Toyota 2013 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2013 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Toyota Global Vision President’s Message Launching a New Structure Special Feature Review of Operations

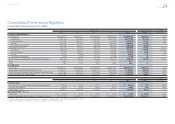

Consolidated Performance

Highlights

Management and

Corporate Information Investor InformationFinancial Section

Page 22

NextPrev

ContentsSearchPrint

ANNUAL REPORT 2013

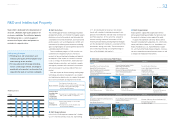

1. Growth: Sustainable growth through continuous forward-looking

investments

We believe that automotive markets worldwide will grow over the medium to

long term. As they expand, the focus of market growth is likely to shift toward

emerging markets and such fuel-effi cient options as hybrid and compact vehi-

cles. We plan to invest effi ciently and actively in these areas to meet structural

shifts in demand and to ensure long-term sustainable growth. For example, we

will prioritize the investment of management resources in the development of

next-generation environmental technologies, such as fuel cells. We will also

expand our lineup of hybrids and other eco-cars and sell them globally while

increasing sales in emerging markets by strengthening locally produced models

and building an optimized supply structure. I believe we should work to realize

a balanced business structure as stated in the Toyota Global Vision, i.e., the

“50:50 sales ratio,” with half of our sales coming from developed markets such

as Japan, the United States, and Europe and the other half from emerging

markets.

2. Effi ciency: Improving profi tability and capital effi ciency

Toyota will continue its push forward with the Toyota New Global Architecture

(TNGA), an initiative to overhaul the way we work with the goal of facilitating the

timely launch of appealing products globally. Under TNGA, we are improving

development effi ciency and making ever-better cars by standardizing parts and

components through grouped development. Moreover, Toyota has improved its

ability to invest capital effi ciently and is aiming to obtain the same results with

less outlay. We will strive to further improve our earnings structure through effi -

cient investment that emphasizes the areas in which we want to advance,

including hybrids, other eco-cars, and emerging markets.

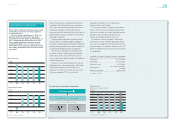

3. Stability: Maintaining a solid fi nancial base

To ensure a solid financial base, we secure suffi cient liquidity and stable share-

holders’ equity. This allows us to maintain capital expenditure and R&D invest-

ment at levels conducive to future growth as well as to maintain working capital

at a level suffi cient for operations, even when business conditions are diffi cult

due to such factors as steep increases in raw materials prices or volatility in

foreign exchange rates. We plan to refi ne and implement measures to improve

business continuity planning in the event of a major disaster. Toyota anticipates

growth in automotive markets, propelled by a recovery in the United States and

expansion in emerging markets. We believe that, in addition to putting crisis

measures into place, maintaining adequate liquidity is essential to the imple-

mentation of forward-looking investment aimed at improving product appeal

and the development of next-generation technologies as well as to the estab-

lishment of global production and sales structures. We will continue to pursue

improvements in capital efficiency and cash flow.

Dividends and Share Acquisitions

Toyota considers the enhancement of shareholder value a priority management

policy and to this end is aiming for sustainable growth through corporate reor-

ganization to increase corporate value. We aim to pay stable, ongoing divi-

dends, targeting a consolidated payout ratio of 30%, while giving due

consideration to such factors as performance each term, investment plans,

and cash and cash equivalents. To succeed in this highly competitive industry,

we plan to use retained earnings to quickly commercialize environment- and

safety-related next-generation technologies, with emphasis on customer safety

and peace of mind. Within this context, Toyota declared an annual dividend

payment of ¥90 per share for the fiscal year ended March 31, 2013.

Toyota did not acquire its own shares in the fiscal year ended March 31, 2013.

We will continue striving to further improve profits and meet the expectations

of our shareholders.

July 2013

Nobuyori Kodaira

Executive Vice President

FY2014 Forecast: Consolidated Financial Summary (Billions of yen)

FY2014 Forecasts

(Apr. 1, 2013–

Mar. 31, 2014)

FY2013 Results

(Apr. 1, 2012–

Mar. 31, 2013)

Change

Net Revenues ¥23,500.0 ¥22,064.1 ¥1,435.9

Operating Income 1,800.0 1,320.8 479.2

Income before Income Taxes

and Equity in Earnings of

Affi liated Companies

1,890. 0 1,403.6 486.4

Net Income Attributable to

Toyota Motor Corporation 1,370.0 962.1 407.9

FOREX Rates Yen/US$ ¥ 90 ¥ 83 ¥ +7

Yen/Euro 120 107 +13

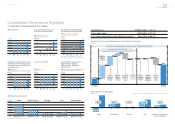

FY2014 Forecast: Consolidated Operating Income Analysis (vs. FY2013)

(Billions of yen)

Operating Income

FY2013 Results 1,320.8

Positive

Factors

Effects of FOREX Rates +400.0

Cost Reduction Efforts +160.0

Marketing Efforts +80.0

Financial Services -30.0

Subtotal +640.0

Negative

Factors

Increase in Expenses, etc. -160.8

FX Effects at Overseas Subsidiaries

(Translational) +60.0

Subtotal -160.8

Total +479.2

FY2014 Forecasts 1,800.0

10,000

8,000

6,000

4,000

2,000

0

FY2014 Forecast: Consolidated Vehicle Sales

(Thousands of units)

9,100

2,120

2,640

830

1,760

1,750

8,871

2,279

2,469

799

1,684

1,640

Change

+110

+76

+31

+171

-159

+229

FY2013 Results FY2014 Forecasts

왎 Japan 왎 North America 왎 Europe 왎 Asia 왎 Other

Message from the Executive Vice President Responsible for Accounting

Making Ever-Better Cars Enriching Lives of Communities Stable Base of Business [3 of 4]