TCF Bank 2012 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

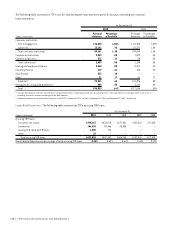

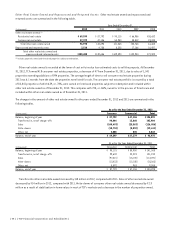

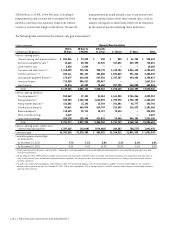

During June 2012, TCF announced that it had submitted

a redemption notice to the property trustee for full

redemption of the $115 million of Trust Preferred Securities.

The determination to redeem the Trust Preferred Securities

followed publication of a proposed rule, which would phase

out the Tier 1 capital treatment of the Trust Preferred

Securities. The Trust Preferred Securities were redeemed

on July 30, 2012 at the redemption price of $25 per Trust

Preferred Security, totaling $115 million plus accumulated

unpaid distributions of $2.6 million. The redemption was

funded with a portion of the net proceeds from TCF’s

offering of depositary shares, each representing

a 1/1,000th interest in a share of TCF’s 7.50% Series A

Non-Cumulative Perpetual Preferred Stock, par value $.01

per share (the “Series A Preferred Stock”), which closed

on June 25, 2012.

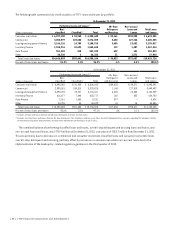

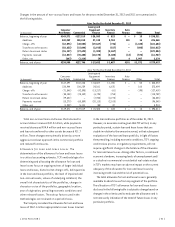

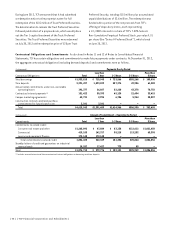

Contractual Obligations and Commitments As disclosed in Notes 11 and 12 of Notes to Consolidated Financial

Statements, TCF has certain obligations and commitments to make future payments under contracts. At December 31, 2012,

the aggregate contractual obligations (excluding demand deposits) and commitments were as follows.

(In thousands) Payments Due by Period

Contractual Obligations Total

Less than

1 Year 1-3 Years 3-5 Years

More than

5 Years

Total borrowings $1,933,815 $ 715,945 $ 723,566 $385,268 $ 109,036

Time deposits 2,291,497 1,593,029 587,274 49,906 61,288

Annual rental commitments under non-cancelable

operating leases 192,377 26,027 52,220 43,378 70,752

Contractual interest payments(1) 151,422 50,393 45,120 22,494 33,415

Campus marketing agreements 43,731 2,994 6,786 5,944 28,007

Construction contracts and land purchase

commitments for future branch sites 3,101 3,101 – – –

Total $4,615,943 $2,391,489 $1,414,966 $506,990 $ 302,498

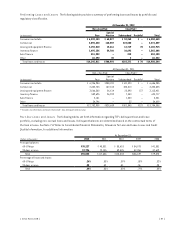

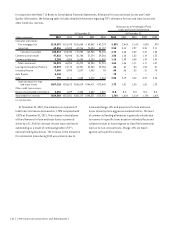

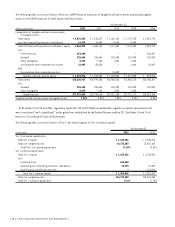

(In thousands) Amount of Commitment — Expiration by Period

Commitments Total

Less than

1 Year 1-3 Years 3-5 Years

More than

5 Years

Commitments to extend credit:

Consumer real estate and other $1,265,092 $ 47,884 $ 83,138 $112,612 $1,021,458

Commercial 419,185 142,317 98,218 113,252 65,398

Leasing and equipment finance 172,148 172,148 – – –

Total commitments to extend credit 1,856,425 362,349 181,356 225,864 1,086,856

Standby letters of credit and guarantees on industrial

revenue bonds 18,287 17,427 775 85 –

Total $1,874,712 $ 379,776 $ 182,131 $225,949 $1,086,856

(1) Includes accrued interest and future contractual interest obligations on borrowings and time deposits.

{ 46 } { TCF Financial Corporation and Subsidiaries }