Tyson Foods 1999 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 1999 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

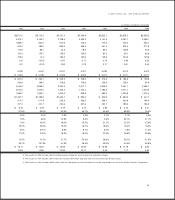

Diluted earnings per share, before asset impair-

ment, loss on the divestiture of the seafood business

and loss on the anticipated divestiture of the swine

business, were $1.20, an increase of 51.9 percent over

last year’s $0.79. Reported sales were $7.4 billion in

both 1998 and 1999. Reported diluted earnings per share

were $1.00 compared to $0.11 last year. Reported

earnings were a record $230.1 million. Sales and

earnings in 1999 were adversely affected by market

conditions in our live swine business throughout

the year, as well as by deteriorating poultry markets

later in the year. When adjusted for businesses sold

and the difference caused by the 53-week accounting

period in 1998, sales increased 2.8 percent in 1999. In

addition, volume of pounds sold increased 12.3 per-

cent. With strong operational cash flow and proceeds

from the sale of assets, the Company reduced total

indebtedness from $2.1 billion in 1998 to $1.8 billion

in 1999 with a debt to capital ratio of 45.9 percent.

Tyson continued focusing on its core business,

chicken. The Company completed the sale of turkey

and egg operations acquired in 1998 with Hudson

Foods. In July we finalized the sale of our Seafood

Division. We signed a letter of intent in September

with Smithfield Foods, Inc. for the sale of The Pork

Group. These businesses, which have struggled in

difficult operating environments, will be in the hands

of people who specialize in seafood and pork while

we concentrate on improving our leadership position

in the chicken industry.

The Company’s operating environment in the

second half of fiscal 1999 was a difficult one for the

entire food business and particularly for the chicken

industry. An oversupply of meat proteins led to

depressed market conditions. To bring our production

and current market demand in balance, we announced

a reduction in production of live birds effective the

first quarter of fiscal 2000. These relatively depressed

market conditions are expected to continue until

meat supplies are back in balance.

As part of our desire to achieve clarity and purpose

in our Company, we initiated a new organizational

structure in March. After considerable introspection

and deliberate study, we determined we needed an

organization with a greater effort directed toward the

marketplace along with defined financial objectives.

While our previous organization was divided along

the lines of sales and production, the new organiza-

tion aligns sales and production together into market

As part of our desire to

achieve clarity and purpose

in our Company, we initi-

ated a new organizational

structure in March.

As we look forward,

we are excited

about the Company.

Tyson Foods is a

stronger company

than it was even just

two years ago.