Toyota 2013 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2013 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Toyota Global Vision President’s Message Launching a New Structure Special Feature Review of Operations

Consolidated Performance

Highlights

Management and

Corporate Information Investor InformationFinancial Section

Page 93

NextPrev

ContentsSearchPrint

ANNUAL REPORT 2013

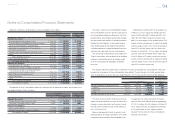

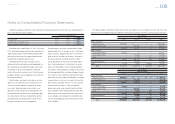

Other payables are mainly related to purchases of property, plant and equipment and non-manufacturing purchases.

15. Other payables

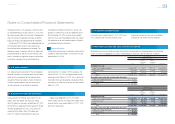

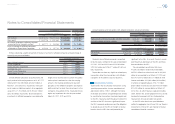

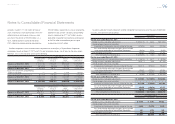

The components of income (loss) before income taxes comprise the following:

Yen in millions U.S. dollars in millions

For the years ended March 31,

For the year ended

March 31,

2011 2012 2013 2013

Income (loss) before income taxes:

Parent company and domestic subsidiaries ¥(278,229) ¥(177,852) ¥ 651,852 $ 6,931

Foreign subsidiaries 841,519 610,725 751,797 7,994

¥ 563,290 ¥ 432,873 ¥1,403,649 $14,925

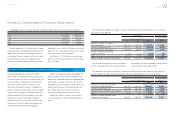

The provision for income taxes consists of the following:

Yen in millions U.S. dollars in millions

For the years ended March 31,

For the year ended

March 31,

2011 2012 2013 2013

Current income tax expense:

Parent company and domestic subsidiaries ¥ 85,290 ¥111,363 ¥178,662 $1,900

Foreign subsidiaries 141,821 144,514 213,016 2,265

Total current 227,111 255,877 391,678 4,165

Deferred income tax expense (benefi t):

Parent company and domestic subsidiaries (44,268) (57,940) 140,041 1,489

Foreign subsidiaries 129,978 64,335 19,967 212

Total deferred 85,710 6,395 160,008 1,701

Total provision ¥312,821 ¥262,272 ¥551,686 $5,866

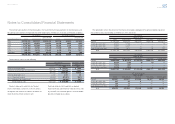

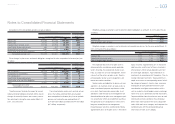

16. Income taxes

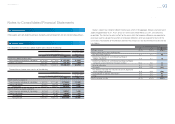

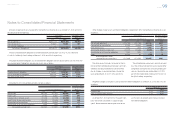

Toyota is subject to a number of different income taxes which, in the aggregate, indicate a statutory rate in

Japan of approximately 40.2%, 40.2% and 37.6% for the years ended March 31, 2011, 2012 and 2013,

respectively. The statutory tax rates in effect for the year in which the temporary differences are expected to

reverse are used to calculate the tax effects of temporary differences which are expected to reverse in the

future years. Reconciliation of the differences between the statutory tax rate and the effective income tax rate

is as follows:

For the years ended March 31,

2011 2012 2013

Statutory tax rate 40.2% 40.2% 37.6%

Increase (reduction) in taxes resulting from:

Non-deductible expenses 2.2 1.7 0.6

Deferred tax liabilities on undistributed earnings of

foreign subsidiaries 4.8 4.7 1.8

Deferred tax liabilities on undistributed earnings of affi liated

companies accounted for by the equity method 12.6 9.2 4.1

Valuation allowance 8.1 14.9 1.7

Tax credits (2.6) (1.8) (3.1)

The difference between the statutory tax rate in Japan and

that of foreign subsidiaries (9.3) (9.6) (4.8)

Unrecognized tax benefi ts adjustments (0.6) 2.5 0.1

Other 0.1 (1.2) 1.3

Effective income tax rate 55.5% 60.6% 39.3%

Notes to Consolidated Financial Statements

Selected Financial Summary (U.S. GAAP) Consolidated Segment Information Consolidated Quarterly Financial Summary Management’s Discussion and Analysis of Financial Condition and Results of Operations Consolidated Financial Statements Notes to Consolidated Financial Statements [16 of 44]

Management’s Annual Report on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm