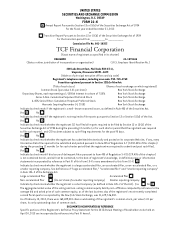

TCF Bank 2012 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The potential rule-making of enforcement actions

from the Consumer Financial Protection Bureau

could have a significant impact on the entire

industry, including TCF. The unpredictability

of future actions leads to uncertainty within the

banking industry.

In Closing

TCF made great progress in 2012 positioning

the company for success moving into 2013. We

recognized the challenges facing the company and

have taken proactive steps to address them. It is now

up to us to execute on our initiatives and increase

stockholder value. I am confident that we have the

right team and the strategy in place to achieve this

goal. While this has certainly been a challenging few

years for TCF, I feel good about where we are going.

We continue to have an alignment with our stock-

holders as our senior management and board of

directors own over 6.7 million shares, or 4.1 percent

of TCF stock. 81.3 percent of our eligible employees

participate in the TCF Employees Stock Purchase

Plan, which at year-end held over 8.5 million shares.

I would like to take a moment to thank our board of

directors for their hard work and counsel. I am very

proud of this group. I appreciate the exceptional

leadership and guidance they have provided over

the years and I look forward to working with them

as we enter 2013.

I would also like to give a special thank you to all

of our employees. This has been a very busy year

focused on building and investing at every level

of the bank. It is because of their hard work and

dedication that I am optimistic about the future.

I am proud of our team and the achievements in

2012 and expect the same level of effort in 2013

as we execute on our strategies.

Thank you for your continued support and

investment in TCF.

William A. Cooper

Chairman and Chief Executive Officer

to higher levels, banks will be challenged to

improve their performance.

• Managing interest-rate risk given the continued

depressed interest rates with an eye toward the

possibility of rapidly increasing rates in the future

continues to be a risk management focus.

• The competitive landscape in the banking industry

remains unsettled. TCF chose to expand its auto

finance and inventory finance businesses, as well as

to bring back its free checking product in 2012 while

other banks are looking at other strategic options.

The profitability of banks can be impacted by both

the strategic decisions made by other banks as well

as the public perception of the industry as a whole.

• TCF takes great pride in listening to and under-

standing its customer base. That said, there is

always some level of uncertainty regarding

consumer behavior when product or service

changes are made. We will continue monitoring

consumer behavior as we evaluate existing

products and introduce new products so that they

fit the needs of our customers.

• SUPERVALU®

, TCF’s supermarket partner and

operator of grocery store chains Cub® Foods in

Minnesota and Jewel-Osco® in Chicago, recently

announced a definitive agreement to sell five of its

grocery chains, including Jewel-Osco, to an invest-

ment group led by Cerberus Capital Management.

Cub Foods was not part of the transaction. With this

acquisition, TCF will seek to work closely with the

buyer to determine how the Jewel-Osco chain will

partner with TCF going forward. TCF maintains a

strong relationship with both Cub Foods and

Jewel-Osco and we continue to believe that the

partnership provides significant value for both parties.

• Growth of our national lending businesses is

challenging in a competitive environment. While we

have the track record and experience to successfully

operate these businesses, it will be important to

stay focused on our customers’ needs and compete

on price, structure, terms and service every day.

• Congressional and regulatory actions continue

to create uncertainty in the banking industry.

{ 2012 Annual Report } { 11 }