TCF Bank 2012 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

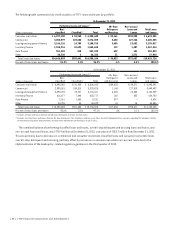

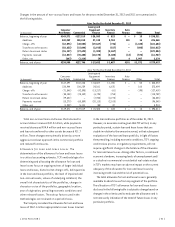

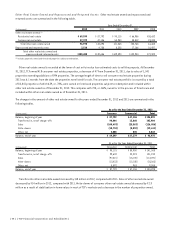

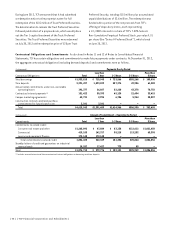

Other Real Estate Owned and Repossessed and Returned Assets Other real estate owned and repossessed and

returned assets are summarized in the following table.

Year Ended December 31,

(In thousands) 2012 2011 2010 2009 2008

Other real estate owned:(1)

Residential real estate $ 69,599 $ 87,792 $ 90,115 $ 66,956 $38,632

Commercial real estate 27,379 47,106 50,950 38,812 23,033

Total other real estate owned 96,978 134,898 141,065 105,768 61,665

Repossessed and returned assets 3,510 4,758 8,325 17,166 10,927

Total other real estate owned and

repossessed and returned assets $100,488 $139,656 $149,390 $122,934 $72,592

(1) Includes properties owned and foreclosed properties subject to redemption.

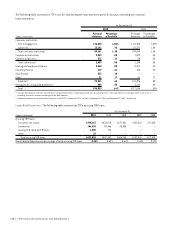

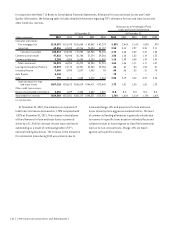

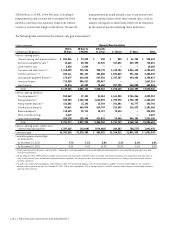

Other real estate owned is recorded at the lower of cost or fair value less estimated costs to sell the property. At December

31, 2012, TCF owned 418 consumer real estate properties, a decrease of 47 from December 31, 2011, due to sales of 1,041

properties exceeding additions of 994 properties. The average length of time to sell consumer real estate properties during

2012 was 6.1 months from the date the properties were listed for sale. The consumer real estate portfolio is secured by a total

of 82,041 properties of which 639, or .78%, were owned or foreclosed properties subject to redemption and included within

other real estate owned as of December 31, 2012. This compares with 723, or .86%, owned or in the process of foreclosure and

included within other real estate owned as of December 31, 2011.

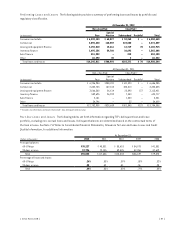

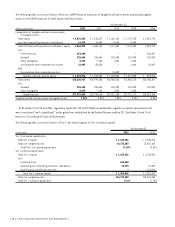

The changes in the amount of other real estate owned for the years ended December 31, 2012 and 2011 are summarized in the

following tables.

At or For the Year Ended December 31, 2012

(In thousands) Consumer Commercial Total

Balance, beginning of year $ 87,792 $ 47,106 $ 134,898

Transferred in, net of charge-offs 90,044 13,860 103,904

Sales (100,493) (25,563) (126,056)

Write-downs (10,752) (8,859) (19,611)

Other, net 3,008 835 3,843

Balance, end of year $ 69,599 $ 27,379 $ 96,978

At or For the Year Ended December 31, 2011

(In thousands) Consumer Commercial Total

Balance, beginning of year $ 90,115 $ 50,950 $ 141,065

Transferred in, net of charge-offs 99,639 22,293 121,932

Sales (97,021) (15,070) (112,091)

Write-downs (13,033) (12,030) (25,063)

Other, net 8,092 963 9,055

Balance, end of year $ 87,792 $ 47,106 $ 134,898

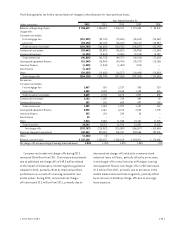

Transfers into other real estate owned increased by $18 million in 2012, compared with 2011. Sales of other real estate owned

decreased by $14 million in 2012, compared with 2011. Write-downs of consumer other real estate owned decreased by $2.3

million as a result of stabilization in home values in most of TCF’s markets and a decrease in the number of properties owned.

{ 44 } { TCF Financial Corporation and Subsidiaries }