TCF Bank 2012 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

{ 04 } { TCF Financial Corporation and Subsidiaries }

• Capital Actions

TCF took several actions to improve its capital

position during the year including the issuances

of $110 million of 6.25 percent subordinated

notes, $172.5 million of 7.50 percent Series A

Non-Cumulative Perpetual Preferred Stock and

$100 million of 6.45 percent Series B Non-

Cumulative Perpetual Preferred Stock. The funds

raised through these capital offerings are being

used to support current and future asset growth

opportunities, including the growth in our national

lending businesses. The capital issuances enabled

TCF to redeem its $115 million of 10.75 percent trust

preferred securities, which would have been phased

out from qualifying as Tier 1 capital over time.

• Return of Free Checking

TCF, like many large banks, eliminated its free

checking product following the implementation

of the Durbin Amendment in October 2011, which

limits debit card interchange revenue. After

listening to its customers and employees, TCF

decided to return to what made it so successful for

so many years — free checking. Since the return of

free checking, TCF has seen a steady increase in

new account production and a decrease in account

attrition. TCF customers and employees are happy

to have one of the most competitive checking

accounts in the country — TCF Free Checking.

SM

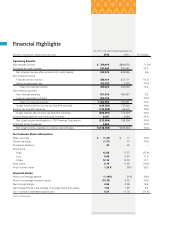

For the first time in 22 years, TCF incurred a net loss in

2012 of $218.5 million, or $1.37 per diluted share. This

loss was the result of the $295.8 million net after-tax

charge related to the balance sheet repositioning.

While TCF prides itself on being a profitable bank and

providing a strong return to shareholders, completing

the balance sheet repositioning in 2012 was the right

thing to do for the company and our stockholders.

TCF remains solidly capitalized with ample liquidity

to conduct business. The capital raising activities

completed during the year have enhanced our ability

to grow the balance sheet. At December 31, 2012,

TCF had $1.6 billion of Tier 1 capital, or 11.09 percent

of total risk-weighted assets.

TCF paid dividends totaling $.20 per share in 2012

and has now paid a dividend in 98 consecutive

quarters. When capital accumulation from earnings

exceeds capital required for asset growth and risk

parameters permit, TCF expects to raise the

dividend. Returning capital to stockholders remains

an important part of how we deliver value.

At December 31, 2012, TCF’s stock price closed

at $12.15 per share, up from $10.32 per share on

December 31, 2011. We believe that credit quality

remained the main issue impacting the stock price

throughout the year. As we continue to execute on

our strategies and home values improve, we expect

the stock price will improve over time.

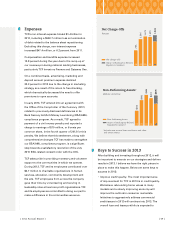

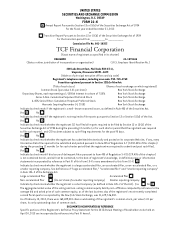

Total Loans & Leases

Billions of Dollars

12100806

$11.5

$13.3

$14.8

$15.4

+5%*

* Six-year compound

annual growth rate

National Lending

Loans & Leases

Billions of Dollars

12100806

$1.8

$2.5

$3.9

$5.3

+20%*

* Six-year compound

annual growth rate