Starwood 2005 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2005 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS

Note 1. Basis of Presentation

The accompanying consolidated Ñnancial statements represent the consolidated Ñnancial position and

consolidated results of operations of (i) Starwood Hotels & Resorts Worldwide, Inc. and its subsidiaries (the

""Corporation''), including Sheraton Holding Corporation and its subsidiaries (""Sheraton Holding'') (for-

merly ITT Corporation) and Starwood Hotels & Resorts and its subsidiaries (the ""Trust'' and, together with

the Corporation, ""Starwood'' or the ""Company''), and (ii) the Trust.

Starwood is one of the world's largest hotel and leisure companies. The Company's principal business is

hotels and leisure, which is comprised of a worldwide hospitality network of more than 860 full-service hotels,

vacation ownership resorts and residential developments primarily serving two markets: luxury and upscale.

The principal operations of Starwood Vacation Ownership, Inc. (""SVO'') include the acquisition, develop-

ment and operation of vacation ownership resorts; marketing and selling vacation ownership interests

(""VOIs'') in the resorts; and providing Ñnancing to customers who purchase such interests.

The Trust was formed in 1969 and elected to be taxed as a real estate investment trust (""REIT'') under

the Internal Revenue Code (the ""Code''). In 1980, the Trust formed the Corporation and made a distribution

to the Trust's shareholders of one share of common stock, par value $0.01 per share, of the Corporation (a

""Corporation Share'') for each common share of beneÑcial interest, par value $0.01 per share, of the Trust (a

""Trust Share'').

Pursuant to a reorganization in 1999, the Trust became a subsidiary of the Corporation, which directly

and indirectly holds all outstanding shares of the new Class A shares of beneÑcial interest of the Trust

(""Class A Shares''). Each Trust Share was converted into one share of the new non-voting Class B Shares of

beneÑcial interest in the Trust (a ""Class B Share''). The Corporation Shares and the Class B Shares trade

together on a one-for-one basis, and pursuant to an agreement between the Corporation and the Trust, may be

transferred only in units (""Shares'') consisting of one Corporation Share and one Class B Share.

The Corporation, through its subsidiaries, is the general partner of, and held, as of December 31, 2005, an

aggregate 98.7% partnership interest in, SLC Operating Limited Partnership (the ""Operating Partnership'').

The Trust, through its subsidiaries, is the general partner of, and held an aggregate 97.6% partnership interest

in, SLT Realty Limited Partnership (the ""Realty Partnership'' and, together with the Operating Partnership,

the ""Partnerships'') as of December 31, 2005. The units of the Partnerships (""LP Units'') held by the limited

partners of the respective Partnerships are exchangeable on a one-for-one basis for Shares. At December 31,

2005, there were approximately 5.4 million LP Units outstanding (including 4.3 million LP Units held by the

Corporation). For all periods presented, the LP Units are assumed to have been converted to Shares for

purposes of calculating basic and diluted weighted average Shares outstanding.

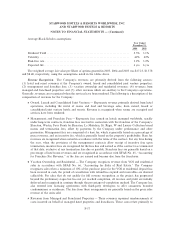

Note 2. SigniÑcant Accounting Policies

Principles of Consolidation. The accompanying consolidated Ñnancial statements of the Company and

the Trust and their subsidiaries include the assets, liabilities, revenues and expenses of majority-owned

subsidiaries over which the Company and/or the Trust exercise control. Intercompany transactions and

balances have been eliminated in consolidation.

Cash and Cash Equivalents. The Company considers all highly liquid investments purchased with an

original maturity of three months or less to be cash equivalents.

Restricted Cash. Restricted cash primarily consists of deposits received on sales of VOIs that are held in

escrow until a certiÑcate of occupancy is obtained, the legal rescission period has expired and the deed of trust

has been recorded in governmental property ownership records.

F-11