Toyota 2013 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2013 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Toyota Global Vision President’s Message Launching a New Structure Special Feature Review of Operations

Consolidated Performance

Highlights

Management and

Corporate Information Investor InformationFinancial Section

Page 100

NextPrev

ContentsSearchPrint

ANNUAL REPORT 2013

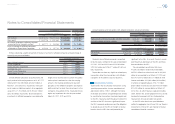

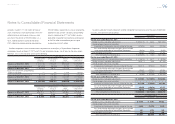

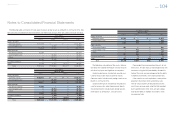

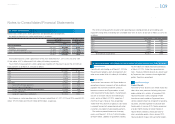

Weighted-average assumptions used to determine net periodic pension cost for the years ended March 31,

2011, 2012 and 2013 are as follows:

For the years ended March 31,

2011 2012 2013

Discount rate 2.3% 2.3% 2.0%

Expected return on plan assets 2.3% 2.5% 2.5%

Rate of compensation increase 2.3% 2.3% 2.3%

During the years ended March 31, 2011, 2012 and

2013, the parent company and certain subsidiaries in

Japan employ “point” based retirement benefi t plans

and do not use the rates of compensation increase

to determine net periodic pension cost.

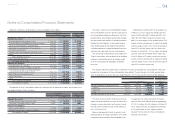

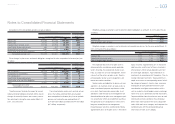

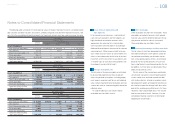

The expected rate of return on plan assets is

determined after considering several applicable fac-

tors including, the composition of plan assets held,

assumed risks of asset management, historical

results of the returns on plan assets, Toyota’s princi-

pal policy for plan asset management, and forecast-

ed market conditions.

Toyota’s policy and objective for plan asset man-

agement is to maximize returns on plan assets to

meet future benefi t payment requirements under

risks which Toyota considers permissible. Asset

allocations under the plan asset management are

determined based on plan asset management poli-

cies of each plan which are established to achieve

the optimized asset compositions in terms of the

long-term overall plan asset management.

Excepting equity securities contributed by Toyota,

approximately 50% of the plan assets is invested in

equity securities, approximately 30% is invested in

debt securities, and the rest of them is invested in

insurance contracts and other products. When

actual allocations are not in line with target alloca-

tions, Toyota rebalances its investments in accor-

dance with the policies. Prior to making individual

investments, Toyota performs in-depth assessments

of corresponding factors including category of prod-

ucts, industry type, currencies and liquidity of each

potential investment under consideration to mitigate

concentrations of risks such as market risk and for-

eign currency exchange rate risk. To assess perfor-

mance of the investments, Toyota establishes

bench mark return rates for each individual invest-

ment, combines these individual bench mark rates

based on the asset composition ratios within each

asset category, and compares the combined rates

with the corresponding actual return rates on each

asset category.

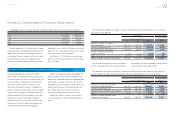

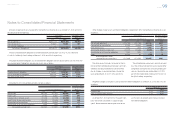

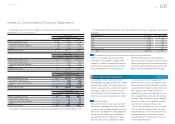

The following table summarizes the fair value of classes of plan assets as of March 31, 2012 and 2013. See

note 26 to the consolidated fi nancial statements for three levels of input which are used to measure fair value.

Yen in millions

March 31, 2012

Level 1 Level 2 Level 3 Total

Equity securities:

Common stocks ¥353,282 ¥ — ¥ — ¥353,282

Commingled funds — 158,027 — 158,027

353,282 158,027 — 511,309

Debt securities:

Government bonds 63,327 — — 63,327

Commingled funds — 176,596 — 176,596

Other — 20,155 591 20,746

63,327 196,751 591 260,669

Insurance contracts — 83,993 — 83,993

Other 27,006 4,503 40,065 71,574

Total ¥443,615 ¥443,274 ¥40,656 ¥927,545

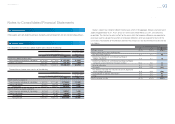

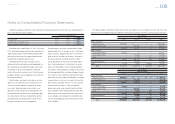

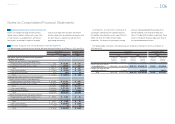

Yen in millions

March 31, 2013

Level 1 Level 2 Level 3 Total

Equity securities:

Common stocks ¥440,971 ¥ — ¥ — ¥ 440,971

Commingled funds — 184,879 — 184,879

440,971 184,879 — 625,850

Debt securities:

Government bonds 81,867 — — 81,867

Commingled funds — 203,933 — 203,933

Other — 23,594 441 24,035

81,867 227,527 441 309,835

Insurance contracts — 91,326 — 91,326

Other 17,789 3,923 41,535 63,247

Total ¥540,627 ¥507,655 ¥41,976 ¥1,090,258

Notes to Consolidated Financial Statements

Selected Financial Summary (U.S. GAAP) Consolidated Segment Information Consolidated Quarterly Financial Summary Management’s Discussion and Analysis of Financial Condition and Results of Operations Consolidated Financial Statements Notes to Consolidated Financial Statements [23 of 44]

Management’s Annual Report on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm