Toyota 2013 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2013 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Toyota Global Vision President’s Message Launching a New Structure Special Feature Review of Operations

Consolidated Performance

Highlights

Management and

Corporate Information Investor InformationFinancial Section

Page 90

NextPrev

ContentsSearchPrint

ANNUAL REPORT 2013

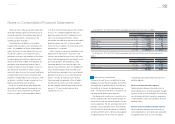

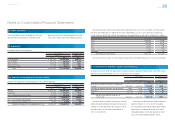

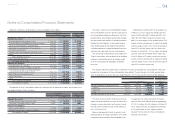

Yen in millions U.S. dollars in millions

For the years ended March 31,

For the year ended

March 31,

2011 2012 2013 2013

Net revenues ¥21,874,143 ¥22,211,233 ¥24,242,046 $257,757

Gross profi t ¥ 2,342,706 ¥ 2,297,660 ¥ 2,620,892 $ 27,867

Net income attributable to affi liated companies

accounted for by the equity method ¥ 641,771 ¥ 554,983 ¥ 705,249 $ 7,499

Equity in earnings of affi liated companies

attributable to Toyota Motor Corporation ¥ 215,016 ¥ 197,701 ¥ 231,519 $ 2,461

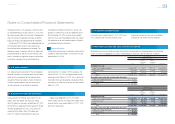

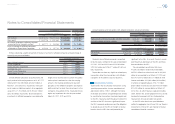

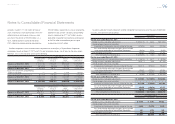

Entities comprising a signifi cant portion of Toyota’s investment in affi liated companies and percentage of

ownership are presented below:

Percentage of ownership

March 31,

Name of affi liated companies 2012 2013

Denso Corporation 24.9% 24.9%

Toyota Industries Corporation 24.8% 24.8%

Aisin Seiki Co., Ltd. 23.4% 23.4%

Toyota Tsusho Corporation 22.1% 22.1%

Toyoda Gosei Co., Ltd. 43.1% 43.0%

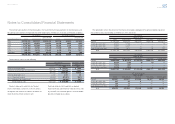

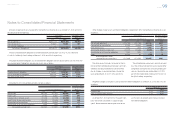

Certain affi liated companies accounted for by the

equity method with carrying amounts of ¥1,467,575

million and ¥1,582,988 million ($16,831 million) at

March 31, 2012 and 2013, respectively, were quot-

ed on various established markets at an aggregate

value of ¥1,477,413 million and ¥1,954,347 million

($20,780 million), respectively. Toyota evaluated its

investments in affi liated companies, considering the

length of time and the extent to which the quoted

market prices have been less than the carrying

amounts, the fi nancial condition and near-term

prospects of the affi liated companies and Toyota’s

ability and intent to retain those investments in the

companies for a period of time. Toyota did not rec-

ognize any impairment loss for the years ended

March 31, 2011, 2012 and 2013.

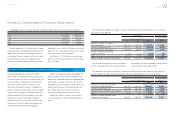

Account balances and transactions with affi liated companies are presented below:

Yen in millions U.S. dollars in millions

March 31, March 31,

2012 2013 2013

Trade accounts and notes receivable, and other receivables ¥283,497 ¥252,708 $2,687

Accounts payable and other payables 707,955 592,027 6,295

Yen in millions U.S. dollars in millions

For the years ended March 31,

For the year ended

March 31,

2011 2012 2013 2013

Net revenues ¥1,612,397 ¥1,536,326 ¥1,926,854 $20,488

Purchases 3,655,185 3,785,284 4,020,138 42,745

Dividends from affi liated companies accounted

for by the equity method for the years ended March

31, 2011, 2012 and 2013 were ¥103,169 million,

¥122,950 million and ¥126,977 million ($1,350 mil-

lion), respectively.

Toyota does not have any signifi cant related party

transactions other than transactions with affi liated

companies in the ordinary course of business.

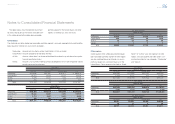

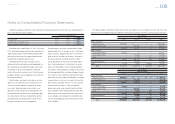

Variable interest entities

Toyota enters into securitization transactions using

special-purpose entities, that are considered vari-

able interest entities (“VIEs”). Although the fi nance

receivables and vehicles on operating leases related

to securitization transactions have been legally sold

to the VIEs, Toyota has both the power to direct the

activities of the VIEs that most signifi cantly impact

the VIEs’ economic performance and the obligation

to absorb losses of the VIEs or the right to receive

benefi ts from the VIEs that could potentially be

signifi cant to the VIEs. As a result, Toyota is consid-

ered the primary benefi ciary of the VIEs and there-

fore consolidates the VIEs.

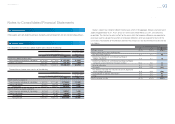

The consolidated securitization VIEs have

¥1,208,136 million in retail fi nance receivables,

¥65,541 million in restricted cash and ¥1,040,816

million in secured debt as of March 31, 2012 and

have ¥1,135,513 million ($12,074 million) in retail

fi nance receivables, ¥41,664 million ($443 million)

in vehicles on operating leases, ¥58,770 million

($625 million) in restricted cash and ¥978,095 million

($10,400 million) in secured debt as of March 31,

2013. Risks to which Toyota is exposed including

credit, interest rate, and/or prepayment risks are not

incremental compared with the situation before

Toyota enters into securitization transactions.

As for VIEs other than those specifi ed above,

neither the aggregate size of these VIEs nor Toyota’s

involvements in these VIEs are material to Toyota’s

consolidated fi nancial statements.

Notes to Consolidated Financial Statements

Selected Financial Summary (U.S. GAAP) Consolidated Segment Information Consolidated Quarterly Financial Summary Management’s Discussion and Analysis of Financial Condition and Results of Operations Consolidated Financial Statements Notes to Consolidated Financial Statements [13 of 44]

Management’s Annual Report on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm