Starwood 2005 Annual Report Download - page 42

Download and view the complete annual report

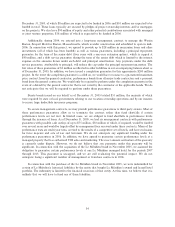

Please find page 42 of the 2005 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Debt and the Senior Notes) through 2007, the Ñnal scheduled maturity date of the terminated Fair Value

Swaps. In order to adjust our Ñxed versus Öoating rate debt position, we immediately entered into two new

Fair Value Swaps with an aggregate notional amount of $300 million.

In May 2001, we sold an aggregate face amount of $572 million Series B zero coupon convertible senior

notes (along with $244 million of Series A notes, which were subsequently repurchased in May 2002) due

2021. The Series B convertible notes were convertible when the market price of our Shares exceeds 120% of

the then-accreted conversion price of the convertible senior notes. The maximum conversion of notes was

approximately 5.8 million Shares. Holders of Series B Convertible Senior Notes put the majority of these

notes to us in May 2004 for a purchase price of approximately $311 million, and in December 2004 we

purchased the remaining $20 million, leaving a zero balance as of December 31, 2004.

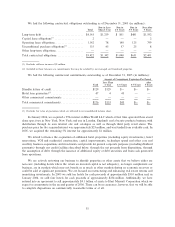

Other. We have approximately $1.219 billion of outstanding debt maturing in 2006. Based upon the

current level of operations, management believes that our cash Öow from operations and pending asset sales,

together with our signiÑcant cash balances (approximately $1.204 billion at December 31, 2005, including

$307 million, of restricted cash discussed earlier), available borrowings under the Revolving Credit Facility

(approximately $860 million at December 31, 2005), available borrowings from international revolving lines of

credit (approximately $83 million at December 31, 2005), and capacity for additional borrowings will be

adequate to meet anticipated requirements for scheduled maturities, dividends, working capital, capital

expenditures, marketing and advertising program expenditures, other discretionary investments, interest and

scheduled principal payments for the foreseeable future. However, we have a substantial amount of

indebtedness at December 31, 2005. There can be no assurance that we will be able to reÑnance our

indebtedness as it becomes due and, if reÑnanced, on favorable terms. In addition, there can be no assurance

that our business will continue to generate cash Öow at or above historical levels or that currently anticipated

results will be achieved.

We maintain non-U.S.-dollar-denominated debt, which provides a hedge of our international net assets

and operations but also exposes our debt balance to Öuctuations in foreign currency exchange rates. During the

year ended December 31, 2005, the eÅect of changes in foreign currency exchange rates was a net decrease in

debt of approximately $23 million compared to a net increase in debt in 2004 of $13 million. Our debt balance

is also aÅected by changes in interest rates as a result of our Fair Value Swaps. The fair market value of the

Fair Value Swaps is recorded as an asset or liability and as the Fair Value Swaps are deemed to be eÅective,

an adjustment is recorded against the corresponding debt. At December 31, 2005, our debt included a

decrease of approximately $3 million related to the unamortized gains on terminated Fair Value Swaps and

the fair market value of current Fair Value Swap liabilities. At December 31, 2004 our debt included an

increase of approximately $29 million related to Fair Value Swap liabilities.

If we are unable to generate suÇcient cash Öow from operations in the future to service our debt, we may

be required to sell additional assets, reduce capital expenditures, reÑnance all or a portion of our existing debt

or obtain additional Ñnancing. Our ability to make scheduled principal payments, to pay interest on or to

reÑnance our indebtedness depends on our future performance and Ñnancial results, which, to a certain extent,

are subject to general conditions in or aÅecting the hotel and vacation ownership industries and to general

economic, political, Ñnancial, competitive, legislative and regulatory factors beyond our control.

On January 27, 2005, Standard & Poor's (""S & P'') gave us a BB° rating with a stable outlook. On

March 7, 2005, Moody's Investor Services (""Moody's'') gave us a Bal rating with a stable outlook. Following

the announcement of the Host Marriott transaction on November 14, 2005, the rating agencies took the

following actions:

¬S & P aÇrmed our BB° rating and revised their outlook to positive from stable. At the same time, S &

P placed the BB° ratings of Sheraton Holding Corporation on CreditWatch with negative implica-

tions, reÖecting the possibility that these obligations will be assumed by Host Marriott, a lower rated

entity.

38