Starwood 2005 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2005 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

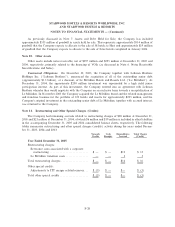

allocated to the sale and the debt to be assumed by Host as held for sale. The Company has also ceased

depreciating these assets.

Under the terms of the Master Agreement and Plan of Merger (""Merger Agreement'') with Host,

Starwood is required to use commercially reasonable eÅorts and Host is required to cooperate with Starwood

in such eÅorts to receive the consent of the bondholders of the $450 million, 2015 Sheraton Holding bonds to

enable these bonds to remain obligations of Sheraton Holding following the transaction with Host. The

Company and Host are currently in discussions regarding the form and timing of this consent, including

whether to amend the Merger Agreement such that a consent would not be pursued. In the event the consent

is not received or the Company and Host agree not to go through the consent process, it is expected that the

Company will seek to retain the debt and, if retained, will be paid an additional $450 million in cash. In

addition, pursuant to the Merger Agreement, Host has given notice that Host is excluding the $150 million,

2025 Sheraton Holding bonds as SpeciÑed Indebtedness (as deÑned in the Merger Agreement), and

therefore, Sheraton Holding will not retain this debt. The Company expects that these bonds will be

redeemed.

As part of the agreement, the hotels sold will generally be encumbered by license and management

agreements with a 20 year initial term and two 10 year extension options exercisable at the Company's

discretion. Accordingly, the operations of the hotels are not classiÑed as discontinued operations and the

expected gain on the sale will be deferred and recognized in earnings over the 20 year initial term of the

agreements. The boards of directors of both companies have approved the proposed transaction. However, the

transaction is subject to the approval of Host shareholders and to customary closing conditions, including

necessary regulatory approvals. The transaction is expected to be completed in the second quarter of 2006.

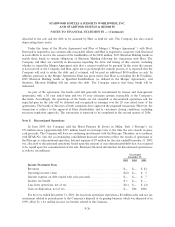

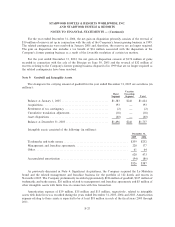

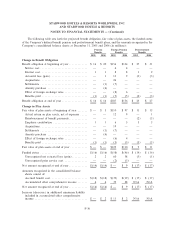

Note 8. Discontinued Operations

In June 2003, the Company sold the Hotel Principe di Savoia in Milan, Italy (""Principe'') for

275 million euros (approximately $315 million based on exchange rates at the time the sale closed) in gross

cash proceeds. The Company will have no continuing involvement with the Principe. Therefore, in accordance

with SFAS No. 144, the accompanying consolidated Ñnancial statements reÖect the results of operations of

the Principe as a discontinued operation. Interest expense of $7 million for the year ended December 31, 2003

was allocated to discontinued operations based upon the amount of euro denominated debt that was required

to be repaid upon the consummation of the sale. Summary Ñnancial information for discontinued operations is

as follows (in millions):

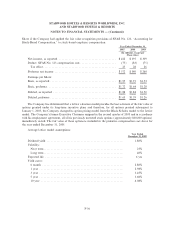

Year Ended

December 31,

2005 2004 2003

Income Statement Data

Revenues ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $Ì $Ì $ 22

Operating income (loss)ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $(2) $Ì $ 5

Interest expense on debt repaid with sales proceeds ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $Ì $Ì $ 7

Income tax beneÑt ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 1 $Ì $ Ì

Loss from operations, net of tax ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $(1) $Ì $ (2)

Gain on disposition, net of taxÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $Ì $26 $206

For the year ended December 31, 2005, the loss from operations represents a $2 million sales and use tax

assessment related to periods prior to the Company's disposal of its gaming business which was disposed of in

1999, oÅset by a $1 million income tax beneÑt related to this business.

F-26