TCF Bank 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.90 days or four months after obtaining title or possession

of the property, are recorded as charge-offs against the

allowance for loan and lease losses. Subsequent valuation

adjustments are recorded as foreclosed real estate expense.

Deposit account overdrafts, which are included within other

loans, are charged-off at or before they are 60 days past

due. Commercial loans, leasing and equipment finance

loans, and inventory finance loans, which are considered

collateral dependent, are charged-off to estimated fair

value, less estimated selling costs, when it becomes

probable, based on current information and events, that

all principal and interest amounts will not be collectible

in accordance with contractual terms. Loans which are

not collateral dependent are charged-off when deemed

uncollectible based on specific facts and circumstances.

The amount of the allowance for loan and lease losses

significantly depends upon management’s estimates of

variables affecting valuation, appraisals of collateral,

evaluations of performance and status, and the amounts

and timing of future cash flows expected to be received.

Such estimates, appraisals, evaluations and cash flows

may be subject to frequent adjustments due to changing

economic prospects of borrowers, lessees or properties.

These estimates are reviewed periodically and adjustments,

if necessary, are recorded in the provision for credit losses

in the periods in which they become known.

Lease Financing TCF provides various types of

commercial lease financing that are classified for

accounting purposes as direct financing, sales-type or

operating leases. Leases that transfer substantially all

of the benefits and risks of ownership to the lessee are

classified as direct financing or sales-type leases and are

included in loans and leases. Direct financing and sales-

type leases are carried at the combined present value of

future minimum lease payments and lease residual values.

The determination of lease classification requires various

judgments and estimates by management including the fair

value of the equipment at lease inception, useful life of the

equipment under lease, estimate of the lease residual value

and collectability of minimum lease payments.

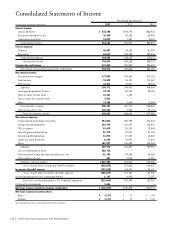

Sales-type leases generate dealer profit which is

recognized at lease inception by recording lease revenue

net of lease cost. Lease revenue consists of the present

value of the future minimum lease payments. Lease

cost consists of the leased equipment’s book value,

less the present value of its residual. Interest income

on direct financing and sales-type leases is recognized

using methods which approximate a level yield over the

fixed, non-cancelable term of the lease. TCF receives pro

rata rent payments for the interim period until the lease

contract commences and the fixed non-cancelable lease

term begins. TCF recognizes these interim payments in the

month they are earned and records the income in interest

income on direct finance leases. Management has policies

and procedures in place for the determination of lease

classification and review of the related judgments and

estimates for all lease financings.

Some lease financings include a residual value compo-

nent, which represents the estimated fair value of the

leased equipment at the expiration of the initial term of

the transaction. The estimation of residual values involves

judgment regarding product and technology changes,

customer behavior, shifts in supply and demand, and other

economic assumptions. TCF reviews residual assumptions on

the portfolio at least annually and downward adjustments,

if necessary, are charged to non-interest expense in the

periods in which they become known.

TCF occasionally sells minimum lease payments, as

a credit risk reduction tool, to third-party financial

institutions at fixed rates on a non-recourse basis with its

underlying equipment as collateral. For those transactions

which achieve sale treatment, the related lease cash flow

stream and the non-recourse financing are derecognized.

For those transactions which do not achieve sale treatment,

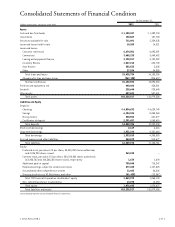

the underlying lease remains on TCF’s Consolidated

Statements of Financial Condition and non-recourse debt

is recorded in the amount of the proceeds received. TCF

retains servicing of these leases and bills, collects and

remits funds to the third-party financial institution. Upon

default by the lessee, the third-party financial institutions

may take control of the underlying collateral which TCF

would otherwise retain as residual value.

Leases which do not transfer substantially all benefits

and risks of ownership to the lessee are classified as

operating leases. Such leased equipment and related

initial direct costs are included in other assets on the

Consolidated Statements of Financial Condition and

depreciated, on a straight-line basis over the term of the

lease, to its estimated salvage value. Depreciation expense

is recorded as operating lease expense and included in

non-interest expense. Operating lease rental income is

recognized when it is due and is reflected as a component

of non-interest income. An allowance for lease losses is not

provided on operating leases.

{ 2012 Form 10K } { 63 }