TCF Bank 2012 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

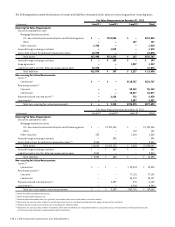

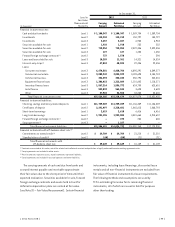

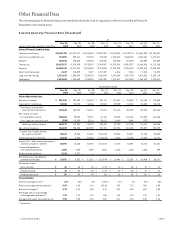

At December 31,

(In thousands)

Level in

Fair Value

Measurement

Hierarchy

2012 2011

Carrying

Amount

Estimated

Fair Value

Carrying

Amount

Estimated

Fair Value

Financial instrument assets:

Cash and due from banks Level 1 $ 1,100,347 $ 1,100,347 $ 1,389,704 $ 1,389,704

Investments Level 2 115,210 115,210 150,797 150,797

Investments Level 3 5,657 5,657 6,983 6,983

Securities available for sale Level 1 1,910 1,910 252 252

Securities available for sale Level 2 710,054 710,054 2,322,336 2,322,336

Securities available for sale Level 3 127 127 1,450 1,450

Forward foreign exchange contracts(1) Level 2 737 1,578 – 396

Loans and leases held for sale Level 3 10,289 11,361 14,321 14,524

Interest-only strips(2) Level 3 47,824 48,024 22,436 22,436

Loans:

Consumer real estate Level 3 6,674,501 6,420,704 6,895,291 6,549,277

Commercial real estate Level 3 3,080,942 3,025,599 3,198,698 3,154,724

Commercial business Level 3 324,293 320,245 250,794 242,331

Equipment finance loans Level 3 1,306,423 1,312,089 1,110,803 1,118,271

Inventory finance loans Level 3 1,567,214 1,556,372 624,700 623,651

Auto finance Level 3 552,833 564,844 3,628 3,628

Other Level 3 27,924 24,558 34,885 30,665

Total financial instrument assets $15,526,285 $15,218,679 $16,027,078 $15,631,425

Financial instrument liabilities:

Checking, savings and money market deposits Level 1 $11,759,289 $11,759,289 $11,136,389 $11,136,389

Certificates of deposit Level 2 2,291,497 2,310,601 1,065,615 1,068,793

Short-term borrowings Level 1 2,619 2,618 6,416 6,416

Long-term borrowings Level 2 1,931,196 1,952,804 4,381,664 4,913,637

Forward foreign exchange contracts(1) Level 2 – 193 284 665

Swap agreement(1) Level 3 – 1,227 – –

Total financial instrument liabilities $15,984,601 $16,026,732 $16,590,368 $17,125,900

Financial instruments with off-balance sheet risk:(3)

Commitments to extend credit(2) Level 2 $ 29,709 $ 29,709 $ 31,210 $ 31,210

Standby letters of credit(4) Level 2 (60) (60) (71) (71)

Total financial instruments with

off-balance sheet risk $ 29,649 $ 29,649 $ 31,139 $ 31,139

(1) Contracts are carried at fair value, net of the related cash collateral received and paid when a legally enforceable master netting agreement exists.

(2) Carrying amounts are included in other assets.

(3) Positive amounts represent assets, negative amounts represent liabilities.

(4) Carrying amounts are included in accrued expenses and other liabilities.

The carrying amounts of cash and due from banks and

accrued interest payable and receivable approximate

their fair values due to the short period of time until their

expected realization. Securities available for sale, forward

foreign exchange contracts and assets held in trust for

deferred compensation plans are carried at fair value

(see Note 20 — Fair Value Measurement). Certain financial

instruments, including lease financings, discounted lease

rentals and all non-financial instruments are excluded from

fair value of financial instrument disclosure requirements.

The following methods and assumptions are used by

TCF in estimating fair value for its remaining financial

instruments, all of which are issued or held for purposes

other than trading.

{ 2012 Form 10K } { 99 }