TCF Bank 2012 Annual Report Download - page 116

Download and view the complete annual report

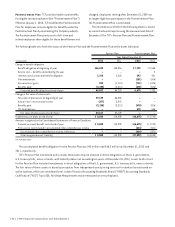

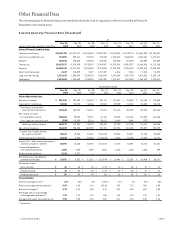

Please find page 116 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Investments The carrying value of investments in FHLB

stock and Federal Reserve stock approximates fair value.

The fair value of other investments is estimated based

on discounted cash flows using current market rates and

consideration of credit exposure.

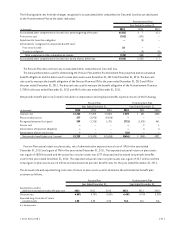

Loans and Leases Held for Sale Loans and leases held

for sale are carried at the lower of cost or fair value. The

cost of loans held for sale includes the unpaid principal

balance, net of deferred loans fees and costs. Estimated

fair values are based upon recent loan sale transactions

and any available price quotes on loans with similar

coupons, maturities and credit quality.

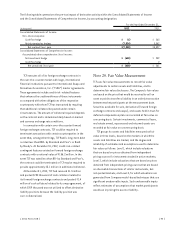

Interest-Only Strips The fair value of the interest-only

strip represents the present value of future cash flows

retained by TCF. TCF uses available market data, along with

its own empirical data and discounted cash flow models,

to arrive at the estimated fair value of its interest-only

strips. The present value of the estimated expected future

cash flows to be received is determined by using discount,

loss and prepayment rates that the Company believes are

commensurate with the risks associated with the cash

flows. These assumptions are inherently subject to volatility

and uncertainty, and as a result, the estimated fair value

of the interest-only strip will potentially fluctuate from

period to period and such fluctuations could be significant.

Loans The fair value of loans is estimated based on

discounted expected cash flows. These cash flows include

assumptions for prepayment estimates over the loans’

remaining lives, consideration of the current interest rate

environment compared with the weighted average rate of

each portfolio, a credit risk component based on the historical

and expected performance of each portfolio and a liquidity

adjustment related to the current market environment.

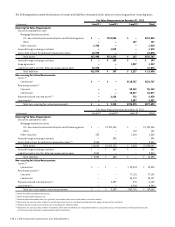

Deposits The fair value of checking, savings and money

market deposits is deemed equal to the amount payable

on demand. The fair value of certificates of deposit is

estimated based on discounted cash flows using currently

offered market rates. The intangible value of long-term

relationships with depositors is not taken into account in

the fair values disclosed.

Borrowings The carrying amounts of short-term

borrowings approximate their fair values. The fair values

of TCF’s long-term borrowings are estimated based on

observable market prices and discounted cash flows using

interest rates for borrowings of similar remaining maturities

and characteristics.

Financial Instruments with Off-Balance Sheet Risk

The fair values of TCF’s commitments to extend credit and

standby letters of credit are estimated using fees currently

charged to enter into similar agreements as commitments

and standby letters of credit similar to TCF’s are not actively

traded. Substantially all commitments to extend credit and

standby letters of credit have floating interest rates and do

not expose TCF to interest rate risk; therefore fair value is

approximately equal to carrying value.

{ 100 } { TCF Financial Corporation and Subsidiaries }