TCF Bank 2012 Annual Report Download - page 39

Download and view the complete annual report

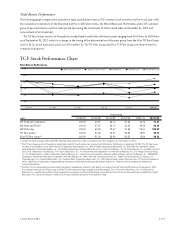

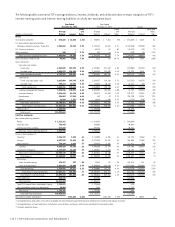

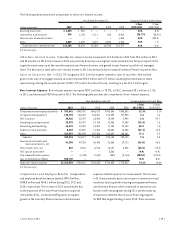

Please find page 39 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Lending non-interest income totaled $138.5 million in

2012, up 36.8% from $101.2 million for 2011, primarily due

to gains on sales of auto finance and consumer real estate

loans. See Item 7. Management’s Discussion and Analysis —

“Consolidated Income Statement Analysis – Non-Interest

Income” for further discussion.

Lending non-interest expense totaled $367.2 million

for 2012, up 15.3% from $318.4 million for 2011. The

increase was primarily due to the full year impact of the

acquisition and ramp-up of the recently acquired auto

finance business as well as increased staffing levels to

support the new Bombardier Recreational Products, Inc.

(“BRP”) program in inventory finance.

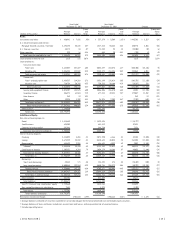

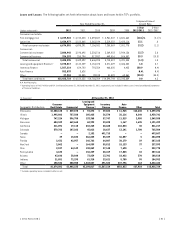

FUNDING–TCF’s funding is primarily derived from branch

banking, consumer and small business deposits, and

treasury investments. With a renewed focus on quality

customer relationships through the introduction of TCF Free

Checking, deposits provide a source of low-cost funds and

fee income. Borrowings may be used to offset reductions in

deposits or to support expanded lending activities. Funding

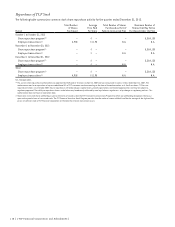

reported a net loss of $239.1 million for 2012, compared

with net income of $77.5 million in 2011. The net loss in

2012 was due to the balance sheet repositioning completed

in the first quarter of 2012.

Funding net interest income for 2012 was $258.3 million,

up 11.5% from $231.6 million in 2011 primarily related

to the reduced costs of borrowings resulting from the

balance sheet repositioning, partially offset by a reduction

of interest income as a result of lower levels of mortgage

backed securities.

Funding non-interest income totaled $338.9 million in

2012, down 6% from $360.6 million in 2011. The decrease

was primarily due to lower banking fees and revenues related

to changes in our deposit product fee structure and the full-

year effect of the new regulations limiting interchange fees

associated with our debit card transactions.

Funding non-interest expense totaled $969.5 million

in 2012, up from $463.8 million in 2011. The increase was

primarily due to the loss on termination of debt of $550.7

million in the first quarter of 2012 in connection with the

balance sheet repositioning.

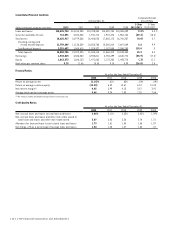

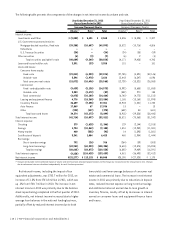

SUPPORT SERVICES — TCF’s Support Services segment

consists of the holding company and corporate functions

that provide data processing, bank operations and other

professional services to the operating segments. Support

Services reported a net loss attributable to common

stockholders of $9.9 million and $4.6 million for 2012 and

2011, respectively.

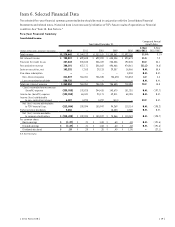

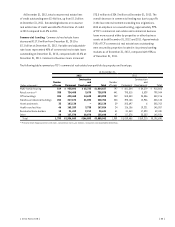

Consolidated Income Statement Analysis

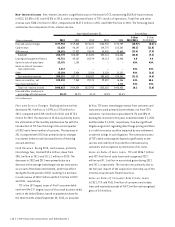

Net Interest Income Net interest income, the difference

between interest earned on loans and leases, investments

and other interest-earning assets (interest income), and

interest paid on deposits and borrowings (interest expense),

represented 61.4% of TCF’s total revenue in 2012, 61.2%

in 2011 and 56.5% in 2010. Net interest income divided by

average interest-earning assets is referred to as the net

interest margin, expressed as a percentage. Net interest

income and net interest margin are affected by changes in

prevailing short- and long-term interest rates, loan and

deposit pricing strategies and competitive conditions, the

volume and the mix of interest-earning assets and interest-

bearing liabilities, the level of non-performing assets, and

the impact of modified loans and leases.

{ 2012 Form 10K } { 23 }