TCF Bank 2012 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and investment banks. Additional significant competition

for deposits comes from institutions selling money market

mutual funds and corporate and government securities. TCF

competes for the origination of loans with banks, mortgage

bankers, mortgage brokers, consumer, and commercial

finance companies, credit unions, insurance companies and

savings institutions. TCF also competes nationwide with

other companies and banks in the financing of equipment,

inventory and automobiles, and leasing of equipment.

Expanded use of the Internet has increased competition

affecting TCF and its loan, lease and deposit products.

Employees As of December 31, 2012, TCF had 7,328

employees, including 2,175 part-time employees. TCF

provides its employees with comprehensive benefits, some

of which are provided on a contributory basis, including

medical and dental plans, a 401(k) savings plan with a

company matching contribution, life insurance and short-

and long-term disability coverage.

Regulation

The banking industry is subject to extensive regulatory

oversight. TCF Financial, as a publicly held bank holding

company, and TCF Bank, which has deposits insured by

the Federal Deposit Insurance Corporation (“FDIC”), are

subject to a number of laws and regulations. Many of

these laws and regulations have undergone significant

change in recent years. These laws and regulations impose

restrictions on activities, minimum capital requirements,

lending and deposit restrictions and numerous other

requirements. TCF Financial’s primary regulator is the

Federal Reserve and TCF Bank’s primary regulator is the

Office of the Comptroller of the Currency (“OCC”).

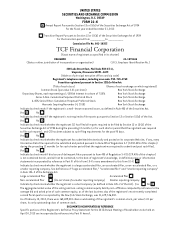

Regulatory Capital Requirements TCF Financial and

TCF Bank are subject to regulatory capital requirements of

the Federal Reserve and the OCC, respectively, as described

below. These regulatory agencies are required by law to

take prompt action when institutions are viewed to be

unsafe or unsound or do not meet certain minimum capital

standards. The Federal Deposit Insurance Corporation

Improvement Act of 1991 (“FDICIA”) defines five levels

of capital condition, the highest of which is “well-

capitalized.” It requires that undercapitalized institutions

be subjected to various restrictions such as limitations

on dividends or other capital distributions, limitations

on growth or restrictions on activities. Undercapitalized

banks must develop a capital restoration plan and the

parent bank holding company is required to guarantee

compliance with the plan. TCF and TCF Bank are “well-

capitalized” under the FDICIA capital standards.

Additionally, the Federal Reserve and the OCC have

adopted rules that could permit them to quantify and

account for interest-rate risk exposure and market risk

from trading activity and to potentially reflect these risks

in higher capital requirements. New legislation, additional

rulemaking, or changes in regulatory policies may affect

future regulatory capital requirements applicable to TCF

Financial and TCF Bank.

Restrictions on Distributions TCF Financial’s ability

to pay dividends is subject to limitations imposed by the

Federal Reserve. In general, Federal Reserve regulatory

guidelines require the board of directors of a bank holding

company to consider a number of factors when considering

the payment of dividends, including the quality and level

of current and future earnings.

Dividends or other capital distributions from TCF Bank

to TCF Financial are an important source of funds to

enable TCF Financial to pay dividends on its preferred and

common stock, to pay TCF Financial’s obligations, or to

meet other cash needs. The ability of TCF Financial and

TCF Bank to pay dividends depends on regulatory policies

and regulatory capital requirements and may be subject

to regulatory approval.

In general, TCF Bank may not declare or pay a dividend

to TCF Financial in excess of 100% of its net retained

profits for the current year combined with its net retained

profits for the preceding two calendar years without prior

approval of the OCC. TCF Bank’s ability to make future

capital distributions will depend on its earnings and ability

to meet minimum regulatory capital requirements in effect

during current and future periods. These capital adequacy

standards may be higher in the future than existing

minimum regulatory capital requirements, including

the potential effects of any U.S. regulatory rule-making

relating to the implementation of the capital and liquidity

standards under Basel III, the international regulatory

framework for banks. The OCC also has the authority to

prohibit the payment of dividends by a national bank when

it determines such payments would constitute an unsafe

and unsound banking practice.

In addition, income tax considerations may limit the

ability of TCF Bank to make dividend payments in excess

of its current and accumulated tax earnings and profits.

Annual dividend distributions in excess of earnings and

profits could result in a tax liability based on the amount

of excess earnings distributed and current tax rates.

{ 4 } { TCF Financial Corporation and Subsidiaries }