Starwood 2005 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2005 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

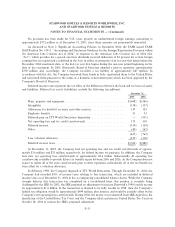

Note 5. Asset Dispositions and Impairments

In December 2005, the Company sold the Hotel Danieli in Venice, Italy for approximately 177 million

euros (approximately $213 million based on the exchange rate at the time the sale closed) in cash. The

Company continues to manage the hotel subject to a long-term management contract. Accordingly, the gain

on the sale of approximately $128 million was deferred and is being recognized in earnings over the 10-year

life of the management contract.

The Company sold four additional hotels for approximately $53 million in cash during 2005 and recorded

losses totaling approximately $13 million associated with these sales. The Company had recorded impairment

charges of $17 million in 2004 related to one of these properties.

Also during 2005, the Company sold three hotels unencumbered by long-term management contracts for

approximately $171 million in cash and recorded gains totaling approximately $38 million associated with

these sales.

In August 2005 the Company completed the sale of the St. Regis hotel in Washington D.C. for

approximately $47 million in cash. The Company continues to manage the hotel subject to a long-term

management contract. Accordingly, the gain on the sale of approximately $32 million was deferred and is

being recognized in earnings over the 15-year life of the management contract.

In April 2005, the Company completed the sale of the Sheraton Lisboa Hotel and Towers in Lisbon,

Portugal for approximately $31 million in cash. The Company continues to manage the hotel subject to a long-

term management contract. Accordingly, the gain on the sale of approximately $6 million was deferred and is

being recognized in earnings over the 20-year life of the management contract.

The hotels sold in 2005 were generally encumbered by long-term management or franchise contracts so

their operations prior to the sale date are not classiÑed as discontinued operations.

The Company recorded an impairment charge of approximately $17 million in 2005 associated with the

owned Sheraton hotel in Cancun, Mexico that is being partially demolished to build vacation ownership units.

The Company also recorded an impairment charge of approximately $32 million in accordance with

SFAS No. 144 in order to write down one hotel to its fair market value.

Subsequent to December 31, 2005, Starwood entered into deÑnitive agreements and later sold two hotels

with a carrying value of approximately $74 million for approximately $123 million in cash. These hotels were

sold subject to franchise agreements. The resulting gain net of allocated goodwill and other liabilities of

approximately $31 million will be recognized in the Ñrst quarter of 2006.

During 2004, the Company sold two hotels for approximately $56 million in cash. The Company recorded

a net loss of $33 million primarily related to the sale of these hotels, the impairment of one hotel sold in

January 2005, and three investments deemed impaired in 2004.

During 2003 the Company recorded a $183 million charge primarily related to the impairment of 18 non-

core domestic hotels that were held for sale. The Company sold 16 of these hotels for approximately

$404 million in cash, the majority of which were sold subject to franchise agreements.

In June 2003, the Company also sold a portfolio of assets including four hotels, a marina and shipyard, a

golf club and a 51% interest in its undeveloped land in Costa Smeralda in Sardinia, Italy (""Sardinia Assets'')

for 290 million euros (approximately $340 million based on exchange rates at the time the sale closed) in

cash. The Company continues to manage the four hotels subject to long-term management contracts.

Accordingly, the results related to the Sardinia Assets prior to the sale date are not classiÑed as discontinued

operations and the gain on sale of approximately $77 million was deferred and is being recognized in earnings

over the 10.5 year life of the management contracts. The Company recorded a $9 million gain on the sale of

F-22