Toyota 2013 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2013 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Toyota Global Vision President’s Message Launching a New Structure Special Feature Review of Operations

Consolidated Performance

Highlights

Management and

Corporate Information Investor InformationFinancial Section

Page 84

NextPrev

ContentsSearchPrint

ANNUAL REPORT 2013

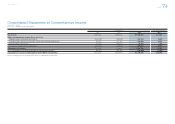

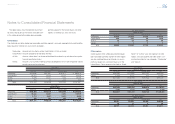

U.S. dollars in millions

March 31, 2013

Cost

Gross

unrealized

gains

Gross

unrealized

losses Fair value

Available-for-sale:

Public and corporate bonds $46,262 $ 2,244 $ 94 $48,412

Common stocks 6,373 8,553 28 14,898

Other 5,713 334 0 6,047

Total $58,348 $11,131 $122 $69,357

Securities not practicable to determine fair value:

Public and corporate bonds $ 214

Common stocks 841

Total $ 1,055

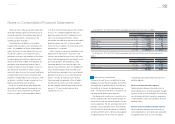

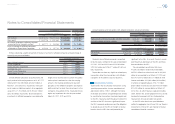

Public and corporate bonds included in available-

for-sale represent 60% of Japanese bonds, and

40% of U.S., European and other bonds as of March

31, 2012, and 49% of Japanese bonds, and 51%

of U.S., European and other bonds as of March 31,

2013. Listed stocks on the Japanese stock markets

represent 83% and 85% of common stocks which

are included in available-for-sale as of March 31,

2012 and 2013, respectively. Public and corporate

bonds include primarily government bonds, and

“Other” includes primarily investment trusts.

Unrealized losses continuing over a 12 month

period or more in the aggregate were not material at

March 31, 2012 and 2013.

As of March 31, 2012 and 2013, maturities of

public and corporate bonds and other included in

available-for-sale are mainly from 1 to 10 years.

Proceeds from sales of available-for-sale securi-

ties were ¥189,037 million, ¥162,160 million and

¥35,178 million ($374 million) for the years ended

March 31, 2011, 2012 and 2013, respectively. On

those sales, gross realized gains were ¥8,974 mil-

lion, ¥4,822 million and ¥1,048 million ($11 million)

and gross realized losses were ¥87 million, ¥15 mil-

lion and ¥31 million ($0 million), respectively.

During the years ended March 31, 2011, 2012

and 2013, Toyota recognized impairment losses on

available-for-sale securities of ¥7,915 million,

¥53,831 million and ¥2,104 million ($22 million),

respectively, which are included in “Other income

(loss), net” in the accompanying consolidated state-

ments of income.

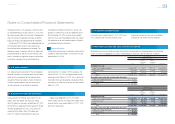

In the ordinary course of business, Toyota main-

tains long-term investment securities, included in

“Marketable securities and other securities invest-

ments” and issued by a number of non-public com-

panies which are recorded at cost, as their fair

values were not readily determinable. Management

employs a systematic methodology to assess the

recoverability of such investments by reviewing the

fi nancial viability of the underlying companies and

the prevailing market conditions in which these

companies operate to determine if Toyota’s invest-

ment in each individual company is impaired and

whether the impairment is other-than-temporary.

Toyota periodically performs this impairment test

for signifi cant investments recorded at cost. If

the impairment is determined to be other-than-

temporary, the carrying value of the investment is

written-down by the impaired amount and the

losses are recognized currently in operations.

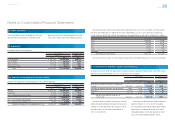

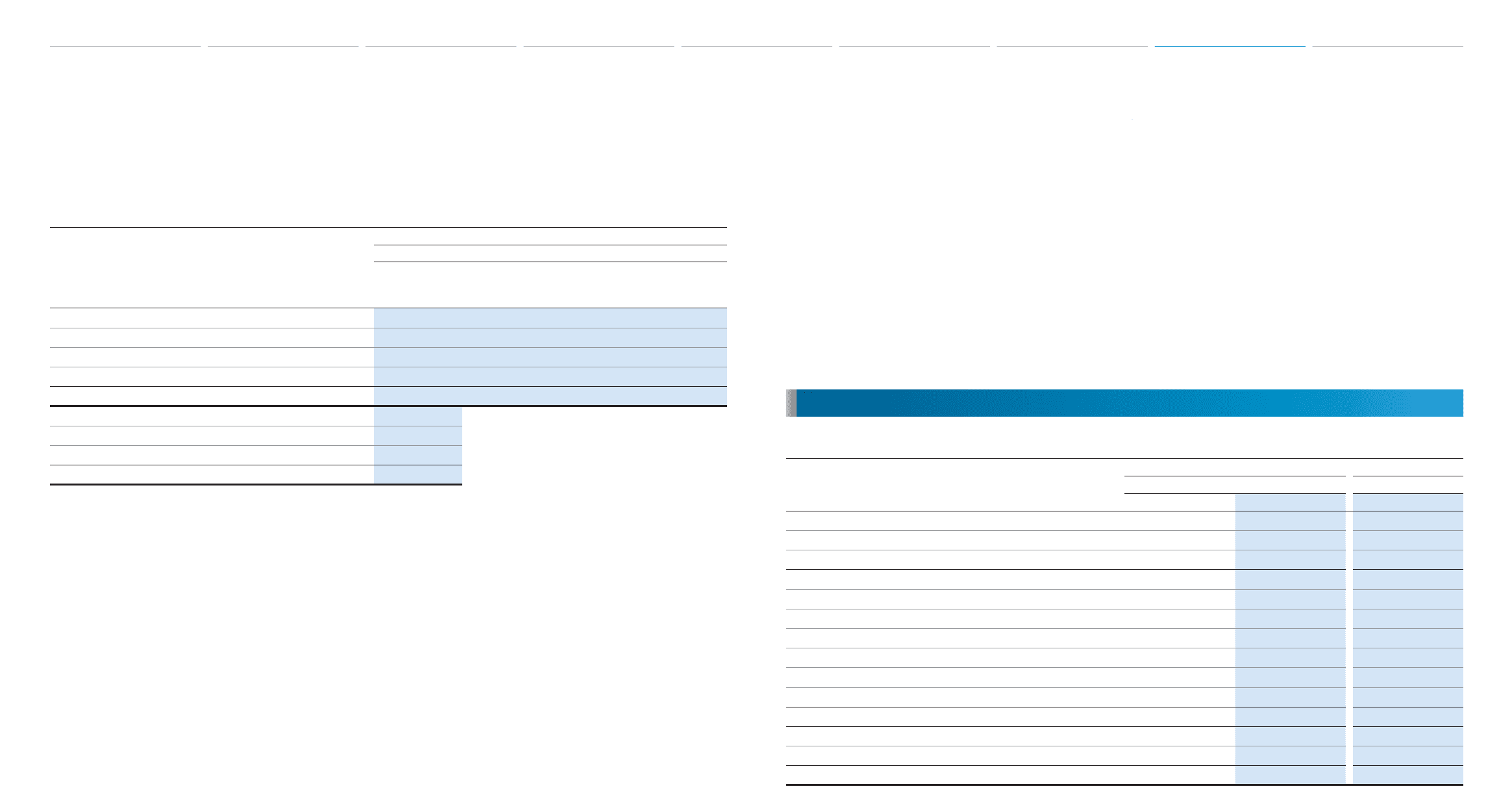

Finance receivables consist of the following:

Yen in millions U.S. dollars in millions

March 31, March 31,

2012 2013 2013

Retail ¥ 7,248,793 ¥ 9,047,782 $ 96,202

Finance leases 955,430 1,029,887 10,950

Wholesale and other dealer loans 2,033,954 2,615,728 27,812

10,238,177 12,693,397 134,964

Deferred origination costs 105,533 135,398 1,439

Unearned income (494,123) (628,340) (6,681)

Allowance for credit losses

Retail (77,353) (83,858) (892)

Finance leases (30,637) (28,928) (307)

Wholesale and other dealer loans (24,238) (26,243) (279)

Total allowance for credit losses (132,228) (139,029) (1,478)

Total fi nance receivables, net 9,717,359 12,061,426 128,244

Less—Current portion (4,114,897) (5,117,660) (54,414)

Noncurrent fi nance receivables, net ¥ 5,602,462 ¥ 6,943,766 $ 73,830

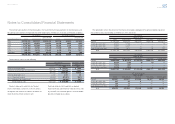

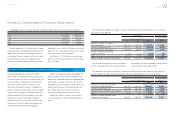

Finance receivables were geographically distribut-

ed as follows: in North America 58.1%, in Japan

12.0%, in Europe 10.3%, in Asia 7.1% and in Other

12.5% as of March 31, 2012, and in North America

57.6%, in Europe 10.0%, in Japan 9.9%, in Asia

9.5% and in Other 13.0% as of March 31, 2013.

7. Finance receivables

Notes to Consolidated Financial Statements

Selected Financial Summary (U.S. GAAP) Consolidated Segment Information Consolidated Quarterly Financial Summary Management’s Discussion and Analysis of Financial Condition and Results of Operations Consolidated Financial Statements Notes to Consolidated Financial Statements [7 of 44]

Management’s Annual Report on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm