Toyota 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Toyota Global Vision President’s Message Launching a New Structure Special Feature Review of Operations

Consolidated Performance

Highlights

Management and

Corporate Information Investor InformationFinancial Section

Page 62

NextPrev

ContentsSearchPrint

ANNUAL REPORT 2013

subsidiaries, respectively, both strengthening

against the U.S. dollar, decreasing the value of

assets denominated in dollars that were not settled

during the year.

Other loss, net decreased by ¥56.0 billion to

¥36.8 billion during fi scal 2012 compared with the

prior fi scal year. This was due to the recognition of

impairment losses on available-for-sale securities.

Income Taxes

The provision for income taxes decreased by ¥50.5

billion, or 16.2%, to ¥262.2 billion during fi scal 2012

compared with the prior fi scal year due to the

decrease in income before income taxes. The effec-

tive tax rate for fi scal 2012 was 60.6%, which was

higher than the statutory tax rate in Japan. This was

due to recurring items such as the valuation allow-

ance and deferred tax liabilities relating to undistrib-

uted earnings in affi liated companies accounted for

by the equity method.

Net Income and Loss Attributable to

Noncontrolling Interests and Equity in

Earnings of Affi liated Companies

Net income attributable to noncontrolling interests

increased by ¥27.4 billion, or 47.9%, to ¥84.7 billion

during fi

scal 2012 compared with the prior fi scal

year. This increase was due to an increase during

fi scal 2012 in net income attributable to the share-

holders of consolidated subsidiaries.

Equity in earnings of affi liated companies during fi s-

cal 2012 decreased by ¥17.3 billion, or 8.1%, to

¥197.7 billion compared with the prior fi scal year. This

decrease was due to a decrease during fi scal 2012 in

net income attributable to the shareholders of affi liated

companies accounted for by the equity method.

Net Income Attributable to Toyota Motor

Corporation

Net income attributable to the shareholders of

Toyota Motor Corporation decreased by ¥124.6 bil-

lion, or 30.5%, to ¥283.5 billion during fi scal 2012

compared with the prior fi scal year.

Other Comprehensive Income and Loss

Other comprehensive loss decreased by ¥263.8 bil-

lion to ¥34.1 billion for fi scal 2012 compared with

the prior fi scal year. This decrease resulted from

unfavorable foreign currency translation adjustments

losses of ¥87.7 billion in fi scal 2012 compared with

losses of ¥287.6 billion in the prior fi scal year, and

from unrealized holding gains on securities in fi scal

2012 of ¥129.3 billion compared with losses of

¥26.1 billion in the prior fi scal year. The increase in

unrealized holding gains on securities was due to

changes in stock prices.

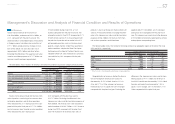

Segment Information

The following is a discussion of results of operations for each of Toyota’s operating segments. The amounts

presented are prior to intersegment elimination.

Yen in millions

Years ended March 31, 2012 vs. 2011 Change

2011 2012 Amount Percentage (%)

Automotive: Net revenues ¥17,337,320 ¥16,994,546 ¥(342,774) –2.0

Operating income 85,973 21,683 (64,290) –74.8

Financial Services: Net revenues 1,192,205 1,100,324 (91,881) –7.7

Operating income 358,280 306,438 (51,842) –14.5

All Other: Net revenues 972,252 1,048,915 76,663 +7.9

Operating income 35,242 42,062 6,820 +19.4

Intersegment elimination/

unallocated amount:

Net revenues (508,089) (560,132) (52,043) —

Operating income (11,216) (14,556) (3,340) —

Automotive Operations Segment

The automotive operations segment is Toyota’s larg-

est operating segment by net revenues. Net reve-

nues for the automotive segment decreased during

fi scal 2012 by ¥342.7 billion, or 2.0%, compared

with the prior fi scal year to ¥16,994.5 billion. The

decrease refl ects the ¥649.2 billion unfavorable

impact of fl uctuations in foreign currency translation

rates and others, partially offset by the ¥320.0 billion

of favorable impact by changes in vehicle unit sales

and sales mix, and other operational factors.

Operating income from the automotive operations

decreased by ¥64.3 billion during fi scal 2012 com-

pared with the prior fi scal year to ¥21.6 billion. This

decrease in operating income was due to the

¥250.0 billion unfavorable impact of fl uctuations in

foreign currency rates and the ¥100.0 billion

increase in miscellaneous costs and others, partially

offset by the ¥170.0 billion effect of cost reduction

efforts, and the ¥150.0 billion of favorable impact by

changes in vehicle unit sales and sales mix.

The changes in vehicle unit sales and changes in

sales mix was due primarily to an increase in

Toyota’s vehicle unit sales by 44 thousand vehicles

compared with the prior fi scal year resulting from

the introduction of new products in spite of the

impact of the Great East Japan Earthquake and the

fl ood in Thailand. The increase in miscellaneous

costs and others was due primarily to the ¥100.0

billion increase in labor costs and the ¥50.0 billion

increase in research and development expenses.

Financial Services Operations Segment

Net revenues for the fi nancial services operations

decreased during fi scal 2012 by ¥91.8 billion, or

7.7%, compared with the prior fi scal year to

¥1,100.3 billion. This decrease was primarily due to

the unfavorable impact of fl uctuations in foreign cur-

rency translation rates and others of ¥66.9 billion

and the ¥18.3 billion decrease in rental income from

vehicles and equipment on operating leases.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Selected Financial Summary (U.S. GAAP) Consolidated Segment Information Consolidated Quarterly Financial Summary Management’s Discussion and Analysis of Financial Condition and Results of Operations [17 of 26] Consolidated Financial Statements Notes to Consolidated Financial Statements

Management’s Annual Report on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm