Toyota 2013 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2013 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Toyota Global Vision President’s Message Launching a New Structure Special Feature Review of Operations

Consolidated Performance

Highlights

Management and

Corporate Information Investor InformationFinancial Section

Page 57

NextPrev

ContentsSearchPrint

ANNUAL REPORT 2013

Net Revenues

Toyota had net revenues for fi scal 2012 of

¥18,583.6 billion, a decrease of ¥410.0 billion, or

2.2%, compared with the prior fi scal year. This

decrease refl ects unfavorable impact of fl uctuations

in foreign currency translation rates and others of

¥717.7 billion, partially offset by changes in num-

bers of the vehicle unit sales and sales mix of

approximately ¥320.0 billion and other factors.

Excluding the difference in the Japanese yen value

used for translation purposes of ¥717.7 billion, net

revenues would have been approximately

¥19,301.3 billion during fi scal 2012, a 1.6%

increase compared with the prior fi scal year. The

automotive market in fi scal 2012 increased by 9.7%

in North America and 3.9% in Asia compared with

the prior fi scal year due to that market in the U.S.

and emerging countries such as Asia have devel-

oped in a steady manner. Under these automotive

market conditions, despite the Great East Japan

Earthquake and the fl ood in Thailand, Toyota’s con-

solidated vehicle unit sales increased to 7,352 thou-

sand vehicles by 0.6% compared with the prior

fi scal year.

products is due to an increase in Toyota vehicle unit

sales by 44 thousand vehicles. Excluding the differ-

ence in the Japanese yen value used for translation

purposes of ¥66.9 billion, net revenues from fi nan-

cial services operations would have been

approximately ¥1,138.6 billion, a 2.9% decrease

during fi scal 2012 compared with the prior fi scal

year. This decrease was mainly due to the decrease

of ¥18.3 billion rental revenue generated by vehicles

and equipment on operating lease.

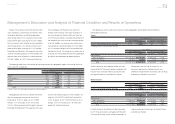

The following table shows the number of fi nancing contracts by geographic region at the end of the fi scal

2012 and 2011, respectively.

Number of fi nancing contracts in thousands

Years ended March 31, 2012 vs. 2011 Change

2011 2012 Amount Percentage (%)

Japan 1,709 1,697 (12) –0.7

North America 4,654 4,535 (119) –2.6

Europe 790 796 6 +0.7

Asia 522 649 127 +24.3

Other* 527 552 25 +4.9

Total 8,202 8,229 27 +0.3

* “Other” consists of Central and South America, Oceania and Africa.

Geographically, net revenues (before the elimina-

tion of intersegment revenues) for fi scal 2012

decreased by 12.5% in North America, 1.2% in

Asia, and 2.7% in Other, whereas net revenues

increased by 1.6% in Japan and 0.6% in Europe

compared with the prior fi scal year. Excluding the

difference in the Japanese yen value used for trans-

lation purposes of ¥717.7 billion, net revenues in

fi scal 2012 would have decreased by 5.1% in North

America, and would have increased by 1.6% in

Japan, 5.3% in Europe, 3.8% in Asia and 1.7% in

Other compared with the prior fi scal year.

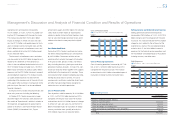

The table below shows Toyota’s net revenues from external customers by product category and by business.

Yen in millions

Years ended March 31, 2012 vs. 2011 Change

2011 2012 Amount Percentage (%)

Vehicles ¥14,507,479 ¥14,164,940 ¥(342,539) –2.4

Parts and components for overseas production 335,366 338,000 2,634 +0.8

Parts and components for after service 1,553,497 1,532,219 (21,278) –1.4

Other 926,411 929,219 2,808 +0.3

Total Automotive 17,322,753 16,964,378 (358,375) –2.1

All Other 497,767 547,538 49,771 +10.0

Total sales of products 17,820,520 17,511,916 (308,604) –1.7

Financial services 1,173,168 1,071,737 (101,431) –8.6

Total ¥18,993,688 ¥18,583,653 ¥(410,035) –2.2

Toyota’s net revenues include net revenues from

sales of products, consisting of net revenues from

automotive operations and all other operations,

which decreased by 1.7% during fi scal 2012 com-

pared with the prior fi scal year to ¥17,511.9 billion,

and net revenues from fi nancial services operations

which decreased by 8.6% during fi scal

2012 compared with the prior fi scal year to

¥1,071.7 billion. Excluding the difference in the

Japanese yen value used for translation purposes of

¥650.8 billion, net revenues from sales of products

would have been ¥18,162.7 billion, a 1.9% increase

during fi scal 2012 compared with the prior fi scal

year. The increase in net revenues from sales of

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Selected Financial Summary (U.S. GAAP) Consolidated Segment Information Consolidated Quarterly Financial Summary Management’s Discussion and Analysis of Financial Condition and Results of Operations [12 of 26] Consolidated Financial Statements Notes to Consolidated Financial Statements

Management’s Annual Report on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm