Toyota 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Toyota Global Vision President’s Message Launching a New Structure Special Feature Review of Operations

Consolidated Performance

Highlights

Management and

Corporate Information Investor InformationFinancial Section

Page 104

NextPrev

ContentsSearchPrint

ANNUAL REPORT 2013

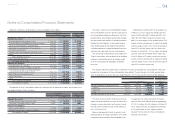

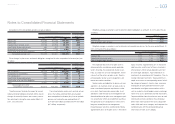

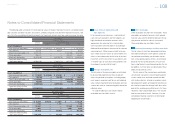

The following table summarizes the fair value of classes of plan assets as of March 31, 2012 and 2013. See

note 26 to the consolidated fi nancial statements for three levels of input which are used to measure fair value.

Yen in millions

March 31, 2012

Level 1 Level 2 Level 3 Total

Equity securities

Common stocks ¥114,955 ¥ — ¥ — ¥114,955

Commingled funds — 74,815 — 74,815

114,955 74,815 — 189,770

Debt securities

Government bonds 25,084 — — 25,084

Commingled funds — 43,062 — 43,062

Other — 29,278 — 29,278

25,084 72,340 — 97,424

Insurance contracts — — — —

Other 21,184 3,471 31,377 56,032

Total ¥161,223 ¥150,626 ¥31,377 ¥343,226

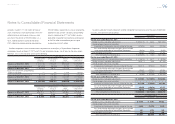

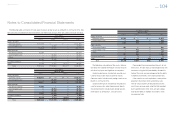

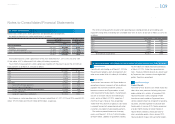

Yen in millions

March 31, 2013

Level 1 Level 2 Level 3 Total

Equity securities

Common stocks ¥183,611 ¥ — ¥ — ¥183,611

Commingled funds — 86,539 — 86,539

183,611 86,539 — 270,150

Debt securities

Government bonds 47,083 — — 47,083

Commingled funds — 42,754 — 42,754

Other — 40,486 — 40,486

47,083 83,240 — 130,323

Insurance contracts — 1,202 — 1,202

Other 30,739 6,218 40,607 77,564

Total ¥261,433 ¥177,199 ¥40,607 ¥479,239

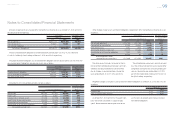

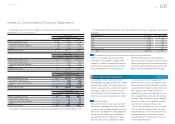

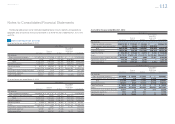

U.S. dollars in millions

March 31, 2013

Level 1 Level 2 Level 3 Total

Equity securities

Common stocks $1,952 $ — $ — $1,952

Commingled funds — 920 — 920

1,952 920 — 2,872

Debt securities

Government bonds 501 — — 501

Commingled funds — 455 — 455

Other — 430 — 430

501 885 — 1,386

Insurance contracts —13— 13

Other 327 66 432 825

Total $2,780 $1,884 $432 $5,096

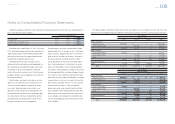

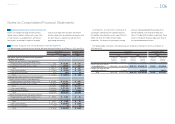

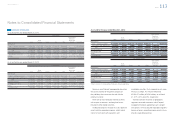

The following is description of the assets, informa-

tion about the valuation techniques used to measure

fair value, key inputs and signifi cant assumptions:

Quoted market prices for identical securities are

used to measure fair value of common stocks.

Common stocks include mainly foreign stocks as of

March 31, 2012 and 2013.

Quoted market prices for identical securities are

used to measure fair value of government bonds.

Government bonds include mainly foreign govern-

ment bonds as of March 31, 2012 and 2013.

Commingled funds are benefi cial interests of col-

lective trust. The fair values of commingled funds are

measured using the NAV provided by the adminis-

trator of the fund, and are categorized by the ability

to redeem investments at the measurement day.

Other consists of cash equivalents, other private

placement investment funds and other assets.

The fair values of other private placement invest-

ment funds are measured using the NAV provided

by the administrator of the fund, and are catego-

rized by the ability to redeem investments at the

measurement day.

Notes to Consolidated Financial Statements

Selected Financial Summary (U.S. GAAP) Consolidated Segment Information Consolidated Quarterly Financial Summary Management’s Discussion and Analysis of Financial Condition and Results of Operations Consolidated Financial Statements Notes to Consolidated Financial Statements [27 of 44]

Management’s Annual Report on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm