TCF Bank 2012 Annual Report Download - page 55

Download and view the complete annual report

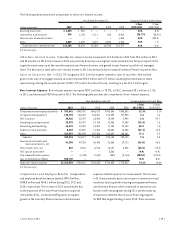

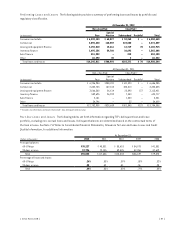

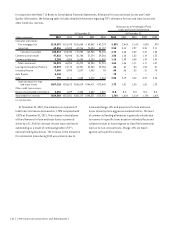

Please find page 55 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TCF modifies loans through reductions in interest

rates, extending payment dates, or term extensions

with reduction of contractual payments (but generally

not a reduction of principal). Loan modifications are

not reported as TDR loans in the calendar years after

modification if the loans were modified to an interest rate

equal to or greater than the yields of new loan originations

with comparable risk at the time of restructuring and the

loan is performing based on the restructured terms.

If TCF has not granted a concession as a result of the

modification, compared with the original terms, the loan is

not considered a TDR loan. Modifications that are not clas-

sified as TDR loans primarily involve interest rate changes

to current market rates for similarly situated borrowers who

have access to alternative funds. Loan modifications to

borrowers who are not experiencing financial difficulties are

not included in the following reporting of loan modifications.

Under consumer real estate programs, TCF typically

reduces a customer’s contractual payments for a period

of time appropriate for the borrower’s financial condition.

Due to clarifying bankruptcy-related regulatory guidance

adopted in the third quarter of 2012, loans discharged in

Chapter 7 bankruptcy where the borrower did not reaffirm

the debt are permanently reported as TDR loans as a result

of the removal of the borrower’s personal liability on the

loan. Although loans classified as TDR loans are considered

impaired, TCF received more than 53% of the contractual

interest due on accruing consumer real estate TDR loans

during 2012 by modifying the loan to a qualified customer

instead of foreclosing on the property. At December 31, 2012,

5.7% of accruing consumer real estate TDR loans were more

than 60-days delinquent, compared with 7% at December

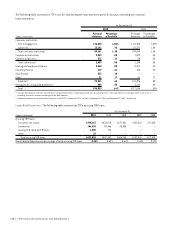

31, 2011. Approximately 3.6% of the $313.5 million accruing

consumer real estate TDR loans modified during the two-year

period preceding December 31, 2012, defaulted during 2012.

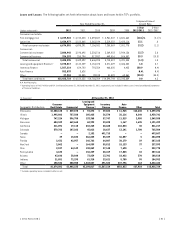

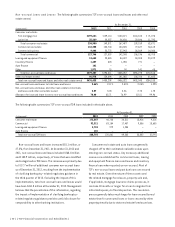

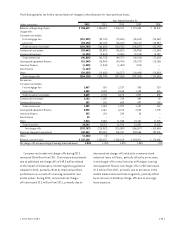

Commercial loans that are 90 or more days past due

and not well secured at the time of modification remain

on non-accrual status. Regardless of whether contractual

principal and interest payments are well-secured at the

time of modification, equipment finance loans that are 90

or more days past due remain on non-accrual status. All

loans modified when on non-accrual status continue to

be reported as non-accrual loans until there is sustained

repayment performance for six consecutive months. At

December 31, 2012, 61% of total commercial TDR loans

were accruing and TCF recognized 97% of the contractual

interest due on accruing commercial TDR loans during 2012.

At December 31, 2012, all accruing commercial TDR loans

were current and performing. Approximately 15.9% of the

$258.3 million accruing commercial TDR loans modified

during the two-year period preceding December 31, 2012

defaulted during 2012.

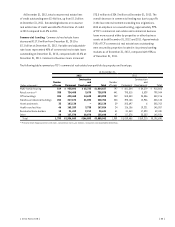

A commercial loan may be modified through a term

extension with a reduction of contractual payments or a

change in interest rate. Commercial loan modifications

which are not classified as TDR loans primarily involve loans

on which interest rates were modified to current market

rates for similarly situated borrowers who have access

to alternative funds or on which TCF received additional

collateral or loan conditions. Reserves for losses on

accruing commercial loan TDR loans were $1.5 million,

or 1% of the outstanding balance, at December 31, 2012,

and $1.4 million, or 1.4% of the outstanding balance, at

December 31, 2011.

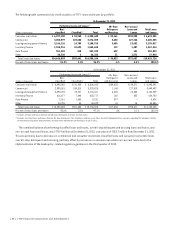

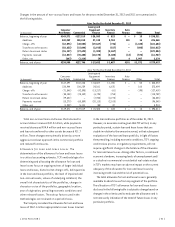

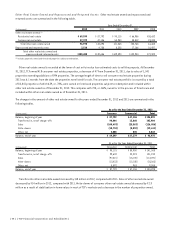

TCF utilizes a multiple note structure as a workout

alternative for certain commercial loans. The multiple

note structure restructures a troubled loan into two notes.

When utilizing a multiple note structure as a workout

alternative for certain commercial loans, the first note

is always classified as a TDR loan. Under TCF policy, the

first note is established at an amount and with market

terms that provide reasonable assurance of payment and

performance. This note may be removed from TDR loan

classification in the calendar years after modification,

if the loan was modified at an interest rate equal to the

yield of a new loan origination with comparable risk at

the time of restructuring and the loan is performing based

on the terms of the restructuring agreement. This note is

reported on accrual status if the loan has been formally

restructured so as to be reasonably assured of payment

and performance according to its modified terms. This

evaluation includes consideration of the customer’s

payment performance for a reasonable period of at least

six consecutive months, which may include time prior to the

restructuring, before the loan is returned to accrual status.

A second note is charged-off. This second note is legally

structured and, for accounting purposes, still outstanding

with the borrower, and should the borrower’s financial

position improve, may become recoverable. At December

31, 2012, nine loans with a contractual balance of $42.9

million and a remaining book balance of $25.6 million had

been restructured under this workout alternative.

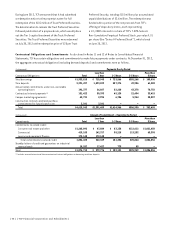

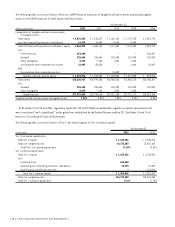

For additional information regarding TCF’s loan

modifications refer to Note 7 of the Notes to Consolidated

Financial Statements, Allowance for Loan and Lease Losses

and Credit Quality Information.

{ 2012 Form 10K } { 39 }