TCF Bank 2012 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

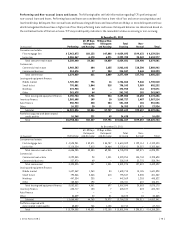

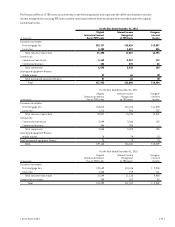

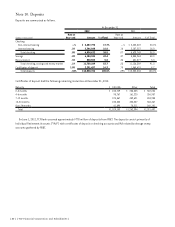

Performing and Non-accrual Loans and Leases The following tables set forth information regarding TCF’s performing and

non-accrual loans and leases. Performing loans and leases are considered to have a lower risk of loss and are on accruing status and

less than 60 days delinquent. Non-accrual loans and leases along with loans and leases that are 60 days or more delinquent are those

which management believes have a higher risk of loss than performing loans and leases. Delinquent balances are determined based on

the contractual terms of the loan or lease. TCF’s key credit quality indicator is the receivable’s status as accruing or non-accruing.

At December 31, 2012

(In thousands) Performing

60-89 Days

Delinquent

and Accruing

90 Days or More

Delinquent

and Accruing

Total

Accruing

Non-

Accrual Total

Consumer real estate:

First mortgage lien $ 3,963,873 $28,132 $47,888 $ 4,039,893 $199,631 $ 4,239,524

Junior lien 2,386,567 6,170 6,971 2,399,708 35,269 2,434,977

Total consumer real estate 6,350,440 34,302 54,859 6,439,601 234,900 6,674,501

Commercial:

Commercial real estate 2,960,383 604 1,655 2,962,642 118,300 3,080,942

Commercial business 314,476 17 354 314,847 9,446 324,293

Total commercial 3,274,859 621 2,009 3,277,489 127,746 3,405,235

Leasing and equipment finance:

Middle market 1,725,252 796 16 1,726,064 9,446 1,735,510

Small ticket 795,881 1,844 518 798,243 3,989 802,232

Winthrop 372,933 22 – 372,955 116 373,071

Other 261,678 64 – 261,742 101 261,843

Total leasing and equipment finance 3,155,744 2,726 534 3,159,004 13,652 3,172,656

Inventory finance 1,565,608 109 10 1,565,727 1,487 1,567,214

Auto finance 550,923 228 304 551,455 101 551,556

Other 26,322 20 11 26,353 1,571 27,924

Subtotal 14,923,896 38,006 57,727 15,019,629 379,457 15,399,086

Portfolios acquired with deteriorated

credit quality 26,348 221 69 26,638 – 26,638

Total $14,950,244 $38,227 $57,796 $15,046,267 $379,457 $15,425,724

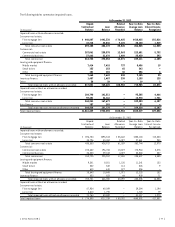

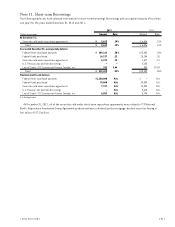

At December 31, 2011

(In thousands) Performing

60-89 Days

Delinquent

and Accruing

90 Days or More

Delinquent

and Accruing

Total

Accruing

Non-

Accrual Total

Consumer real estate:

First mortgage lien $ 4,525,951 $ 32,571 $ 54,787 $ 4,613,309 $ 129,114 $ 4,742,423

Junior lien 2,110,334 7,813 14,464 2,132,611 20,257 2,152,868

Total consumer real estate 6,636,285 40,384 69,251 6,745,920 149,371 6,895,291

Commercial:

Commercial real estate 3,092,855 98 1,001 3,093,954 104,744 3,198,698

Commercial business 227,970 49 – 228,019 22,775 250,794

Total commercial 3,320,825 147 1,001 3,321,973 127,519 3,449,492

Leasing and equipment finance:

Middle market 1,627,369 1,260 84 1,628,713 13,185 1,641,898

Small ticket 792,566 2,368 613 795,547 5,535 801,082

Winthrop 447,334 235 – 447,569 1,253 448,822

Other 185,563 198 – 185,761 610 186,371

Total leasing and equipment finance 3,052,832 4,061 697 3,057,590 20,583 3,078,173

Inventory finance 623,717 153 7 623,877 823 624,700

Auto finance – – – – – –

Other 34,829 20 21 34,870 15 34,885

Subtotal 13,668,488 44,765 70,977 13,784,230 298,311 14,082,541

Portfolios acquired with

deteriorated credit quality 65,820 766 1,128 67,714 – 67,714

Total $ 13,734,308 $ 45,531 $ 72,105 $ 13,851,944 $ 298,311 $ 14,150,255

{ 2012 Form 10K } { 73 }