TCF Bank 2012 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

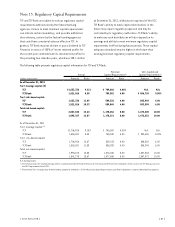

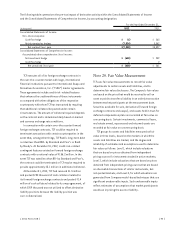

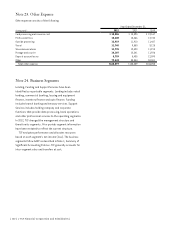

The following table summarizes the pre-tax impact of derivative activity within the Consolidated Statements of Income

and the Consolidated Statements of Comprehensive Income, by accounting designation.

For the Year Ended December 31,

(In thousands) 2012 2011

Consolidated Statements of Income:

Non-interest expense:

Cash flow hedge $ (6) $ 265

Not designated as hedges (7,524) 3,062

Net realized (loss) gain $(7,530) $3,327

Consolidated Statements of Comprehensive Income:

Accumulated other comprehensive (loss) income:

Net investment hedge $ (630) $ 259

Cash flow hedge – 2

Net unrealized (loss) gain $ (630) $ 261

TCF executes all of its foreign exchange contracts in

the over-the-counter market with large, international

financial institutions pursuant to International Swaps and

Derivatives Association, Inc. (“ISDA”) master agreements.

These agreements include credit risk-related features

that enhance the creditworthiness of these instruments

as compared with other obligations of the respective

counterparty with whom TCF has transacted by requiring

that additional collateral be posted under certain

circumstances. The amount of collateral required depends

on the contract and is determined daily based on market

and currency exchange rate conditions.

In connection with certain over-the counter forward

foreign exchange contracts, TCF could be required to

terminate transactions with certain counterparties in the

event that, among other things, TCF Bank’s long-term debt

is rated less than BBB- by Standard and Poor’s or Baa3

by Moody’s. At December 31, 2012, credit risk-related

contingent features existed on forward foreign exchange

contracts with a notional value of $156.2 million. In the

event TCF was rated less than BB- by Standard and Poor’s,

the contract could be terminated or TCF may be required to

provide approximately $3.1 million in additional collateral.

At December 31, 2012, TCF had received $1.3 million

and posted $250 thousand of cash collateral related to

its forward foreign exchange contracts and posted $1.4

million of cash collateral related to its swap agreement, of

which $209 thousand was not utilized to offset derivative

liability positions because the liability position was

over-collateralized.

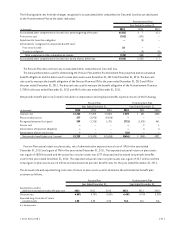

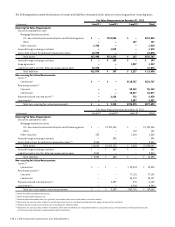

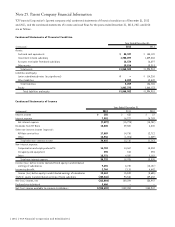

Note 20. Fair Value Measurement

TCF uses fair value measurements to record fair value

adjustments to certain assets and liabilities, and to

determine fair value disclosures. The Company’s fair values

are based on the price that would be received to sell an

asset or paid to transfer a liability in an orderly transaction

between market participants at the measurement date.

Securities available for sale, derivatives (forward foreign

exchange contracts and swaps), and assets held in trust for

deferred compensation plans are recorded at fair value on

a recurring basis. Certain investments, commercial loans,

real estate owned, repossessed and returned assets are

recorded at fair value on a nonrecurring basis.

TCF groups its assets and liabilities measured at fair

value in three levels, based on the markets in which the

assets and liabilities are traded, and the degree and

reliability of estimates and assumptions used to determine

fair value as follows: Level 1, which include valuations

that are based on prices obtained from independent

pricing sources for instruments traded in active markets;

Level 2, which include valuations that are based on prices

obtained from independent pricing sources that are based

on observable transactions of similar instruments, but

not quoted markets; and Level 3, for which valuations are

generated from Company model-based techniques that use

significant unobservable inputs. Such unobservable inputs

reflect estimates of assumptions that market participants

would use in pricing the asset or liability.

{ 2012 Form 10K } { 95 }