Toyota 2013 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2013 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Toyota Global Vision President’s Message Launching a New Structure Special Feature Review of Operations

Consolidated Performance

Highlights

Management and

Corporate Information Investor InformationFinancial Section

Page 99

NextPrev

ContentsSearchPrint

ANNUAL REPORT 2013

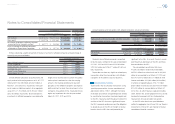

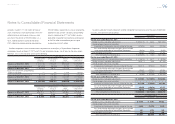

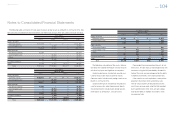

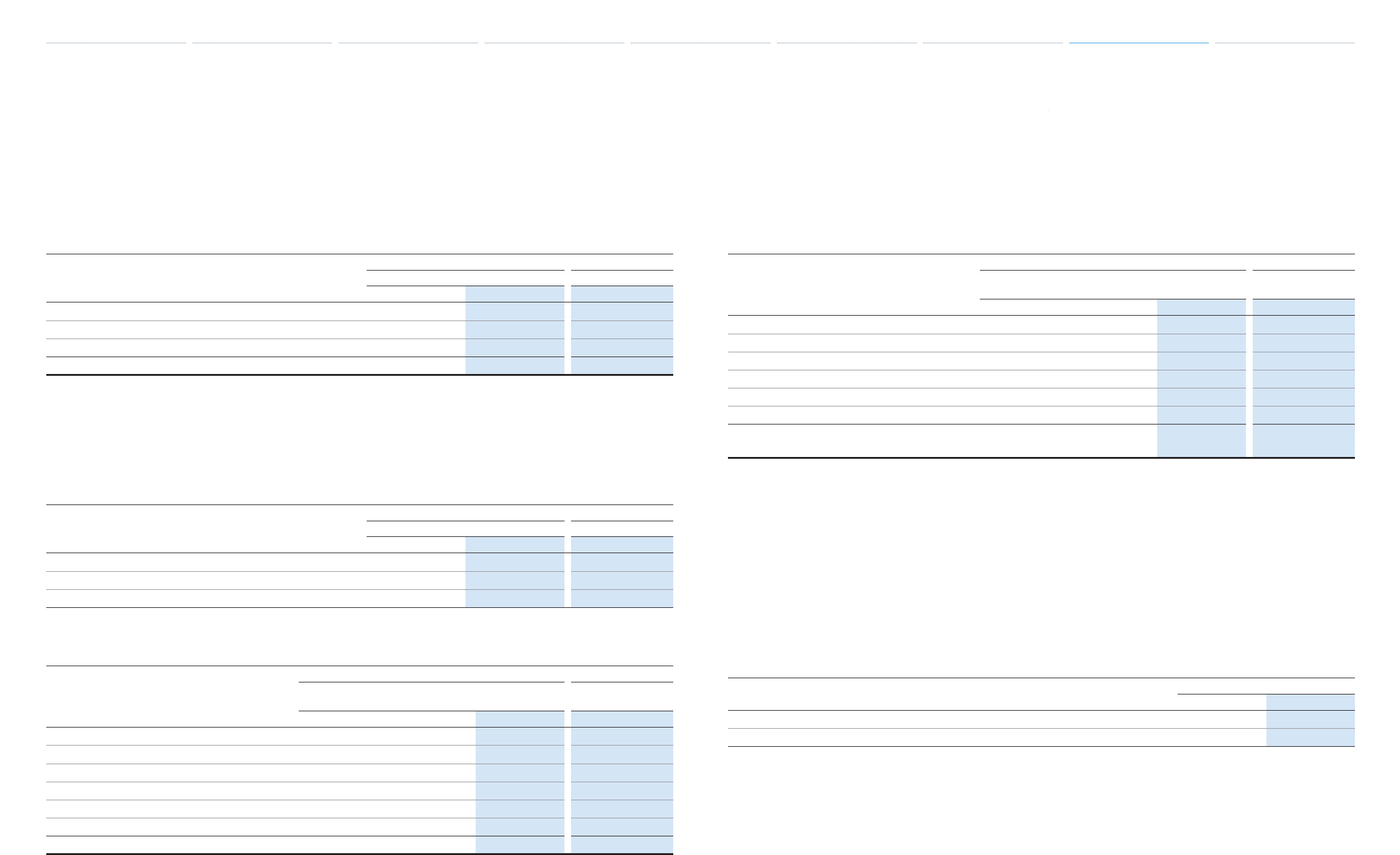

Amounts recognized in accumulated other comprehensive income (loss) as of March 31, 2012 and 2013

are comprised of the following:

Yen in millions U.S. dollars in millions

March 31, March 31,

2012 2013 2013

Net actuarial loss ¥(381,770) ¥(333,203) $(3,543)

Prior service costs 57,930 53,360 567

Net transition obligation — ——

Net amount recognized ¥(323,840) ¥(279,843) $(2,976)

The accumulated benefi t obligation for all defi ned benefi t pension plans was ¥1,379,373 million and

¥1,494,011 million ($15,885 million) at March 31, 2012 and 2013, respectively.

The projected benefi t obligation, accumulated benefi t obligation and fair value of plan assets for which the

accumulated benefi t obligations exceed plan assets are as follows:

Yen in millions U.S. dollars in millions

March 31, March 31,

2012 2013 2013

Projected benefi t obligation ¥728,469 ¥749,561 $7,970

Accumulated benefi t obligation 639,196 685,763 7,291

Fair value of plan assets 153,945 165,262 1,757

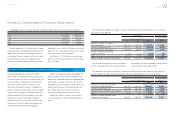

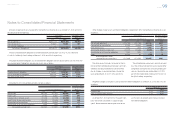

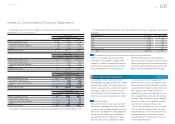

Components of the net periodic pension cost are as follows:

Yen in millions U.S. dollars in millions

For the years ended March 31,

For the year ended

March 31,

2011 2012 2013 2013

Service cost ¥61,134 ¥57,241 ¥60,261 $641

Interest cost 31,782 30,660 27,804 296

Expected return on plan assets (21,200) (21,558) (22,352) (238)

Amortization of prior service costs (24,421) (16,326) (8,033) (86)

Recognized net actuarial loss 15,029 28,342 16,619 177

Amortization of net transition obligation 1,944 1,626 ——

Net periodic pension cost ¥64,268 ¥79,985 ¥74,299 $790

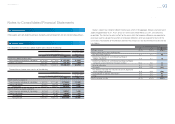

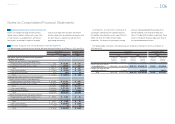

Other changes in plan assets and benefi t obligations recognized in other comprehensive income (loss) are

as follows:

Yen in millions U.S. dollars in millions

For the years ended March 31,

For the year ended

March 31,

2011 2012 2013 2013

Net actuarial gain (loss) ¥(15,734) ¥(87,163) ¥32,122 $341

Recognized net actuarial loss 15,029 28,342 16,619 177

Prior service costs 1,287 (632) 3,462 37

Amortization of prior service costs (24,421) (16,326) (8,033) (86)

Amortization of net transition obligation 1,944 1,626 ——

Other 10,529 63 (173) (2)

Total recognized in other

comprehensive income (loss) ¥(11,366) ¥(74,090) ¥43,997 $467

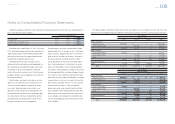

The other amount includes the impact of transi-

tion to defi ned contribution pension plans and con-

solidation and deconsolidation of certain entities

due to changes in ownership interest during the

years ended March 31, 2011, 2012 and 2013.

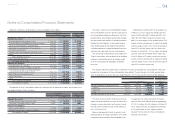

The estimated prior service costs and net actuarial

loss that will be amortized from accumulated other

comprehensive income (loss) into net periodic pen-

sion cost during the year ending March 31, 2014

are ¥(5,000) million ($(53) million) and ¥12,200 mil-

lion ($130 million), respectively.

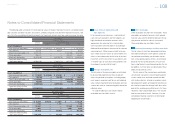

Weighted-average assumptions used to determine benefi t obligations as of March 31, 2012 and 2013 are

as follows:

March 31,

2012 2013

Discount rate 2.0% 1.7%

Rate of compensation increase 2.3% 2.2%

As of March 31, 2012 and 2013, the parent com-

pany and certain subsidiaries in Japan employ

“point” based retirement benefi t plans and do not

use the rates of compensation increase to deter-

mine benefi t obligations.

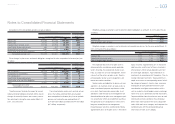

Notes to Consolidated Financial Statements

Selected Financial Summary (U.S. GAAP) Consolidated Segment Information Consolidated Quarterly Financial Summary Management’s Discussion and Analysis of Financial Condition and Results of Operations Consolidated Financial Statements Notes to Consolidated Financial Statements [22 of 44]

Management’s Annual Report on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm