Starwood 2005 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2005 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

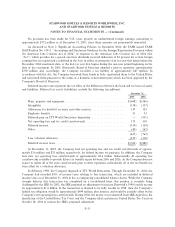

As previously discussed in Note 7. Assets and Debt Held for Sale, the Company has included

approximately $533 million of goodwill in assets held for sale. This represents approximately $514 million of

goodwill that the Company expects to allocate to the sale of 38 hotels to Host and approximately $19 million

of goodwill that the Company expects to allocate to the sale of three hotels completed in January 2006.

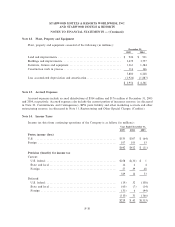

Note 10. Other Assets

Other assets include notes receivable, net of $297 million and $295 million at December 31, 2005 and

2004, respectively, primarily related to the Ñnancing of VOIs (as discussed in Note 6. Notes Receivable

Securitizations and Sales).

Contractual Obligations. On December 30, 2003, the Company together with Lehman Brothers

Holdings Inc. (""Lehman Brothers''), announced the acquisition of all of the outstanding senior debt

(approximately $1.3 billion), at a discount, of Le Mπeridien Hotels and Resorts Ltd. (""Le Mπeridien''). At

December 31, 2004, the approximate $200 million investment was represented by a high yield junior

participation interest. As part of this investment, the Company entered into an agreement with Lehman

Brothers whereby they would negotiate with the Company on an exclusive basis towards a recapitalization of

Le Mπeridien. In November 2005 the Company acquired the Le Mπeridien brand and the related management

and franchise business for the portfolio of 122 hotels and resorts for approximately $225 million, and the

Company's original investment in the outstanding senior debt of Le Mπeridien, together with accrued interest,

was returned to the Company.

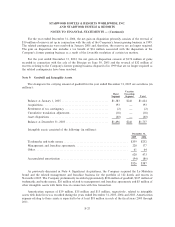

Note 11. Restructuring and Other Special Charges (Credits)

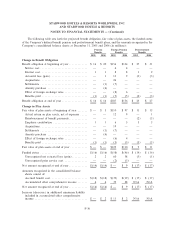

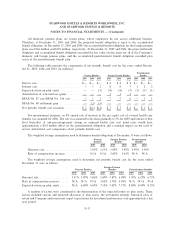

The Company had remaining accruals related to restructuring charges of $28 million at December 31,

2005 and $23 million at December 31, 2004, of which $6 million and $19 million is included in other liabilities

in the accompanying December 31, 2005 and 2004 consolidated balance sheets, respectively. The following

tables summarize restructuring and other special charges (credits) activity during the years ended Decem-

ber 31, 2005, 2004 and 2003:

Noncash Cash Expenditures Total Charge

Credits Receipts Accrued (Credit)

Year Ended December 31, 2005

Restructuring charges:

Severance costs associated with a corporate

restructuring ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ Ì $ Ì $13 $ 13

Le Mπeridien transition costs ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì 3 3

Total restructuring charges ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ Ì $ Ì $16 $ 16

Other special credits:

Adjustments to ITT merger related reservesÏÏÏ $ (3) $ Ì $Ì $ (3)

Total other special credits ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ (3) $ Ì $Ì $ (3)

F-28