not appear that any statements at issue in the indictment resulted in or is alleged to have resulted in any illnesses.

All defendants have entered not guilty pleas and intend to vigorously defend the case at a trial which will be held in the

federal courthouse in Lincoln, Neb. According to the government, the potential penalty for Hudson is a fine of up to

$500,000 and the individual defendants each face the possibility of up to five years imprisonment and fines of up to

$250,000.

The Company received notice from the Environmental Crimes Section of the Department of Justice and the U.S.

Attorney’s Office for the Southern District of Mississippi indicating that McCarty Farms, Inc. (McCarty), a former subsidiary

of the Company which has been merged into the Company, may be pursued for alleged violations of the Federal Clean

Water Act arising out of its partial ownership of Central Industries, Inc. (Central), which operates a rendering plant in Forest,

Miss. The allegations arise from the alleged discharge of pollutants from Central’s rendering facility in Forest, Miss. in the

summer of 1995, which was prior to the Company’s purchase of McCarty in September 1995. Neither the likelihood of unfa-

vorable outcome nor the amount of ultimate liability, if any, with respect to this case can be determined at this time.

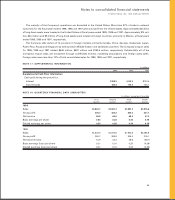

NOTE 8: COMMITMENTS

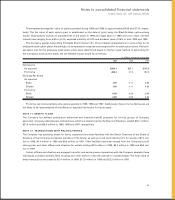

The Company leases certain farms and other properties and equipment for which the total rentals thereon approximated

$64.2 million in 1999, $46.7 million in 1998 and $34 million in 1997. Most farm leases have terms ranging from one to 10

years with various renewal periods. The most significant obligations assumed under the terms of the leases are the

upkeep of the facilities and payments of insurance and property taxes.

Minimum lease commitments under noncancelable leases at Oct. 2, 1999, total $133.8 million composed of $45.2 mil-

lion for 2000, $33.8 million for 2001, $25.3 million for 2002, $16.4 million for 2003, $8 million for 2004 and $5.1 million for

later years. These future commitments are expected to be offset by future minimum lease payments to be received under

subleases of approximately $15.5 million.

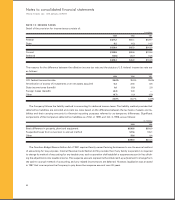

The Company assists certain of its swine and poultry growers in obtaining financing for growout facilities by provid-

ing the growers with extended growout contracts and conditional operation of the facilities should a grower default

under their growout or loan agreement. The Company also guarantees debt of outside third parties of $64.8 million.