TCF Bank 2012 Annual Report Download - page 46

Download and view the complete annual report

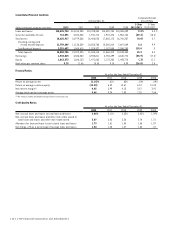

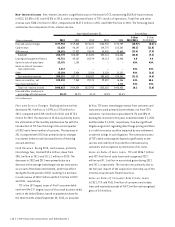

Please find page 46 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.were partially offset by a decrease in employee medical

costs, an increase in net gains recognized on the pension

re-measurement during the fourth quarter of 2011 and

decreases in branch banking compensation expenses as a

result of branch closures during 2011.

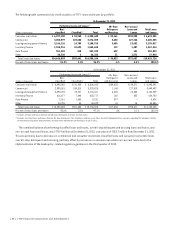

FDIC Insurance FDIC premiums expense totaled $30.4

million in 2012, an increase from $28.7 million in 2011 and

$23.6 million in 2010. The increases in 2012 and 2011 were

primarily the result of changes in the FDIC insurance rate

calculations for banks with over $10 billion in total assets,

which were implemented in April 2011.

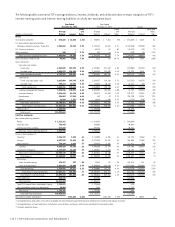

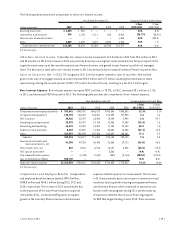

Advertising, Marketing and Deposit Account Premiums

Advertising and marketing expenses increased to $16.6 million

in 2012, compared with $10 million in 2011 and $13.1 million

in 2010. The increase in 2012 was primarily the result of

increased spending on media advertising associated with

the reintroduction of free checking. The decrease in 2011

was primarily due to the discontinuation of the debit card

rewards program in the third quarter of 2011 in response

to new federal regulation regarding debit card interchange

fees. Deposit account premiums expense decreased to

$8.7 million in 2012, compared with $22.9 million in

2011 and $17.3 million in 2010. The decrease in 2012 was

primarily attributable to an enhanced strategy to gain

higher quality accounts through the reintroduction of free

checking products rather than through offering premiums.

The increase in deposit account premium expense in 2011

was primarily due to changes in the account premium

programs beginning in April 2011, which increased the

premiums paid for each qualified account opening.

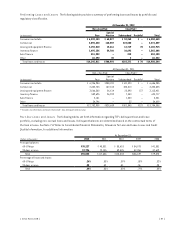

Foreclosed Real Estate and Repossessed Assets, Net

Foreclosed real estate and repossessed assets expense,

net totaled $41.4 million in 2012 compared to $49.2 million

in 2011 and $40.4 million in 2010. The decrease in 2012

was primarily due to reduced writedowns on consumer real

estate properties as a result of a decrease in the number

of properties owned and the associated expenses. The

increase in 2011 was primarily due to increased valuation

writedowns on commercial real estate properties.

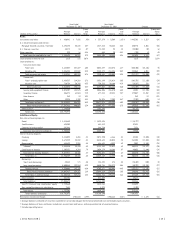

Other Non-Interest Expense Other non-interest expense

totaled $163.9 million in 2012, compared to $146.9 million

and $147.9 million in 2011 and 2010, respectively. The 2012

increase was primarily due to a $10 million accrual for the

civil money penalty assessed pursuant to previously disclosed

deficiencies in TCF’s Bank Secrecy Act compliance program.

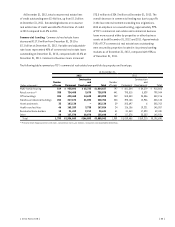

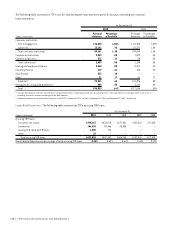

Loss on Termination of Debt In connection with

the balance sheet repositioning completed in March 2012,

TCF restructured $3.6 billion of long-term borrowings

that had a 4.3% weighted average rate, at a pre-tax loss

of $550.7 million. As part of the debt restructuring, TCF

replaced $2.1 billion of 4.4% weighted average fixed rate,

Federal Home Loan Bank advances with a mix of floating

and fixed-rate, long- and short-term borrowings with a

current weighted average rate of .5%, and terminated

$1.5 billion of 4.2% weighted average fixed-rate

borrowings under repurchase agreements. Related to these

transactions, TCF sold $1.9 billion of mortgage-backed

securities, and recognized a pre-tax gain of $77 million.

Income Taxes Income tax benefit represented 39.13%

of loss before income tax benefit in 2012, compared with

income tax expense of 36.04% and 36.89% of income

before income tax expense in 2011 and 2010, respectively.

The higher effective income tax rate for 2012, compared

with 2011 was primarily due to the 2012 pretax loss

compared with pretax income in 2011 and 2010.

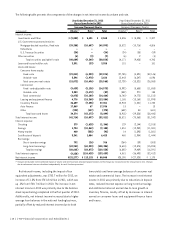

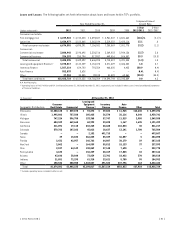

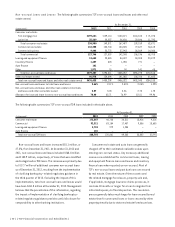

Consolidated Financial Condition Analysis

Securities Available for Sale Securities available

for sale were $712.1 million, or 3.9% of total assets, at

December 31, 2012 as compared to $2.3 billion, or 12.2%

of total assets, at December 31, 2011. TCF’s securities

available for sale portfolio primarily consists of

fixed-rate mortgage-backed securities issued by the

Federal National Mortgage Association and the Federal

Home Loan Mortgage Corporation. Net unrealized pre-tax

gains on securities available for sale totaled $18.8 million

at December 31, 2012, compared with net unrealized pre-

tax gains of $88.8 million at December 31, 2011. During

March 2012, as part of TCF’s balance sheet repositioning,

the Company sold $1.9 billion of U.S. government-

sponsored mortgage backed securities at a gain of $77

million. TCF may, from time to time, sell treasury and

agency securities and utilize the proceeds to reduce

borrowings, fund growth in loans and leases or for other

corporate purposes.

TCF’s securities portfolio does not contain commercial

paper, asset-backed commercial paper or asset-backed

securities secured by credit cards or auto loans. TCF also

has not participated in structured investment vehicles.

{ 30 } { TCF Financial Corporation and Subsidiaries }