Toyota 2013 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2013 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Toyota Global Vision President’s Message Launching a New Structure Special Feature Review of Operations

Consolidated Performance

Highlights

Management and

Corporate Information Investor InformationFinancial Section

Page 97

NextPrev

ContentsSearchPrint

ANNUAL REPORT 2013

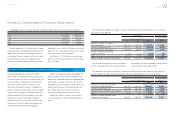

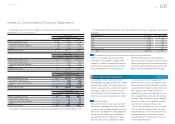

In June 1997, the parent company’s shareholders

approved a stock option plan for board members.

In June 2001, the shareholders approved an

amendment of the plan to include both board mem-

bers and key employees. Each year until June

2010, since the plans’ inception, the shareholders

have approved the authorization for the grant of

options for the purchase of Toyota’s common stock.

Authorized shares for each year that remain ungranted

are unavailable for grant in future years. Stock

options granted in and after August 2006 have

terms of 8 years and an exercise price equal to

1.025 times the closing price of Toyota’s common

stock on the date of grant. These options generally

vest 2 years from the date of grant.

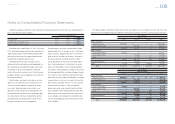

For the years ended March 31, 2011, 2012 and

2013, Toyota recognized stock-based compensa-

tion expenses for stock options of ¥2,522 million,

¥1,539 million and ¥325 million ($3 million) as sell-

ing, general and administrative expenses.

The weighted-average grant-date fair value of

options granted during the year ended March 31,

2011 was ¥724 per share. The fair value of options

granted is amortized over the option vesting period

in determining net income attributable to Toyota

Motor Corporation in the consolidated statements

of income. The grant-date fair value of options

granted is estimated using the Black-Scholes

option pricing model with the following weighted-

average assumptions:

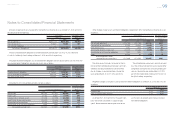

2011

Dividend rate 1.5%

Risk-free interest rate 0.3%

Expected volatility 32%

Expected holding period (years) 5.0

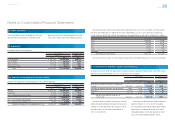

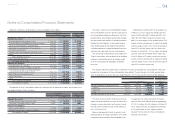

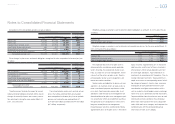

18. Stock-based compensation The following table summarizes Toyota’s stock option activity:

Yen Yen in millions

Number of

shares

Weighted-average

exercise

price

Weighted-average

remaining

contractual life

in years

Aggregate

intrinsic value

Options outstanding at March 31, 2010 13,716,700 ¥5,363 5.23 ¥ —

Granted 3,435,000 3,183

Exercised — —

Canceled (1,364,900) 4,759

Options outstanding at March 31, 2011 15,786,800 4,941 5.04 ¥ 565

Granted — —

Exercised — —

Canceled (3,256,800) 5,059

Options outstanding at March 31, 2012 12,530,000 4,910 4.55 ¥1,065

Granted — —

Exercised (645,000) 3,328

Canceled (1,036,000) 5,907

Options outstanding at March 31, 2013 10,849,000 ¥4,909 3.56 ¥5,921

Options exercisable at March 31, 2011 9,347,800 ¥5,821 3.79 ¥ —

Options exercisable at March 31, 2012 9,778,000 ¥5,396 4.05 ¥ —

Options exercisable at March 31, 2013 10,849,000 ¥4,909 3.56 ¥5,921

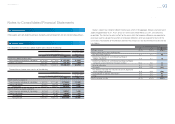

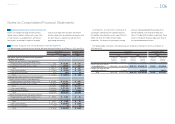

No options were exercised for the years ended

March 31, 2011 and 2012. The total intrinsic value

of options exercised for the year ended March 31,

2013 was ¥364 million ($4 million).

No cash was received from the exercise of stock

options for the years ended March 31, 2011 and

2012. Cash received from the exercise of stock

options for the year ended March 31, 2013 was

¥2,147 million ($23 million).

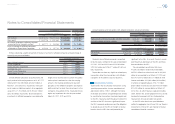

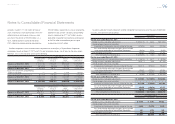

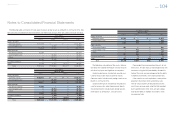

The following table summarizes information for options outstanding and options exercisable at March 31, 2013:

Outstanding Exercisable

Exercise price

range Number of

shares

Weighted-average

exercise price

Weighted-

average

remaining life Number of

shares

Weighted-average

exercise price

Yen Yen U.S. dollars Years Yen U.S. dollars

¥3,183 – 5,000 7,480,000 ¥4,068 $43 4.31 7,480,000 ¥4,068 $43

5,001 – 7,278 3,369,000 6,774 72 1.89 3,369,000 6,774 72

3,183 – 7,278 10,849,000 4,909 52 3.56 10,849,000 4,909 52

Notes to Consolidated Financial Statements

Selected Financial Summary (U.S. GAAP) Consolidated Segment Information Consolidated Quarterly Financial Summary Management’s Discussion and Analysis of Financial Condition and Results of Operations Consolidated Financial Statements Notes to Consolidated Financial Statements [20 of 44]

Management’s Annual Report on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm