Toyota 2013 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2013 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Toyota Global Vision President’s Message Launching a New Structure Special Feature Review of Operations

Consolidated Performance

Highlights

Management and

Corporate Information Investor InformationFinancial Section

Page 121

NextPrev

ContentsSearchPrint

ANNUAL REPORT 2013

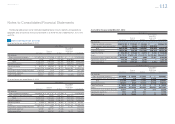

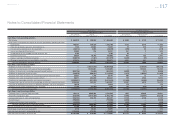

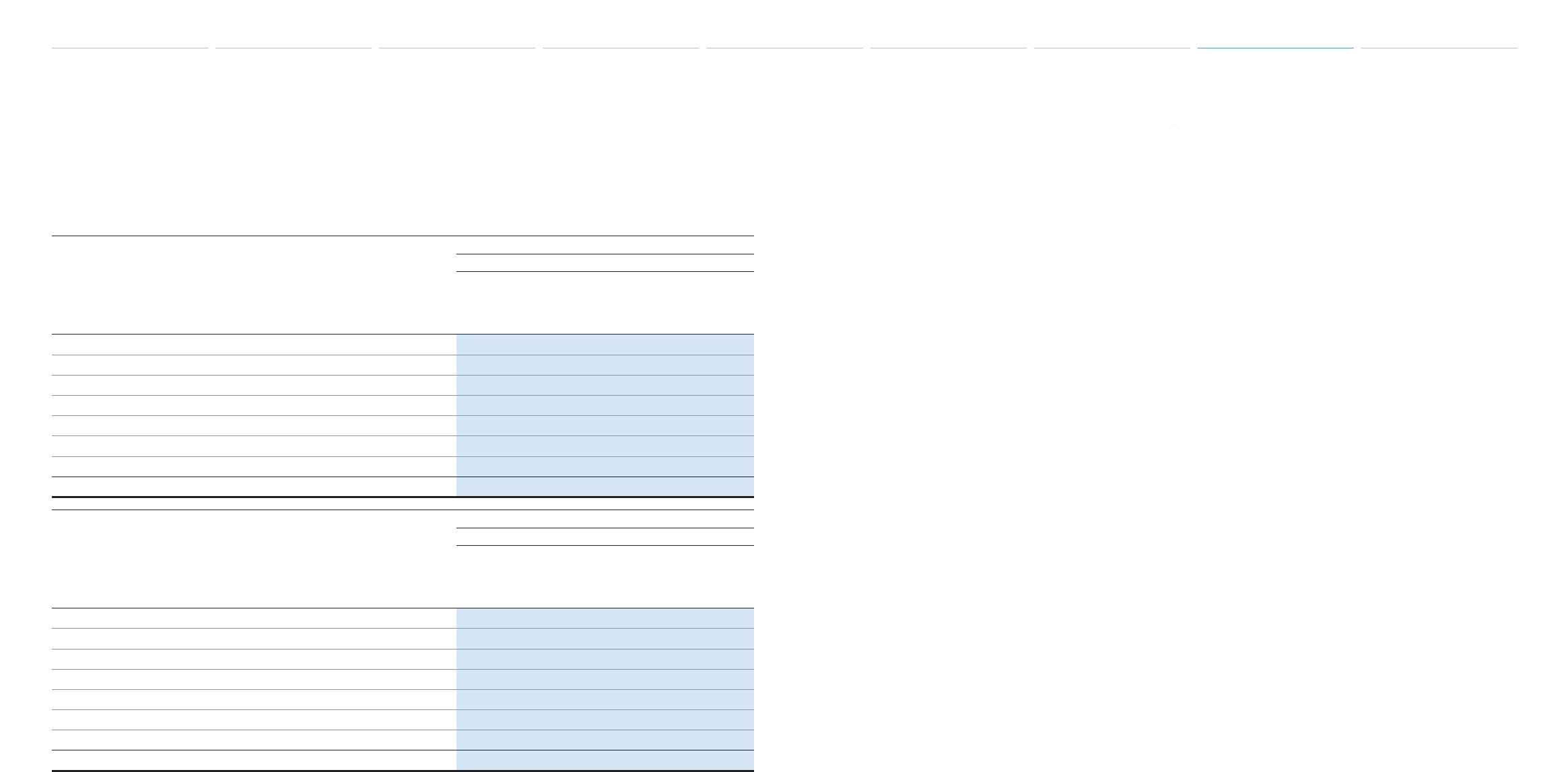

Yen in millions

For the year ended March 31, 2013

Marketable

securities and

other securities

investments

Derivative

fi nancial

instruments Total

Balance at beginning of year ¥1,684 ¥4,739 ¥ 6,423

Total gains (losses)

Included in earnings 24 2,118 2,142

Included in other comprehensive income (loss) 58 — 58

Purchases and issuances 3,607 — 3,607

Settlements (1,563) (2,343) (3,906)

Other 3,079 613 3,692

Balance at end of year ¥6,889 ¥5,127 ¥12,016

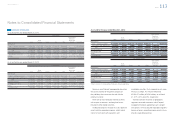

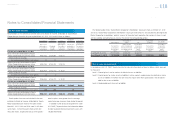

U.S. dollars in millions

For the year ended March 31, 2013

Marketable

securities and

other securities

investments

Derivative

fi nancial

instruments Total

Balance at beginning of year $18 $50 $ 68

Total gains (losses)

Included in earnings 022 22

Included in other comprehensive income (loss) 1— 1

Purchases and issuances 38 — 38

Settlements (16) (25) (41)

Other 32 7 39

Balance at end of year $73 $54 $127

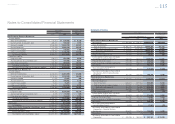

“Included in earnings” in marketable securities

and other securities investments and derivative

fi nancial instruments are included in “Other income

(loss), net” and “Cost of fi nancing operations” in

the accompanying consolidated statements of

income, respectively.

In the reconciliation table above, derivative fi nan-

cial instruments are presented net of assets and lia-

bilities. The other amount includes consolidated

retained interests in securitized fi nancial receivables

of ¥(13,165) million, certain derivative fi nancial

instruments transferred into Level 2 due to be mea-

sured at observable inputs of ¥(21,413) million and

the impact of currency translation adjustments for

the year ended March 31, 2011, and includes the

impacts of level transfers and currency translation

adjustments for the year ended March 31, 2012,

and includes the currency translation adjustments

for the year ended March 31, 2013.

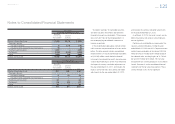

As of March 31, 2013, the Level 3 assets and lia-

bilities measured at fair value on a recurring basis

are not signifi cant.

Certain assets and liabilities are measured at fair

value on a nonrecurring basis. During the years

ended March 31, 2012 and 2013, Toyota measured

certain fi nance receivables at fair value of ¥32,056

million and ¥32,974 million ($351 million) based on

the collateral value, resulting in gains of ¥1,736 mil-

lion and ¥978 million ($10 million). This fair value

measurement on a nonrecurring basis is classifi ed in

Level 3. See note 21 to the consolidated fi nancial

statements for the fair value measurement. These

Level 3 fi nancial assets are not signifi cant.

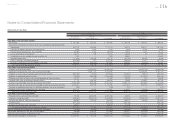

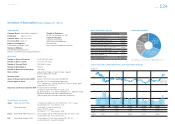

Notes to Consolidated Financial Statements

Selected Financial Summary (U.S. GAAP) Consolidated Segment Information Consolidated Quarterly Financial Summary Management’s Discussion and Analysis of Financial Condition and Results of Operations Consolidated Financial Statements Notes to Consolidated Financial Statements [44 of 44]

Management’s Annual Report on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm