TCF Bank 2012 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

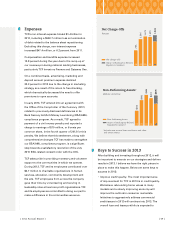

Lending

TCF’s Lending division consists of retail lending,

commercial banking and the national lending

businesses (TCF Equipment Finance, Winthrop, TCF

Inventory Finance and Gateway One). Total loan and

lease balances of $15.4 billion at December 31, 2012

increased $1.3 billion, or 9 percent from a year ago,

primarily due to strong growth in TCF Inventory

Finance and Gateway One, as well as increased

originations across most lending platforms. The

emphasis on national lending has led to increased

diversity throughout the lending portfolio — a portfolio

that is now 43 percent consumer real estate, 35

percent national lending and 22 percent commercial.

Loan and lease balances in TCF’s national lending

businesses increased 41 percent to $5.3 billion at

December 31, 2012. With experienced management

teams and strong asset diversification by industry,

transaction size, geography and collateral type, the

national lending businesses not only originate the

highest yielding assets at TCF, but also deliver the

best credit quality.

The most significant asset growth during the year

came from TCF Inventory Finance. Largely due to

the floorplan financing agreement with BRP, portfolio

balances totaled $1.6 billion at year-end, up 150.9

percent. TCF Inventory Finance is well-diversified

with loans spread across powersports, lawn and

garden, consumer electronics and appliances,

recreation vehicle, and marine product industries.

This portfolio has a high average yield (6.20 percent

in 2012), while maintaining credit quality that is

among the best of TCF’s lending businesses.

TCF Inventory Finance now has agreements with

many industry-leading manufacturers including

BRP, The Toro Company and Arctic Cat, Inc. These

relationships, along with its seasoned and

experienced management team, have given TCF

Inventory Finance strong credibility and made

it a significant player in the inventory finance

marketplace. We believe TCF Inventory Finance

will continue to be a key contributor to the TCF

story as we pursue additional programs in 2013.

TCF began originating high quality indirect auto

loans following the acquisition of Gateway One in

November 2011. Gateway One finished 2012 with

loan balances of $552.8 million and an average yield

of 6.06 percent. Gateway One also has managed

assets, which includes portfolio loans, loans held

for sale and loans sold and serviced for others,

of $1.3 billion. After joining TCF with 3,200 dealer

relationships in 30 states, Gateway One now has

nearly 6,200 dealer relationships in 43 states.

Throughout 2012, TCF has successfully integrated

Gateway One into TCF. In addition to the strong

on-balance sheet growth at Gateway One, we have

also executed on our strategy of selling a portion of

the originations each quarter to generate additional

revenue. In 2012, TCF realized gains of $22.1 million

as a result of the sales of these auto loans, which we

continue to service. We expect Gateway One will

continue to provide disciplined growth in 2013.

A Better Way of Lending

“The emphasis on national lending has

led to increased diversity throughout

the lending portfolio — a portfolio

that is now 43 percent consumer real

estate, 35 percent national lending

and 22 percent commercial.”

{ 2012 Annual Report } { 05 }