Tyson Foods 1999 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 1999 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

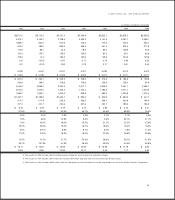

ACQUISITIONS On Jan. 9, 1998, the Company completed the acquisition of Hudson Foods, Inc. (Hudson or Hudson

Acquisition). At the effective time of the acquisition, the Class A and Class B shareholders of Hudson received approxi-

mately 18.4 million shares of the Company’s Class A common stock valued at approximately $363.5 million and

approximately $257.4 million in cash. The Company borrowed funds under its commercial paper program to finance the

cash portion of the Hudson Acquisition and to repay approximately $61 million under Hudson’s revolving credit facilities.

The Hudson Acquisition has been accounted for as a purchase and the excess of investment over net assets acquired is

being amortized straight-line over 40 years. The Company’s consolidated results of operations include the operations of

Hudson since the acquisition date.

DISPOSITIONS During fiscal 1999, management completed the following transactions in furtherance of the Company’s

previously stated objective to focus on its core business, chicken.

Effective Sept. 28, 1999, the Company signed a letter of intent to sell its wholly-owned subsidiary The Pork Group, Inc.

(The Pork Group) to Smithfield Foods, Inc. (Smithfield). The Company will receive approximately three million shares of

Smithfield common stock, subject to certain restrictions. Certain assets of The Pork Group with a fair value of approxi-

mately $70 million are classified as assets held for sale at Oct. 2, 1999. Additionally, the Company has accrued expenses

related to the closure of certain assets not purchased by Smithfield. The Company’s operating results for the fiscal year

ended Oct. 2, 1999, include a pretax charge of $35.2 million related to the anticipated loss on the sale and closure of these

assets. The transaction is subject to the successful negotiation of a definitive agreement and is expected to close by the

second quarter of fiscal 2000.

On July 17, 1999, the Company completed the sale of the assets of Tyson Seafood Group in two separate transactions.

Under the terms of the agreements, the Company received net proceeds of approximately $165 million, which was used

to reduce indebtedness, and subsequently collected receivables totaling approximately $16 million. The Company

recognized a pretax loss of approximately $19.2 million on the sale of the seafood assets.

Effective Dec. 31, 1998, the Company sold Willow Brook Foods, its integrated turkey production and processing busi-

ness, and its Albert Lea, Minn., processing facility which primarily produced sausages, lunch and deli meats. In addition,

on Dec. 31, 1998, the Company sold its National Egg Products Company operations in Social Circle, Ga. These facilities

were sold for amounts that approximated their carrying values. These operations, which were reflected in assets held for

sale at Oct. 3, 1998, were acquired as part of the Hudson Acquisition.

IMPAIRMENT AND OTHER CHARGES In July 1999, the Company signed a letter of intent to sell Mallard’s Food Products

(Mallard’s) for an amount less than net book value. The sale of Mallard’s was not consummated. However, based upon

these negotiations and the Company’s cash flow projections, management believes that certain long-lived assets and

related excess of investments over net assets acquired are impaired. The Company recorded in the fourth quarter of 1999

pretax charges totaling $22.5 million ($0.10 per share) for impairment of property and equipment and write-down of

related excess of investments over net assets acquired of Mallard’s. Management expects that Mallard’s will continue to

be a part of the Prepared Foods Group.

On Aug. 28, 1998, the Company’s Board of Directors approved management’s proposed restructure plan. The restruc-

turing, which resulted in asset impairment and related charges described below, was in furtherance of the Company’s

previously stated objective to focus on its core business, chicken. The acquisition of Hudson and the assimilation of

Hudson’s facilities and operations into the Company’s business permitted the Company to review and rationalize the pro-

ductive capabilities and cost structure of its core business. The restructuring included, among other things, the closure

of eight plants and feedmills resulting in work force reductions, the write-down of excess of investments over net assets

acquired allocated to closed facilities, the reconfiguration of various production facilities and the write-down to estimated

net realizable value of certain seafood assets which were sold in fiscal 1999.

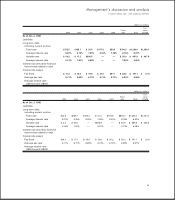

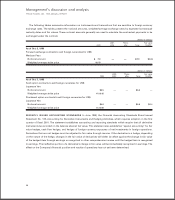

Management’s discussion and analysis

TYSON FOODS, INC. 1999 ANNUAL REPORT

26