Starwood 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

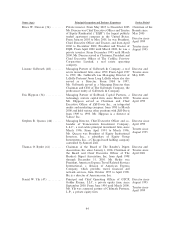

Other Compensation,'' ""Executive Compensation,'' ""Option Grants,'' ""Option Exercises and Holdings,''

""Employment and Compensation Agreements with Executive OÇcers,'' ""Compensation Committee Inter-

locks and Insider Participation'' and ""Compensation and Option Committee Report.''

Item 12. Security Ownership of Certain BeneÑcial Owners and Management and Related Stockholder

Matters.

Equity Compensation Plan Information-December 31, 2005

(a) (b) (c)

Number of securities

Number of securities remaining available for

to be issued upon Weighted-average future issuance under

exercise of exercise price of equity compensation plans

outstanding options, outstanding options, (excluding securities

warrants and rights warrants and rights reÖected in Column (a))

Equity compensation plans approved by

security holders ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 26,768,910 $35.45 53,812,523(1)

Equity compensation plans not approved

by security holders ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì Ì

Total ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 26,768,910 $35.45 53,812,523

(1) Does not include deferred share units (that vest over three years and may be settled in Shares) that have been issued pursuant to the

Executive Annual Incentive Plan (""Executive AIP''). The Executive AIP does not limit the number of deferred share units that may

be issued. This plan has been amended to provide for a termination date of May 26, 2009 to comply with new NYSE requirements.

In addition, 8,985,511 Shares remain available for issuance under our Employee Stock Purchase Plan, a stock purchase plan meeting

the requirements of Section 423 of the Internal Revenue Code.

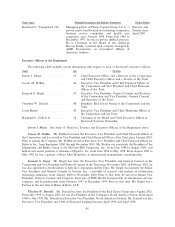

The remaining information called for by Item 12 is incorporated by reference to the information under

the caption ""Security Ownership of Certain BeneÑcial Owners and Management'' in the Proxy Statement.

Item 13. Certain Relationships and Related Transactions.

Policies of the Board of Directors of the Corporation and the Board of Trustees of the Trust

The policy of the Board of Directors of the Corporation and the Board of Trustees of the Trust provides

that any contract or transaction between the Corporation or the Trust, as the case may be, and any other entity

in which one or more of its Directors, Trustees or executive oÇcers are directors or oÇcers, or have a Ñnancial

interest, must be approved or ratiÑed by the Governance and Nominating Committee (which is currently

comprised of Stephen R. Quazzo, Ambassador Barshefsky and Lizanne Galbreath) or by a majority of the

disinterested Directors or Trustees in either case after the material facts as to the relationship or interest and

as to the contract or transaction are disclosed or are known to them.

Employee Loans

We on occasion made loans to employees, including executive oÇcers, prior to August 23, 2002,

principally in connection with home purchases upon relocation. As of December 31, 2005, approximately

$4.1 million in loans to 11 employees was outstanding of which approximately $2.9 million were non-interest

bearing home loans. Home loans are generally due Ñve years from the date of issuance or upon termination of

employment and are secured by a second mortgage on the employee's home. Theodore W. Darnall, President,

Real Estate Group, an executive oÇcer, received a home loan in connection with relocation in 1996 and 1998

(original balance of $750,000 ($150,000 bridge loan in 1996 and $600,000 home loan in 1998)). Mr. Darnall

repaid $600,000 in 2003. As a result of the acquisition of ITT Corporation in 1998, restricted stock awarded to

Mr. Darnall in 1996 vested at a price for tax purposes of $53 per Share. This amount was taxable at ordinary

income rates. By late 1998, the value of the stock had fallen below the amount of income tax owed. In order to

avoid a situation in which the executive could be required to sell all of the Shares acquired by him to cover

47