TCF Bank 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

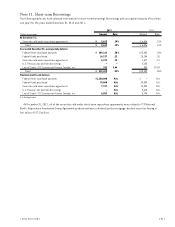

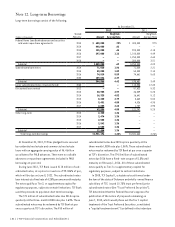

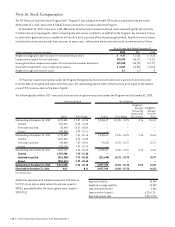

Note 12. Long-term Borrowings

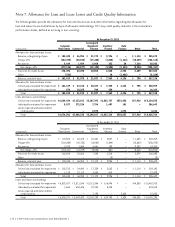

Long-term borrowings consist of the following.

At December 31,

2012 2011

(Dollars in thousands)

Stated

Maturity Amount

Weighted-

Average Rate Amount

Weighted-

Average Rate

Federal Home Loan Bank advances and securities

sold under repurchase agreements 2013 $ 680,000 .73% $ 400,000 .97%

2014 448,000 .42 – –

2015 125,000 .44 900,000 4.18

2016 297,000 1.12 1,100,000 4.49

2017 – – 1,250,000 4.60

2018 – – 300,000 3.51

Subtotal 1,550,000 .69 3,950,000 4.02

Subordinated bank notes 2014 71,020 1.96 71,020 2.21

2015 50,000 1.89 50,000 2.14

2016 74,810 5.59 74,661 5.63

2022 109,036 6.37 – –

Subtotal 304,866 4.42 195,681 3.49

Junior subordinated notes (trust preferred) 2068 – – 114,236 12.83

Discounted lease rentals 2012 – – 57,622 5.32

2013 30,985 4.97 36,009 5.28

2014 16,325 4.82 16,641 5.12

2015 8,240 4.79 5,662 5.04

2016 5,451 4.80 4,026 4.98

2017 2,885 4.62 1,787 4.98

Subtotal 63,886 4.88 121,747 5.25

Other long-term 2013 2,340 1.36 – –

2014 2,474 1.36 – –

2015 2,508 1.36 – –

2016 2,542 1.36 – –

2017 2,580 1.36 – –

Subtotal 12,444 1.36 – –

Total long-term borrowings $1,931,196 1.42% $4,381,664 4.26%

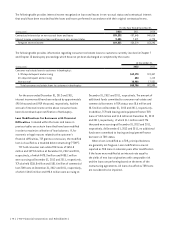

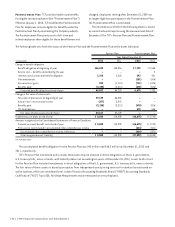

At December 31, 2012, TCF has pledged loans secured

by residential real estate and commercial real estate

loans with an aggregate carrying value of $6.4 billion

as collateral for FHLB advances. There were no callable

advances or repurchase agreements included in FHLB

borrowings at year end.

During June 2012, TCF Bank issued $110 million of sub-

ordinated notes, at a price to investors of 99.086% of par,

which will be due on June 8, 2022. The subordinated notes

bear interest at a fixed rate of 6.25% per annum until maturity.

The notes qualify as Tier 2, or supplementary capital for

regulatory purposes, subject to certain limitations. TCF Bank

used the proceeds to pay down short term borrowings.

The $71 million of subordinated notes due 2014 reprice

quarterly at the three-month LIBOR rate plus 1.63%. These

subordinated notes may be redeemed by TCF Bank at par

once a quarter at TCF’s discretion. The $50 million of

subordinated notes due 2015 reprice quarterly at the

three-month LIBOR rate plus 1.56%. These subordinated

notes may be redeemed by TCF Bank at par once a quarter

at TCF’s discretion. The $74.8 million of subordinated

notes due 2016 have a fixed-rate coupon of 5.5% until

maturity on February 1, 2016. All of these subordinated

notes qualify as Tier 2 or supplementary capital for

regulatory purposes, subject to certain limitations.

In 2008, TCF Capital I, a statutory trust formed under

the laws of the state of Delaware and wholly-owned finance

subsidiary of TCF, issued 10.75% trust preferred junior

subordinated notes (the “Trust Preferred Securities”).

TCF determined that the Federal Reserve’s approval for

publication of the notice of proposed rulemaking on

June 7, 2012, which would phase out the Tier 1 capital

treatment of the Trust Preferred Securities, constituted

a “capital treatment event” (as defined in the indenture

{ 82 } { TCF Financial Corporation and Subsidiaries }