Toyota 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Toyota Global Vision President’s Message Launching a New Structure Special Feature Review of Operations

Consolidated Performance

Highlights

Management and

Corporate Information Investor InformationFinancial Section

Page 63

NextPrev

ContentsSearchPrint

ANNUAL REPORT 2013

As for our world future business environment, the

U.S. economy is expected to benefi t from ongoing

moderate recovery and a pickup in the pace of eco-

nomic expansion in emerging countries. Europe,

meanwhile, still faces the risk of economic stagna-

tion due to the sovereign debt crisis and other fac-

tors, though a gradual bottoming out is anticipated.

The automotive market is expected to see recov-

ery in the U.S. and expansion in emerging countries.

However, amid the change in market structure, as

seen in the expansion and diversifi cation of demand

for eco-cars backed by rising environmental con-

sciousness, fi erce competition exists on a global

scale. With the foregoing external factors in mind,

Toyota expects that net revenues for fi scal 2014 will

increase compared with fi scal 2013 as results of a

favorable impact of fl uctuations in foreign currency

translation rates and an increase in vehicle unit

sales. With respect to operating income, factors

expected to contribute to an increase in operating

income include the favorable impact of fl uctuations

in foreign currency rates, increased vehicle unit

sales through marketing efforts, and cost reduction

efforts. On the other hand, factors expected to con-

tribute to a decrease in operating income include

increase in miscellaneous costs and others. As the

Outlook

Historically, Toyota has funded its capital expenditures and research and development activities through cash

generated by operations.

Liquidity and Capital Resources

result, Toyota expects that operating income will

increase in fi scal 2014 compared with fi scal 2013.

Also, Toyota expects that income before income

taxes and equity in earnings of affi liated companies

and net income attributable to Toyota Motor

Corporation will increase in fi scal 2014.

For the purposes of this outlook discussion,

Toyota is assuming an average exchange rate of

¥90 to the U.S. dollar and ¥120 to the euro.

Exchange rate fl uctuations can materially affect

Toyota’s operating results. In particular, a strength-

ening of the Japanese yen against the U.S. dollar

can have a material adverse effect on Toyota’s

operating results. See “Overview—Currency

Fluctuations” for further discussion.

The foregoing statements are forward-looking

statements based upon Toyota’s management’s

assumptions and beliefs regarding exchange rates,

market demand for Toyota’s products, economic

conditions and others. See “Cautionary Statement

Concerning Forward-Looking Statements”. Toyota’s

actual results of operations could vary signifi cantly

from those described above as a result of unantici-

pated changes in the factors described above or

other factors, including those described in

“Risk Factors”.

3,000

0

2,000

2,500

1,500

500

1,000

1,500

0

1,200

900

600

300

2,500

0

2,000

1,500

1,000

500

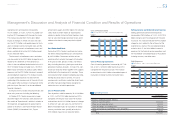

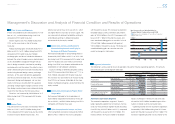

Net Cash Provided by

Operating Activities and

Free Cash Flow*

* (Net cash provided by operating activities)-

(Capital expenditures for property, plant and

equipment, excluding vehicles and

equipment on operating leases)

왎왎 Net cash provided by operating activities

왎왎 Free cash flow

(¥ Billion)

FY ’09 ’10 ’11 ’12 ’13

Capital Expenditures for

Property, Plant and Equipment*

and Depreciation

* Excluding vehicles and equipment on operating leases

왎왎 Capital expenditures 왎왎 Depreciation

(¥ Billion)

FY ’09 ’10 ’11 ’12 ’13

Cash and Cash Equivalents

at End of Year

(¥ Billion)

FY ’09 ’10 ’11 ’12 ’13

Management’s Discussion and Analysis of Financial Condition and Results of Operations

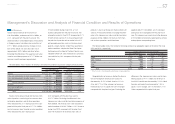

Operating income from fi nancial services opera-

tions decreased by ¥51.8 billion, or 14.5%, to

¥306.4 billion during fi scal 2012 compared with the

prior fi scal year. This decrease was due primarily to

the recording of ¥20.8 billion of valuation losses on

interest rate swaps stated at fair value.

Ratio of credit loss experience in the United States is as follows:

Years ended March 31,

2011 2012

Net charge-offs as a percentage of average gross earning assets:

Finance receivables 0.61% 0.24%

Operating lease 0.22 0.11

Total 0.52% 0.21%

All Other Operations Segment

Net revenues for Toyota’s other operations seg-

ments increased by ¥76.6 billion, or 7.9%, to

¥1,048.9 billion during fi

scal 2012 compared with

the prior fi scal year.

Operating income from Toyota’s other operations

segments increased by ¥6.8 billion, or 19.4%, to

¥42.0 billion during fi scal 2012 compared with the

prior fi scal year.

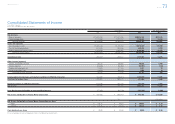

Selected Financial Summary (U.S. GAAP) Consolidated Segment Information Consolidated Quarterly Financial Summary Management’s Discussion and Analysis of Financial Condition and Results of Operations [18 of 26] Consolidated Financial Statements Notes to Consolidated Financial Statements

Management’s Annual Report on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm