TCF Bank 2012 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

{ 02 } { TCF Financial Corporation and Subsidiaries }

It is no secret that the past few years have been very

challenging for TCF and the banking industry as a

whole. Banks have had to work through the deepest

recession since the Great Depression, which included

stressed home values and elevated unemployment,

as well as many regulatory and legislative changes.

We took an approach that we believe better positions

TCF for the future and made 2012 a “Building and

Investing” year.

TCF was proactive in taking several key steps to

enhance its business model and better prepare for the

future. TCF expanded its national lending platforms,

repositioned its balance sheet and brought back its

free checking product to consumers. We recognize that

the banking world has undergone a permanent change

in many regards and we are committed to taking the

necessary steps to ensure TCF’s long-term success.

The building and investing we did in 2012 was

just the first step in accomplishing our goals as

an organization. We now look for 2013 to be an

“Execution and Results” year. With the actions taken

in 2012, I am optimistic that 2013 will be a year in

which we increase the value of our organization.

.......... Dear Stockholders:

A Look at 2012

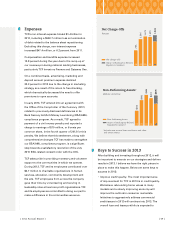

TCF has always relied on a diversified approach to

generating its revenue. Given the recent regulatory

and legislative changes, this diversified approach is

more important than ever as deposit accounts may

never be as profitable for banks as they have been

in the past. Instead of looking to increase revenue

simply by imposing new fees on our retail customers,

TCF chose to build a better way by taking a broader,

company-wide approach to increasing overall

revenue and making the company a more diverse

and powerful revenue-producing machine.

• Expansion of National Lending Platforms

National lending platforms have been a part of TCF’s

business model since it acquired Winthrop Resources

Corporation (Winthrop) in 1997. Since then, TCF

started an equipment finance company in 1999,

added TCF Inventory Finance in 2008 and expanded

into indirect auto finance in 2011. With limited asset

growth opportunities for regional banks within their

footprints today, TCF made a concerted effort to

make the national lending platforms a more substan-

tial part of its loan and lease portfolio.

William A. Cooper,

Chairman of the Board & Chief Executive Ofcer