TCF Bank 2012 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

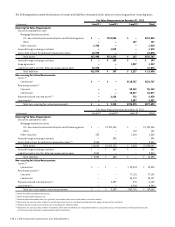

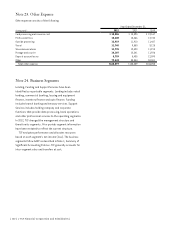

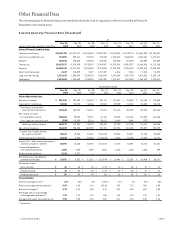

Note 23. Other Expense

Other expense consists of the following.

Year Ended December 31,

(In thousands) 2012 2011 2010

Card processing and issuance cost $ 15,586 $ 18,593 $ 19,167

Professional fees 13,608 15,466 17,742

Outside processing 12,919 11,910 11,487

Travel 11,740 9,880 9,125

Telecommunications 11,735 12,420 11,915

Postage and courier 10,107 10,241 11,926

Deposit account losses 8,759 8,435 12,590

Other 79,443 58,544 52,301

Total other expense $163,897 $145,489 $146,253

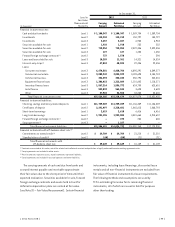

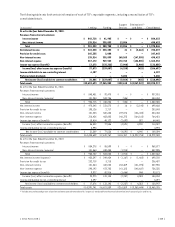

Note 24. Business Segments

Lending, Funding and Support Services have been

identified as reportable segments. Lending includes retail

lending, commercial banking, leasing and equipment

finance, inventory finance and auto finance. Funding

includes branch banking and treasury services. Support

Services includes holding company and corporate

functions that provide data processing, bank operations

and other professional services to the operating segments.

In 2012, TCF changed the management structure and

therefore its segments. Prior periods segment information

have been restated to reflect the current structure.

TCF evaluates performance and allocates resources

based on each segment’s net income (loss). The business

segments follow GAAP as described in Note 1, Summary of

Significant Accounting Policies. TCF generally accounts for

inter-segment sales and transfers at cost.

{ 102 } { TCF Financial Corporation and Subsidiaries }