Toyota 2013 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2013 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Toyota Global Vision President’s Message Launching a New Structure Special Feature Review of Operations

Consolidated Performance

Highlights

Management and

Corporate Information Investor InformationFinancial Section

Page 80

NextPrev

ContentsSearchPrint

ANNUAL REPORT 2013

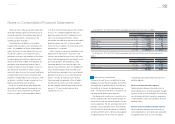

Toyota classifi es wholesale and other dealer loan

receivables portfolio segment into three classes of

wholesale, real estate and working capital, based

on the risk characteristics associated with the

underlying fi nance receivables.

A receivable account balance is considered

impaired when, based on current information and

events, it is probable that Toyota will be unable to

collect all amounts due according to the terms of

the contract. Factors such as payment history,

compliance with terms and conditions of the under-

lying loan agreement and other subjective factors

related to the fi nancial stability of the borrower are

considered when determining whether a loan is

impaired. Impaired fi nance receivables include cer-

tain nonaccrual receivables for which a specifi c

reserve has been assessed. An account modifi ed as

a troubled debt restructuring is considered to be

impaired. A troubled debt restructuring occurs when

an account is modifi ed through a concession to a

borrower experiencing fi nancial diffi culty.

All classes of wholesale and other dealer loan

receivables portfolio segment are placed on non-

accrual status when full payment of principal or

interest is in doubt, or when principal or interest

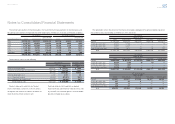

As of March 31, 2012 and 2013, fi nance receivables on nonaccrual status were as follows:

Yen in millions U.S. dollars in millions

March 31, March 31,

2012 2013 2013

Retail ¥ 2,822 ¥ 4,443 $ 47

Finance leases 958 1,135 12

Wholesale 5,485 1,985 21

Real estate 11,736 4,354 46

Working capital 37 70 1

¥21,038 ¥11,987 $127

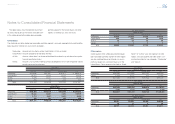

As of March 31, 2012 and 2013, fi nance receivables past due over 90 days and still accruing were as

follows:

Yen in millions U.S. dollars in millions

March 31, March 31,

2012 2013 2013

Retail ¥24,263 ¥18,442 $196

Finance leases 7,674 3,464 37

¥31,937 ¥21,906 $233

is 90 days or more contractually past due, whichev-

er occurs fi rst. Collateral dependent loans are

placed on nonaccrual status if collateral is insuffi -

cient to cover principal and interest. Interest

accrued but not collected at the date a receivable is

placed on nonaccrual status is reversed against

interest income. In addition, the amortization of net

deferred fees is suspended.

Interest income on nonaccrual receivables is rec-

ognized only to the extent it is received in cash.

Accounts are restored to accrual status only when

interest and principal payments are brought current

and future payments are reasonably assured.

Receivable balances are written-off against the

allowance for credit losses when it is probable that

a loss has been realized. Retail receivables class

and fi nance lease receivables class are not placed

generally on nonaccrual status when principal or

interest is 90 days or more past due. However,

these receivables are generally written-off against

the allowance for credit losses when payments

due are no longer expected to be received or the

account is 120 days contractually past due,

whichever occurs fi rst.

Notes to Consolidated Financial Statements

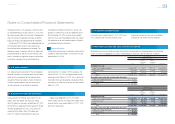

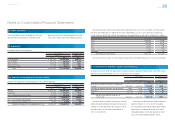

Allowance for credit losses

Allowance for credit losses is established to cover

probable losses on fi

nance receivables and vehicles

and equipment on operating leases, resulting from

the inability of customers to make required pay-

ments. Provision for credit losses is included in sell-

ing, general and administrative expenses.

The allowance for credit losses is based on a sys-

tematic, ongoing review and evaluation performed

as part of the credit-risk evaluation process, histori-

cal loss experience, the size and composition of the

portfolios, current economic events and conditions,

the estimated fair value and adequacy of collateral

and other pertinent factors. Vehicles and equipment

on operating leases are not within the scope of

accounting guidance governing the disclosure of

portfolio segments.

Retail receivables portfolio segment

Toyota calculates allowance for credit losses to

cover probable losses on retail receivables by apply-

ing reserve rates to such receivables. Reserve rates

are calculated mainly by historical loss experience,

current economic events and conditions and other

pertinent factors.

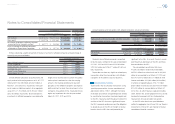

Finance lease receivables portfolio segment

Toyota calculates allowance for credit losses to

cover probable losses on fi

nance lease receivables

by applying reserve rates to such receivables.

Selected Financial Summary (U.S. GAAP) Consolidated Segment Information Consolidated Quarterly Financial Summary Management’s Discussion and Analysis of Financial Condition and Results of Operations Consolidated Financial Statements Notes to Consolidated Financial Statements [3 of 44]

Management’s Annual Report on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm