TCF Bank 2012 Annual Report Download - page 82

Download and view the complete annual report

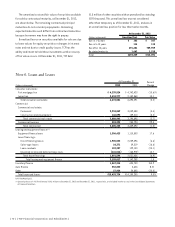

Please find page 82 of the 2012 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.estimated costs to sell, declines to less than the carrying

amount of the asset, the deficiency is recognized in the

period in which it becomes known and is included in other

non-interest expense. Operating expenses of properties and

recoveries on sales of other real estate owned are recorded

in foreclosed real estate and repossessed assets, net.

Operating revenue from foreclosed property is included

in other non-interest income. Other real estate owned

at December 31, 2012 and 2011 was $97 million and

$134.9 million, respectively. Repossessed and returned

assets at December 31, 2012 and 2011 were $3.5 million

and $4.8 million, respectively.

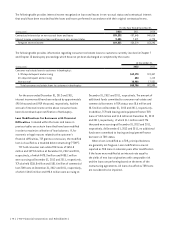

Investments in Affordable Housing Limited

Partnerships Investments in affordable housing consist

of investments in limited partnerships that operate

qualified affordable housing projects or that invest in

other limited partnerships formed to operate affordable

housing projects. TCF generally utilizes the effective yield

method to account for these investments with the tax

credits and amortization of the investment reflected in

the Consolidated Statements of Income as a reduction of

income tax expense. However, depending on circumstances,

the equity or cost methods may be utilized. The amount

of the investment along with any unfunded equity

contributions which are unconditional and legally binding

are recorded in other assets. A liability for the unfunded

equity contributions is recorded in other liabilities. At

December 31, 2012, TCF’s investments in affordable

housing limited partnerships were $15.8 million,

compared with $22.7 million at December 31, 2011.

Five of these investments in affordable housing

limited partnerships are considered variable interest

entities. These partnerships are not consolidated with

TCF. As of December 31, 2012 and 2011, the carrying

amount of these five investments was $15.2 million and

$22.1 million, respectively. The maximum exposure to loss

on these five investments was $15.2 million at December

31, 2012, however the general partner of these partnerships

provides various guarantees to TCF including guaranteed

minimum returns. These guarantees are backed by an

investment grade credit-rated company, which further

reduces the risk of loss. In addition to the guarantees,

the investments are supported by the performance of the

underlying real estate properties which also mitigates the

risk of loss.

Interest-Only Strips TCF periodically sells loans to

third-party financial institutions at fixed or variable rates.

For those transactions which achieve sale treatment, the

underlying loan is not recognized on TCF’s Consolidated

Statements of Financial Condition. The Company sells these

loans at par value and retains an interest in the future cash

flows of borrower loan payments, known as an interest-

only strip. The interest-only strip is recorded at fair value

at the time of sale. The fair value of the interest-only strip

represents the present value of future cash flows generated

by the loans, to be retained by TCF. After initial recording of

the interest-only strip, the accretable yield is measured as

the difference between the fair value and the present value

of cash flows expected to be collected. The accretable

yield is amortized into interest income over the life of the

interest-only strip using the effective yield method. The

expected cash flows are evaluated quarterly to determine if

they have changed from previous projections. If the present

value of the original cash flows expected to be collected is

less than the present value of the current estimate of cash

flows to be collected, the change is adjusted prospectively

over the remaining life of the interest-only strip. If the present

value of the original cash flows expected to be collected is

greater than the present value of the current estimate an

other than temporary impairment is generally recorded.

Intangible Assets All assets and liabilities acquired in

purchase acquisitions, including goodwill and other intan-

gibles, are recorded at fair value. Goodwill is recorded when

the purchase price of an acquisition is greater than the

fair value of net assets, including identifiable intangible

assets. Goodwill is not amortized, but assessed for impair-

ment on an annual basis at the reporting unit level, which

is one level below reportable operating segments. Interim

impairment analysis may be required if events occur or cir-

cumstances change that would more likely than not reduce

a reporting unit’s fair value below its carrying amount.

Other intangible assets are amortized on a straight-line or

effective yield basis over their estimated useful lives, and

are subject to impairment if events or circumstances indi-

cate a possible inability to realize their carrying amounts.

When testing for goodwill impairment, TCF may initially

perform a qualitative assessment. Based on the results

of this qualitative assessment, if TCF concludes it is more

likely than not that a reporting unit’s fair value is less than

its carrying amount, a quantitative analysis is performed.

TCF’s quantitative valuation methodologies primarily

include discounted cash flow analysis in determining fair

value of reporting units. If the fair value is less than the

carrying amount, additional analysis is required to measure

{ 66 } { TCF Financial Corporation and Subsidiaries }