Toyota 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Toyota Global Vision President’s Message Launching a New Structure Special Feature Review of Operations

Consolidated Performance

Highlights

Management and

Corporate Information Investor InformationFinancial Section

Page 95

NextPrev

ContentsSearchPrint

ANNUAL REPORT 2013

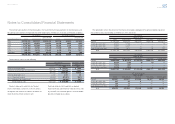

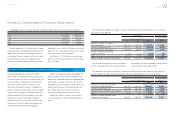

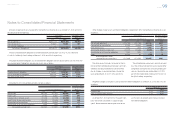

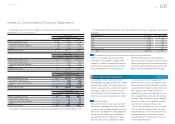

A summary of the gross unrecognized tax benefi ts changes for the years ended March 31, 2011, 2012 and

2013 is as follows:

Yen in millions U.S. dollars in millions

For the years ended March 31,

For the year ended

March 31,

2011 2012 2013 2013

Balance at beginning of year ¥23,965 ¥15,453 ¥16,901 $180

Additions based on tax positions related to

the current year 213 4,187 2,401 26

Additions for tax positions of prior years 12,564 10,801 4,339 46

Reductions for tax positions of prior years (16,133) (363) (1,619) (17)

Reductions for tax positions related to lapse

of statute of limitations — — ——

Reductions for settlements (2,794) (12,820) (2,776) (30)

Other (2,362) (357) 3,201 34

Balance at end of year ¥15,453 ¥16,901 ¥22,447 $239

The amount of unrecognized tax benefi ts that, if

recognized, would affect the effective tax rate was

not material at March 31, 2011, 2012 and 2013,

respectively. Toyota does not believe it is reasonably

possible that the total amounts of unrecognized tax

benefi ts will signifi cantly increase or decrease within

the next twelve months.

Interest and penalties related to income tax liabili-

ties are included in “Other income (loss), net”. The

amounts of interest and penalties accrued as of and

recognized for the years ended March 31, 2011,

2012 and 2013, respectively, were not material.

Toyota remains subject to income tax examina-

tion for the tax returns related to the years beginning

on and after April 1, 2006 and January 1, 2000,

with various tax jurisdictions in Japan and foreign

countries, respectively.

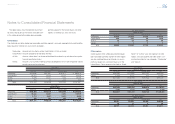

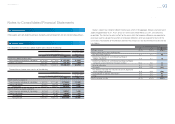

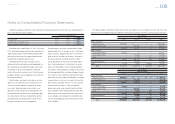

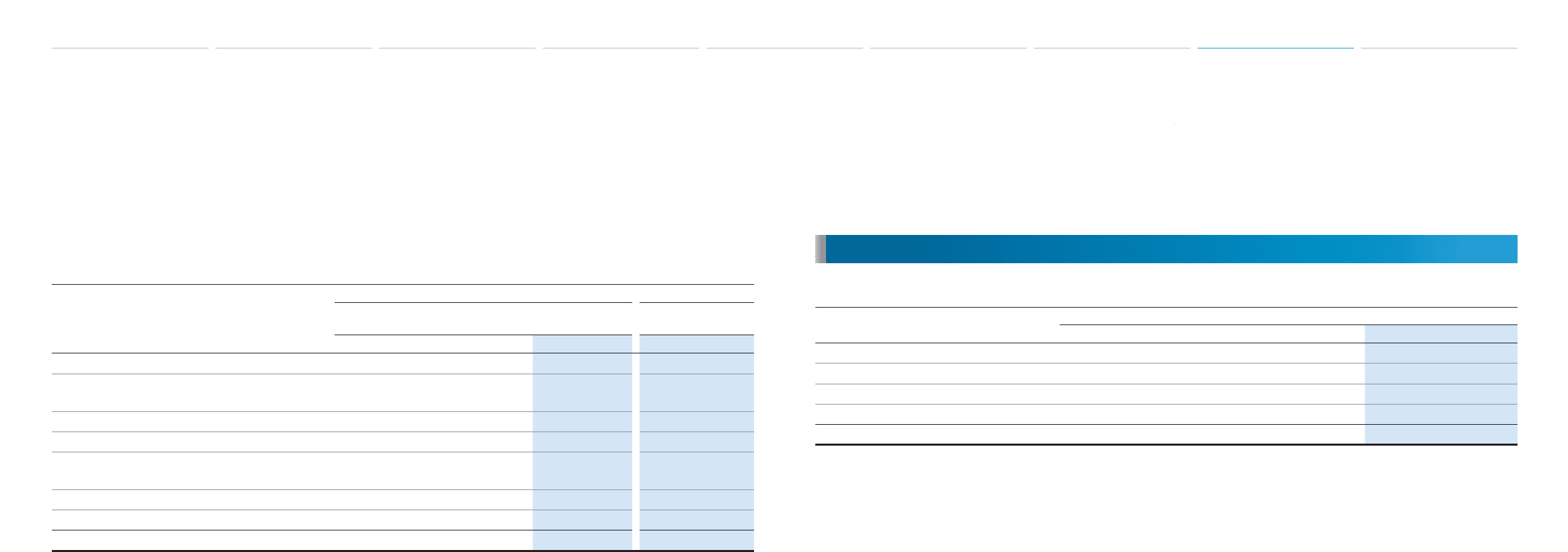

Changes in the number of shares of common stock issued have resulted from the following:

For the years ended March 31,

2011 2012 2013

Common stock issued:

Balance at beginning of year 3,447,997,492 3,447,997,492 3,447,997,492

Issuance during the year — — —

Purchase and retirement — — —

Balance at end of year 3,447,997,492 3,447,997,492 3,447,997,492

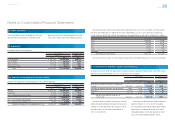

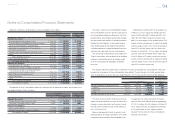

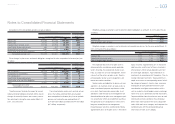

The Companies Act provides that an amount

equal to 10% of distributions from surplus paid by

the parent company and its Japanese subsidiaries

be appropriated as a capital reserve or a retained

earnings reserve. No further appropriations are

required when the total amount of the capital

reserve and the retained earnings reserve reaches

25% of stated capital.

The retained earnings reserve included in retained

earnings as of March 31, 2012 and 2013 was

¥173,711 million and ¥175,735 million ($1,869 mil-

lion), respectively. The Companies Act provides that

the retained earnings reserve of the parent company

and its Japanese subsidiaries is restricted and

unable to be used for dividend payments, and is

excluded from the calculation of the profi t available

for dividend.

The amounts of statutory retained earnings of the

parent company available for dividend payments to

shareholders were ¥5,348,279 million and

¥5,858,551 million ($62,292 million) as of March 31,

2012 and 2013, respectively. In accordance with

customary practice in Japan, the distributions from

surplus are not accrued in the fi nancial statements

for the corresponding period, but are recorded in

the subsequent accounting period after sharehold-

ers’ approval has been obtained. Retained earnings

at March 31, 2013 include amounts representing

year-end cash dividends of ¥190,046 million

($2,020 million), ¥60 ($0.64) per share, which were

approved at the Ordinary General Shareholders’

Meeting, held on June 14, 2013.

Retained earnings at March 31, 2013 include

¥1,576,055 million ($16,758 million) relating to equi-

ty in undistributed earnings of affi liated companies

accounted for by the equity method.

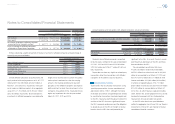

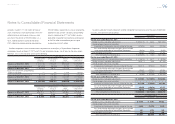

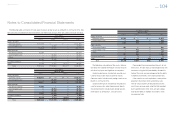

On January 1, 2012, the parent company imple-

mented share exchanges as a result of which the

parent company became a wholly-owning parent

company and each of Toyota Auto Body Co., Ltd.

and Kanto Auto Works, Ltd. became a wholly-

owned subsidiary, and the parent company

acquired additional shares of each subsidiary. As

a˛result of these share exchanges, the parent

17. Shareholders’ equity

Notes to Consolidated Financial Statements

Selected Financial Summary (U.S. GAAP) Consolidated Segment Information Consolidated Quarterly Financial Summary Management’s Discussion and Analysis of Financial Condition and Results of Operations Consolidated Financial Statements Notes to Consolidated Financial Statements [18 of 44]

Management’s Annual Report on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm