Toyota 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Toyota Global Vision President’s Message Launching a New Structure Special Feature Review of Operations

Consolidated Performance

Highlights

Management and

Corporate Information Investor InformationFinancial Section

Page 82

NextPrev

ContentsSearchPrint

ANNUAL REPORT 2013

Goodwill and intangible assets

Goodwill is not material to Toyota’s consolidated

balance sheets.

Intangible assets consist mainly of software.

Intangible assets with a defi nite life are amortized on

a straight-line basis with estimated useful lives

mainly of 5 years. Intangible assets with an indefi nite

life are tested for impairment whenever events or

circumstances indicate that a carrying amount of an

asset (asset group) may not be recoverable.

An impairment loss would be recognized when

the carrying amount of an asset exceeds the esti-

mated undiscounted cash fl ows used in determining

the fair value of the asset. The amount of the impair-

ment loss to be recorded is generally determined by

the difference between the fair value of the asset

using a discounted cash fl ow valuation method and

the current book value.

Employee benefi t obligations

Toyota has both defi ned benefi t and defi ned contri-

bution plans for employees’ retirement benefi ts.

Retirement benefi t obligations are measured by

actuarial calculations in accordance with U.S. GAAP.

The funded status of the defi ned benefi t postretire-

ment plans is recognized on the consolidated bal-

ance sheets as prepaid pension and severance costs

or accrued pension and severance costs, and the

funded status change is recognized in the year in

which it occurs through other comprehensive income.

Environmental matters

Environmental expenditures relating to current oper-

ations are expensed or capitalized as appropriate.

rates. All derivative fi nancial instruments are record-

ed on the consolidated balance sheets at fair value,

taking into consideration the effects of legally

enforceable master netting agreements that allow

us to net settle positive and negative positions and

offset cash collateral held with the same counter-

party on a net basis. Toyota does not use deriva-

tives for speculation or trading purposes. Changes

in the fair value of derivatives are recorded each

period in current earnings or through other compre-

hensive income, depending on whether a derivative

is designated as part of a hedge transaction and the

type of hedge transaction. The ineffective portion of

all hedges is recognized currently in operations.

Net income attributable to Toyota Motor

Corporation per share

Basic net income attributable to Toyota Motor

Corporation per common share is calculated by

dividing net income attributable to Toyota Motor

Corporation by the weighted-average number of

shares outstanding during the reported period.

The calculation of diluted net income attributable

to Toyota Motor Corporation per common share

is similar to the calculation of basic net income

attributable to Toyota Motor Corporation per share,

except that the weighted-average number of shares

outstanding includes the additional dilution from the

assumed exercise of dilutive stock options.

Stock-based compensation

Toyota measures compensation expense for its stock-

based compensation plan based on the grant-date fair

value of the award, and accounts for the award.

Expenditures relating to existing conditions caused

by past operations, which do not contribute to cur-

rent or future revenues, are expensed. Liabilities for

remediation costs are recorded when they are prob-

able and reasonably estimable, generally no later

than the completion of feasibility studies or Toyota’s

commitment to a plan of action. The cost of each

environmental liability is estimated by using current

technology available and various engineering, fi nan-

cial and legal specialists within Toyota based on

current law. Such liabilities do not refl ect any offset

for possible recoveries from insurance companies

and are not discounted. There were no material

changes in these liabilities for all periods presented.

Income taxes

The provision for income taxes is computed based

on the pretax income included in the consolidated

statements of income. The asset and liability

approach is used to recognize deferred tax assets

and liabilities for the expected future tax conse-

quences of temporary differences between the car-

rying amounts and the tax bases of assets and

liabilities. Valuation allowances are recorded to

reduce deferred tax assets when it is more likely

than not that a tax benefi t will not be realized.

Derivative fi nancial instruments

Toyota employs derivative fi nancial instruments,

including forward foreign currency exchange con-

tracts, foreign currency options, interest rate swaps,

interest rate currency swap agreements and interest

rate options to manage its exposure to fl uctuations

in interest rates and foreign currency exchange

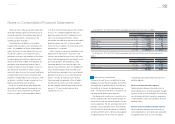

Other comprehensive income

Other comprehensive income refers to revenues,

expenses, gains and losses that, under U.S. GAAP

are included in comprehensive income, but are

excluded from net income as these amounts are

recorded directly as an adjustment to shareholders’

equity. Toyota’s other comprehensive income is pri-

marily comprised of unrealized gains/losses on mar-

ketable securities designated as available-for-sale,

foreign currency translation adjustments and adjust-

ments attributed to pension liabilities associated

with Toyota’s defi ned benefi t pension plans.

Accounting changes

In June 2011, FASB issued updated guidance on

the presentation of comprehensive income. This

guidance requires to present the total of compre-

hensive income, the components of net income,

and the components of other comprehensive

income either in a single continuous statements of

comprehensive income or in two separate but con-

secutive statements. Toyota adopted this guidance

from the interim period within the fi scal year, begun

after December 15, 2011. The adoption of this

guidance did not have a material impact on Toyota’s

consolidated fi nancial statements.

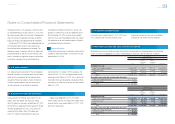

Recent pronouncements to be adopted in

future periods

In December 2011, FASB issued updated guidance

of disclosures about offsetting assets and liabilities.

This guidance requires additional disclosures about

gross and net information for assets and liabilities

including fi nancial instruments eligible for offset in

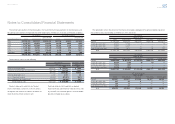

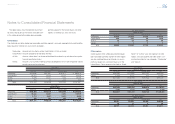

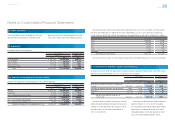

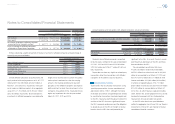

Notes to Consolidated Financial Statements

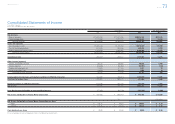

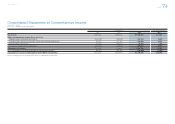

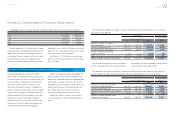

Selected Financial Summary (U.S. GAAP) Consolidated Segment Information Consolidated Quarterly Financial Summary Management’s Discussion and Analysis of Financial Condition and Results of Operations Consolidated Financial Statements Notes to Consolidated Financial Statements [5 of 44]

Management’s Annual Report on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm