Starwood 2005 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2005 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

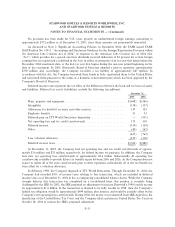

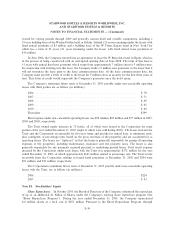

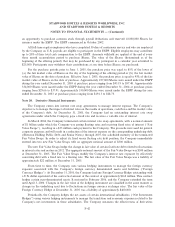

On October 22, 2004, the President signed the American Jobs Creation Act of 2004 (the ""Act''). The

Act creates a temporary incentive for U.S. corporations to repatriate accumulated income earned abroad by

providing an 85 percent dividends received deduction for certain dividends from controlled foreign corpora-

tions. In order to repatriate funds in accordance with the Act, in October 2005 the Company increased several

existing bank credit lines available to its wholly owned subsidiary, Starwood Italia, from 129 million euros to

399 million euros, 350 million euros of which was borrowed at that time. These credit lines had interest rates

ranging from Euribor ° 0.50% to Euribor ° 0.85% and maturities ranging from April 1, 2006 to May 8, 2007.

These proceeds, along with approximately 100 million euros which Starwood Italia borrowed from the

Corporate Credit Line (total borrowings of 450 million euros) were used to temporarily Ñnance the

repatriation of approximately $550 million pursuant to the Act. These temporary borrowings are being paid oÅ

with Starwood Italia asset sales, and as of December 31, 2005, approximately 175 million euros had been

repaid. The Company expects the remainder of these borrowings to be repaid over the course of 2006.

In August 2004, the Company completed a $300 million addition to the term loan under its existing

Senior Credit Facility. As of December 31, 2005, the Senior Credit Facility consisted of a $1.0 billion

revolving loan and a $450 million term loan, each maturing in 2006 with a one year extension option and had

an interest rate of LIBOR plus 1.25% (""Previous Senior Credit Facility''). The proceeds of the Previous

Senior Credit Facility were used to repay a portion of the then existing revolving credit facility and for general

corporate purposes. In February 2006 the Company closed a new, Ñve-year $1.5 billion Senior Credit Facility

(""2006 Facility'') which replaces the Previous Senior Credit Facility. Approximately $240 million of the

Term Loan balance under the Previous Senior Credit Facility was paid down with cash and the remainder was

reÑnanced with the 2006 Facility. The 2006 Facility is expected to be used for general corporate purposes. The

2006 Facility matures February 10, 2011 and has a current interest rate of LIBOR plus 0.70%. The Company

currently expects to be in compliance with all covenants of the 2006 Facility.

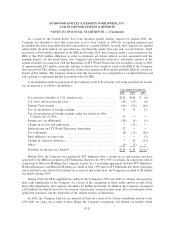

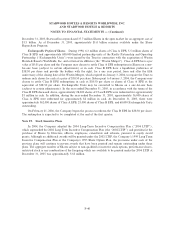

In May 2003, the Company sold an aggregate of $360 million 3.5% coupon convertible senior notes due

2023. The notes are convertible, subject to certain conditions, into 7.2 million Shares based on a conversion

price of $50.00 per Share (the ""Convertible Debt''). Gross proceeds received were used to repay a portion of

the Company's Senior Credit Facility and for other operational purposes. Holders may Ñrst present their

Convertible Debt to the Company for repurchase in May 2006. One of the trigger events for the Convertible

Debt is met if the closing sale price per Share is $60 or more for a speciÑed length of time. During the fourth

quarter of 2005, this trigger event was met. The Company expects to settle the principal portion of the

Convertible Debt in cash with the excess amount settled in Shares. As a result, approximately 400,000 Shares

were included in the diluted Shares for the year ended December 31, 2005 based on the Company's closing

stock price of $63.86 on December 30, 2005.

The Company had the ability to draw down on its Revolving Credit Facility in various currencies.

Drawdowns in currencies other than the U.S. dollar represent a natural hedge of the Company's foreign

denominated net assets and operations. At December 31, 2005, the Company had $11 million drawn in

Canadian dollars.

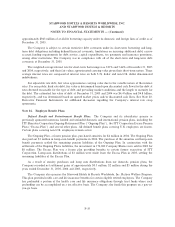

The Previous Senior Credit Facility (and now the 2006 Facility), the Senior Notes and the Convertible

Debt are guaranteed by the Sheraton Holding Corporation, a wholly owned subsidiary of the Corporation. The

Sheraton Holding public debt is guaranteed by the Corporation. See Note 24. Guarantor Subsidiary for

consolidating Ñnancial information for Starwood Hotels & Resorts Worldwide, Inc. (the ""Parent''), Sheraton

Holding Corporation (the ""Guarantor Subsidiary'') and all other legal entities that are consolidated into the

Company's results including the Trust, but which are not the Guarantor Subsidiary (the ""Non-Guarantor

Subsidiaries'').

The Company maintains lines of credit under which bank loans and other short-term debt are drawn. In

addition, smaller credit lines are maintained by the Company's foreign subsidiaries. The Company had

F-34