TCF Bank 2012 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

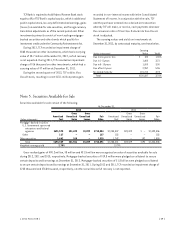

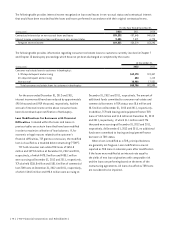

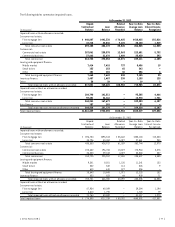

The amortized cost and fair value of securities available

for sale by contractual maturity, at December 31, 2012,

are shown below. The remaining contractual principal

maturities do not consider prepayments. Remaining

expected maturities will differ from contractual maturities

because borrowers may have the right to prepay.

Unrealized losses on securities available for sale are due

to lower values for equity securities or changes in interest

rates and not due to credit quality issues. TCF has the

ability and intent to hold these investments until a recovery

of fair value occurs. At December 31, 2011, TCF held

$1.5 million of other securities with an unrealized loss totaling

$192 thousand. This unrealized loss was not considered

other than temporary as of December 31, 2011, and was in

an unrealized loss position for less than twelve months.

At December 31, 2012

(Dollars in thousands) Amortized Cost Fair Value

Due in 1-5 years $ 102 $ 107

Due in 5-10 years 114 115

Due after 10 years 691,481 709,959

No stated maturity 1,642 1,910

Total $693,339 $712,091

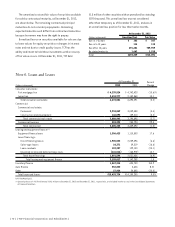

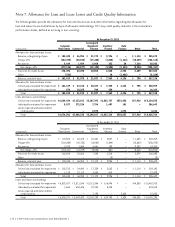

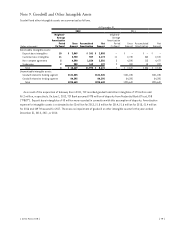

Note 6. Loans and Leases

At December 31, Percent

Change(Dollars in thousands) 2012 2011

Consumer real estate:

First mortgage lien $ 4,239,524 $ 4,742,423 (10.6)%

Junior lien 2,434,977 2,152,868 13.1

Total consumer real estate 6,674,501 6,895,291 (3.2)

Commercial:

Commercial real estate:

Permanent 2,934,849 3,039,488 (3.4)

Construction and development 146,093 159,210 (8.2)

Total commercial real estate 3,080,942 3,198,698 (3.7)

Commercial business 324,293 250,794 29.3

Total commercial 3,405,235 3,449,492 (1.3)

Leasing and equipment finance:(1)

Equipment finance loans 1,306,423 1,110,803 17.6

Lease financings:

Direct financing leases 1,905,532 2,039,096 (6.6)

Sales-type leases 24,371 29,219 (16.6)

Lease residuals 103,207 129,100 (20.1)

Unearned income and deferred lease costs (141,516) (165,959) 14.7

Total lease financings 1,891,594 2,031,456 (6.9)

Total leasing and equipment finance 3,198,017 3,142,259 1.8

Inventory finance 1,567,214 624,700 150.9

Auto finance 552,833 3,628 N.M.

Other 27,924 34,885 (20.0)

Total loans and leases $15,425,724 $14,150,255 9.0%

N.M. Not Meaningful.

(1) Operating leases of $82.9 million and $69.6 million at December 31, 2012 and December 31, 2011, respectively, are included in other assets in the Consolidated Statements

of Financial Condition.

{ 70 } { TCF Financial Corporation and Subsidiaries }